Knowing and understanding the risks when investing helps one to make better investment decisions.

Myth 1

Any investment risk is bad

Fact

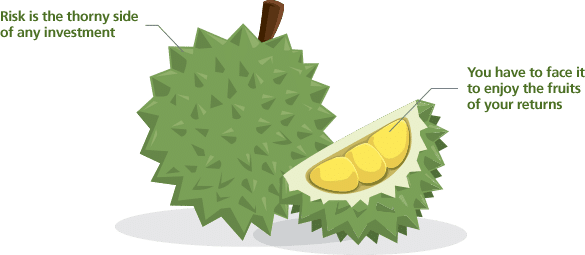

Risk is part of any investment

Risk is not to be feared but understood. Understanding risk and being comfortable with it is the key to achieving one’s financial goals.

Even the most conservative investors would need to take on some risk so that their savings can grow faster than inflation.

Myth 2

Only high risk will produce high returns

Fact

Low risk can produce high returns, if the purchase price is low and holding period long

Utility stocks, for example, are typically considered lower risk due to their non-cyclical nature. Investing in these at the right price and holding them can potentially result in attractive regular income and capital gains, as many utility stocks pay regular dividends.

Myth 3

Risk is the same as volatility

Fact

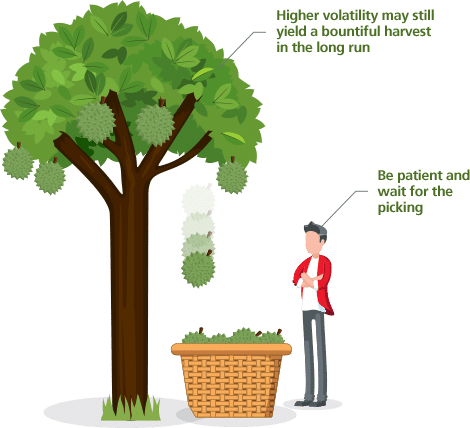

Higher volatility does not necessarily equate to higher risk

Typically, the greater the price fluctuations, the more volatile the investment. However, higher volatility does not necessarily mean higher risk. Investing during periods of market volatility can be rewarding for long term investors.

Having well-defined financial goals can help investors ride through choppy markets and stay the course during turbulent times.