Executive Summary

- Mobilising capital towards closing the transition financing gap is essential in achieving the goals of the Paris Agreement. Capital markets present a key financing platform given their size but to date their full potential has arguably not been realised.

- The common challenge is the lack of definition for financing the ‘brown to green’ assets. But true impact cannot be achieved by ignoring or excluding the harder to decarbonise assets in investment portfolios; without them, climate goals cannot be reached.

- A practical framework is needed to build a capital markets’ portfolio of companies that are actively transitioning their business models towards a Net Zero future as well as reducing their emissions without negatively impacting the social element.

This article is a summary of an Eastspring-Prudential whitepaper which details a framework for investing in climate transition in the capital markets, of which” Building a holistic transition investing framework for capital markets” is a key section.

The fundamental concept of ‘just transition’ is to ensure that no market or sector is left behind as companies, communities and countries adapt and make contributions to a climate-changed future. While all countries have a role to play in achieving the Paris Agreement goals1, a just transition should recognise ‘common but differentiated responsibilities’ at a country level. This then ideally must be followed through to the sector and company level after considering the varying business models, the economic viability of transition technology, as well as the social impact. Underpinning this is the need for financing the climate transition – an area where the capital markets can play a significant role.

The current challenges in transition financing

About USD 2 trillion will be required annually by 20302 to finance the transition. Capital markets present a key financing platform given their size; global equities markets are worth nearly USD 106 trillion and bond markets another USD128 trillion3. Mainstreaming transition finance through capital markets can significantly impact and help close the financing gap. However, to date, their full potential has arguably not been realised. This is due to the difficulty in finding an all-encompassing company-level metric that is reasonably market-and-sector-inclusive and not tilted to either emissions reduction or specific transition-activities.

Current sustainable finance taxonomies primarily define opportunities at the activity-level, not at the company-level. This limits the eligibility criteria and favours companies that have a significant revenue share from a green activity. In most cases, these tend to match pure play cleantech and/or renewable companies.

Although industry bodies4 have provided guidance on principles to qualify businesses/assets as being transition-aligned, there is no clear indication of the types of large-scale data available to measure this alignment. Existing data solutions tend to heavily represent companies with predominantly green revenue streams or have a bigger focus on emissions reduction targets and/or commitments5.

The above challenges have limited the investible universe for asset owners/managers. However true impact cannot be achieved by ignoring or excluding the harder to decarbonise assets in investment portfolios; without them, climate goals cannot be reached.

An investing framework that is inclusive and practical

The first step is to broaden the universe of companies that can qualify for the transition finance to include brown-to-green or brown to less-brown6 companies which are committed to emissions reductions and are progressing towards best-practice climate targets. There is also the need to be flexible and differentiate between emerging and developed markets. Applying the same standards and thresholds to both despite their different circumstances and challenges creates a barrier to invest in the transition and is not in line with the principles of the ‘common but differentiated responsibilities’ of the Paris Agreement.

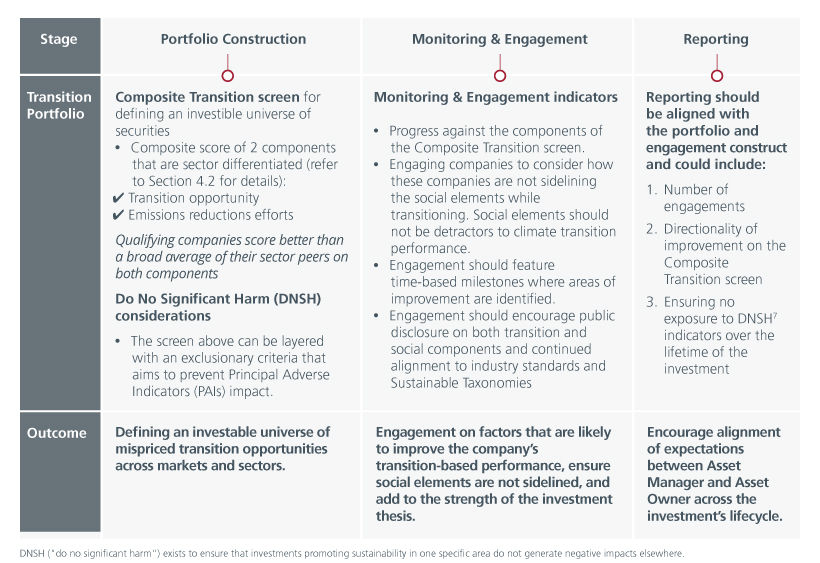

Our Composite Transition framework proposes to identify companies that are already aligned or making credible progress in aligning their business activities according to these criteria:

- The Green and Amber categories of both national and/or regional sustainable financing taxonomies

- Green: companies that offer climate solutions and/or are aligned to a 1.5 degree or below 2 degree pathway

- Amber: brown to green companies that are aligning to 1.5 degree or below 2-degree pathway and/or transitioning amidst growth such as ones in carbon intensive sectors in high-growth economies and/or companies that are in the managed phase out process i.e., coal plants

- The best-practice transition principles from international industry bodies such as GFANZ and CBI

- Ensuring adequate coverage of eligible companies within emerging markets

- Ensuring the social element of a just transition is not sidelined

Considering the above criteria alongside the need to be more inclusive and flexible, our framework uses current third-party ESG and/or market data to derive a composite score from two components that identify actions and outcomes. This dual approach assesses companies’ efforts in both transition opportunities (“more of the good” actions) and emissions reduction (“less of the bad” outcomes).

