Summary

If the US economy continues to perform well, the higher-for-longer narrative could persist, and risk assets are likely to do well in the near term. However, the multi asset team’s base case is for a shallow recession in the 6-12 months horizon and they stand ready to adopt a more defensive positioning.

Macro: Resilient US economy delays Fed’s pivot

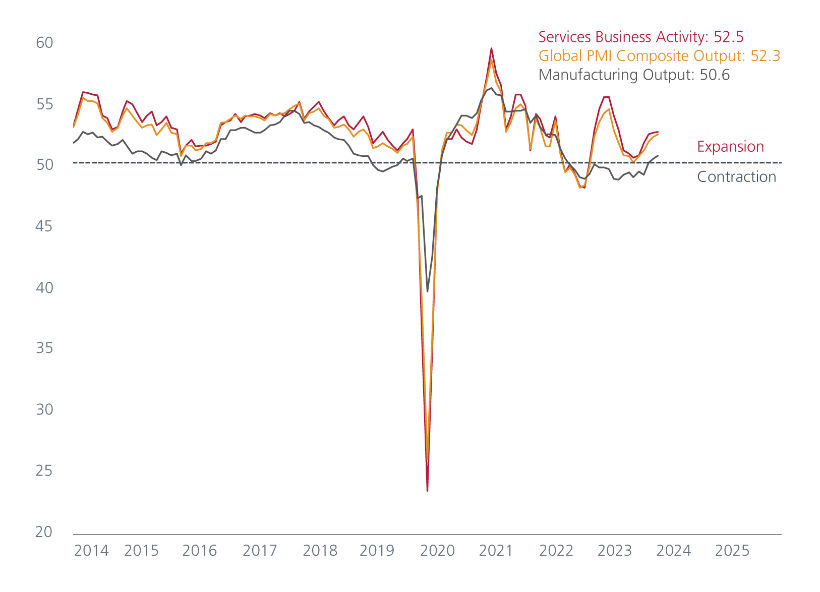

The global economy continues to expand steadily, led by strong US growth. The expansion in manufacturing output was widespread across various countries and sectors. The service sector leads the global output. US consumer spending, a key driver of US growth, continues to be robust. Given the recent resilient US economic data, the multi asset team expects the data-dependent Fed to begin pivoting only on clear signs of an impending recession and/or clear easing of core inflation toward its 2% target rate.

Global PMI, March 2024

Source: J.P. Morgan, LSEG Datastream, 15 March 2024.

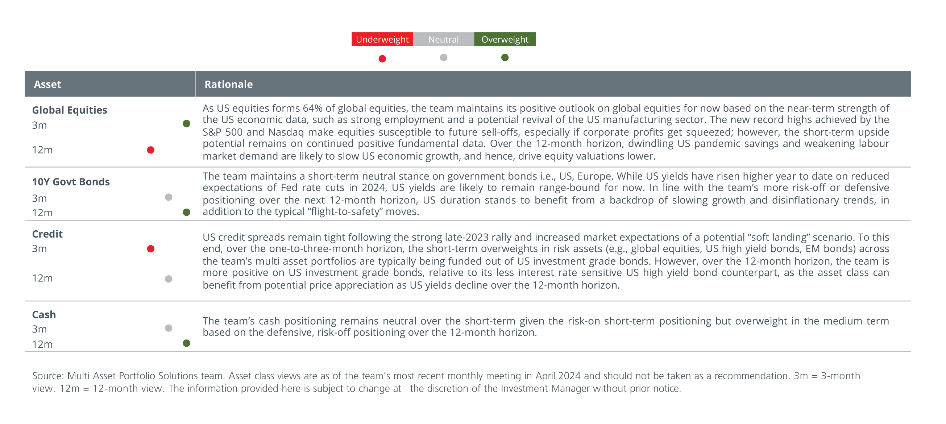

Asset allocation: Staying “risk-on” for now

The market backdrop continues to be driven by positive US economic data pointing to a robust environment. As a result, the multi asset team is tactically overweight US equities in the shorter term. However, given that US valuations are at historically high levels, the team remains cautious and prepared to reallocate to fixed income once US growth starts slowing and sentiment turns negative. Over the 12-month horizon, the team is positive on long-term government bonds as US duration stands to benefit from a backdrop of slowing growth and disinflation.

