Equities are perhaps the largest investment asset class from an investor's perspective. When you invest in equities, you get income from dividends (and capital gains if you sell your equities at a profit). Dividends are an important source of returns and can help make your portfolio more defensive. Learn more about their attractive features, in particular Asian dividends.

Dividends make up a big part of equity returns in Asia

In the last 10 years, dividends make up a whopping 46% of total returns in Asia, much more than in the US 1. Don't miss out.

Dividends have been steadier than earnings in Asia

Dividends offer an important source of stability, especially during times when markets are uncertain.

Asian dividends offer diversification

Although utility and telecoms sectors typically pay out high dividends, you can get dividends from many other sectors in Asia like financials, information technology, materials, industrials, etc.

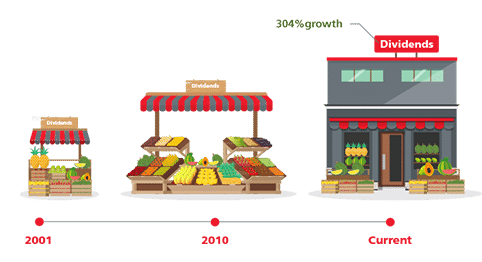

Asian dividends have been growing

From 2001, Asian dividends per share grew 304% 2. This is due to stronger cashflows, healthier balance sheets and lower debt levels.

Room for even more

While dividends are not guaranteed, Asian companies can pay out more dividends. They are only paying out 34% of their earnings in dividends, below the 44% average of developed markets 3.

Demand for diversified income from retirees will keep demand for dividend stocks high. By 2050, over 40% of the population from Korea, Taiwan, Hong Kong and Singapore will be 60 years and above 4.

Sources:

1 Bloomberg. MSCI Asia Pacific ex Japan. April 2019.

2 Morgan Stanley. Jan 2019.

3 Bloomberg. DM: MSCI World. Asia: MSCI Asia ex Japan. Annual data. December 2018.

4 United Nations, Population Division: World Population Prospects – The 2017 Revision (based on medium variants), as at June 2017 future returns.