Transition opportunities assess a company’s actions based on a variety of forward-looking indicators along the transition solutions product development cycle such as high-quality climate mitigation and adaptation patents, CAPEX, and transition solution revenues. This allows for an early assessment of a company’s future transition business alignment.

Emissions reduction will focus on a company’s existing efforts in emission reduction and energy efficiency. This includes retrospective indicators such as emissions reduction trends and any CAPEX transition efforts such as upgrades to energy efficient management systems. Other measures include the availability and quality of a company’s climate strategy and public commitments (if any).

That said, it is important to note that the existence/non-existence of public commitments alone are not a primary focus of the screening process, which remains more “action based.” Selecting companies that perform better on both elements of the composite screen, relative to a broad sector-peer mean would ideally result in a portfolio of companies that are willing, and already taking steps to prepare for a climate-changed future.

As such the presence or absence of such commitments would naturally fall into the design of ongoing engagement milestones, alongside other actions such as the monitoring of social elements as enhancers or detractors of transition performance, as well as the progress of alignment to international frameworks and Sustainable Finance taxonomies.

Fig 1: Overview of our Just Transition investing framework

Source: Eastspring Investments, Sep 2024

While the screen allows for a broader range of eligible companies, the quantity and quality of data remain crucial. To address potential data limitations, particularly around the public or certified Net Zero commitments made by companies in emerging markets and certain high emissions sectors, the screen focuses on selecting indicators that correspond to concrete actions in climate transition at the business-level. Recognising the importance of public targets for best-practice transparency, the framework also includes investor-investee dialogue on “turning action into public best practice disclosure.” This may include seeking verification from organisations like the SBTi7 during the investment holding period, if necessary.

Why this framework stands out

Our composite transition screen aims to identify companies across markets and sectors that are trying to capture transition (climate mitigation and adaptation) opportunities along the product revenue cycle while limiting their exposure to emissions risk.

By proactively identifying companies that are genuinely committed to shift toward more sustainable business models through measurable actions and outcomes, investors can build portfolios of companies that effectively manage transition risks and opportunities. This approach allows investors to identify potentially mispriced assets early on.

Our methodology also captures an investment’s entire life cycle via monitoring and engagement with companies to track continued good transition progress, monitor that social factors are not detractors for transition performance and encourage enhanced disclosure and continued alignment to international frameworks. Part of the engagement process also features setting up time-based milestones to drive continuous progress.

Achieving the aims of the Paris Agreement requires a step-up in transition financing and investments. However, the diverse landscape has led to multiple, often uneven, interpretations across the capital stack. In fact, climate transition funds have grown in the past couple of years to become the largest climate fund category with USD 210 billion in assets, up 25% in the last year.8 However around 70% of these funds track the Europe’s climate transition benchmarks which have emissions reduction as their primary goals. Only a small percentage screen for revenue.

We believe that our more inclusive, flexible, and bottom-up framework can close the current gap in allocating and managing capital at the company level and help asset owners allocate capital towards transition portfolios. Such portfolios can potentially benefit from the future repricing of climate risk in the capital markets. Combined with active engagement and reporting throughout the investment’s lifecycle, the concept of a just transition can be implemented at scale by asset managers and asset owners investing in public equity and/or bond portfolios.

Please click on link to download a copy of the whitepaper “Framework for Investing in Climate Transition in the Capital Markets”.

Sources:

1 The Paris Agreement is an international treaty on climate change that was signed in 2016. The treaty covers climate change mitigation, adaptation, and finance.

2 International Energy Agency estimates

3 Impact Taskforce, 2021, Mobilising institutional capital towards the Sustainable Development Goals and a Just Transition

4 Refer to Climate Bond Initiative (CBI), the Glasgow Financial Alliance for Net Zero (GFANZ) and the Paris Aligned Investment Initiative (PAII)

5 Morningstar, 2024, Investing in Times of Climate Change: 2023 in Review

6 “Brown” companies undergoing climate transition may be transitioning to a “less brown” mode over the lifetime of the investment up till a respective transition end-date (termed as a sunset date in most Sustainable Finance taxonomies with a transition component). Hence, a company may be in a brown to less brown mode of operation but still remain aligned with Sustainable Finance taxonomies and other best practice industry guidance should the lifetime of the investment lies within an acceptable transition to Net Zero for the company’s specific country and sector.

7 DNSH ("do no significant harm") exists to ensure that investments promoting sustainability in one specific area do not generate negative impacts elsewhere.

8 Morningstar, Dec 2023

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).

.jpg)