Asset allocation views

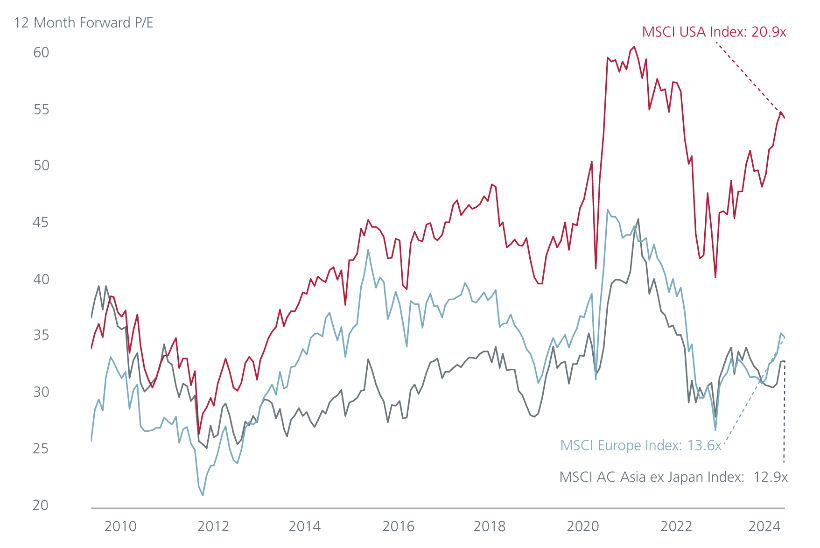

Equities: Asian equity valuations remain cheap relative to other regional markets

The team believes there is more short-term upside for US equities if economic data and sentiment remain firm. Over the medium term, the team is more constructive on Asia ex-Japan equities especially since earnings growth in the region has the potential to outpace that of developed markets. This is especially the case if a global recession transpires and is concentrated in developed markets. Furthermore, Asian valuations are relatively more attractive than the US and Europe.

IBES MSCI 12 forward P/E: US vs. Asia ex-japan

Source: LSEG Datastream, 17 April 2024.

Bonds: Higher yielding assets remain in favour

While the Fed will not prematurely cut rates, over the 12-month horizon the team anticipates that US yields will move down as the disinflation trend plays out. For now, they favour US high yields to US investment grades given the latter’s extremely tight spreads. The current economic backdrop, i.e., the lower chances of a severe recession and reduced expectations of rate cuts, is also ideal for Emerging Market USD debt. EM debt is less sensitive to EM monetary policies and more sensitive to changes in US rates.

US Investment Grade and High Yield ICE BoFA Option Adjusted Spread (in basis points)

Source: LSEG Datastream, 16 April 2024.

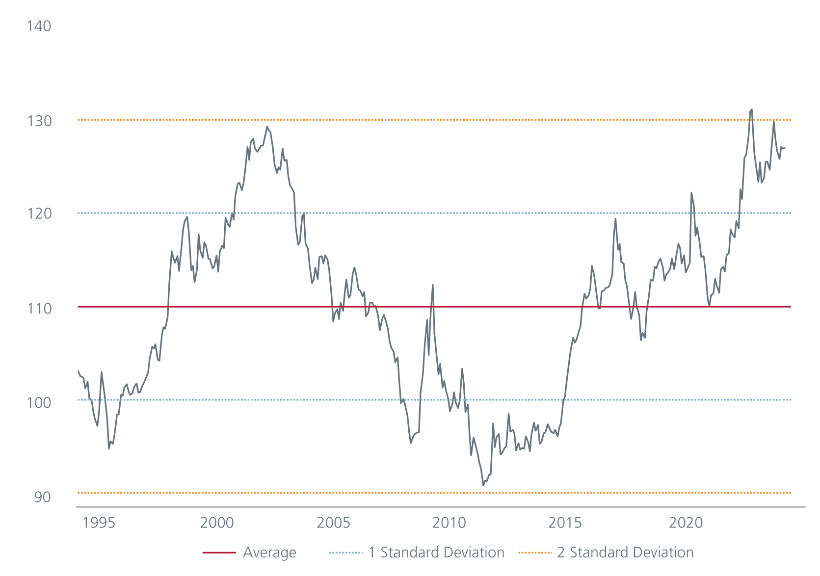

Currencies: USD continues to be supported by resilient US growth

The team recently upgraded the short-term outlook on USD (broad) to slightly positive from a neutral stance. Strong US growth and high real rates should continue to support USD in the near term. Over the 12-month horizon, the USD, given its counter-cyclical nature, stands to benefit in a slowing global growth environment.

JP Morgan US Dollar REER

Source: LSEG Datastream, 7 April 2024.

This is an extract of the 2Q24 Market Outlook. Click here to download the full report which includes a special feature “India: Why the future looks bright”.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).