Summary

Despite tariff uncertainty, better than expected earnings have kept asset market returns positive and market volatility moderate somewhat. China gets good news on property and AI while India begins monetary reflation.

What’s top of investors’ minds

Earnings work to offset uncertainty over tariffs and inflation.

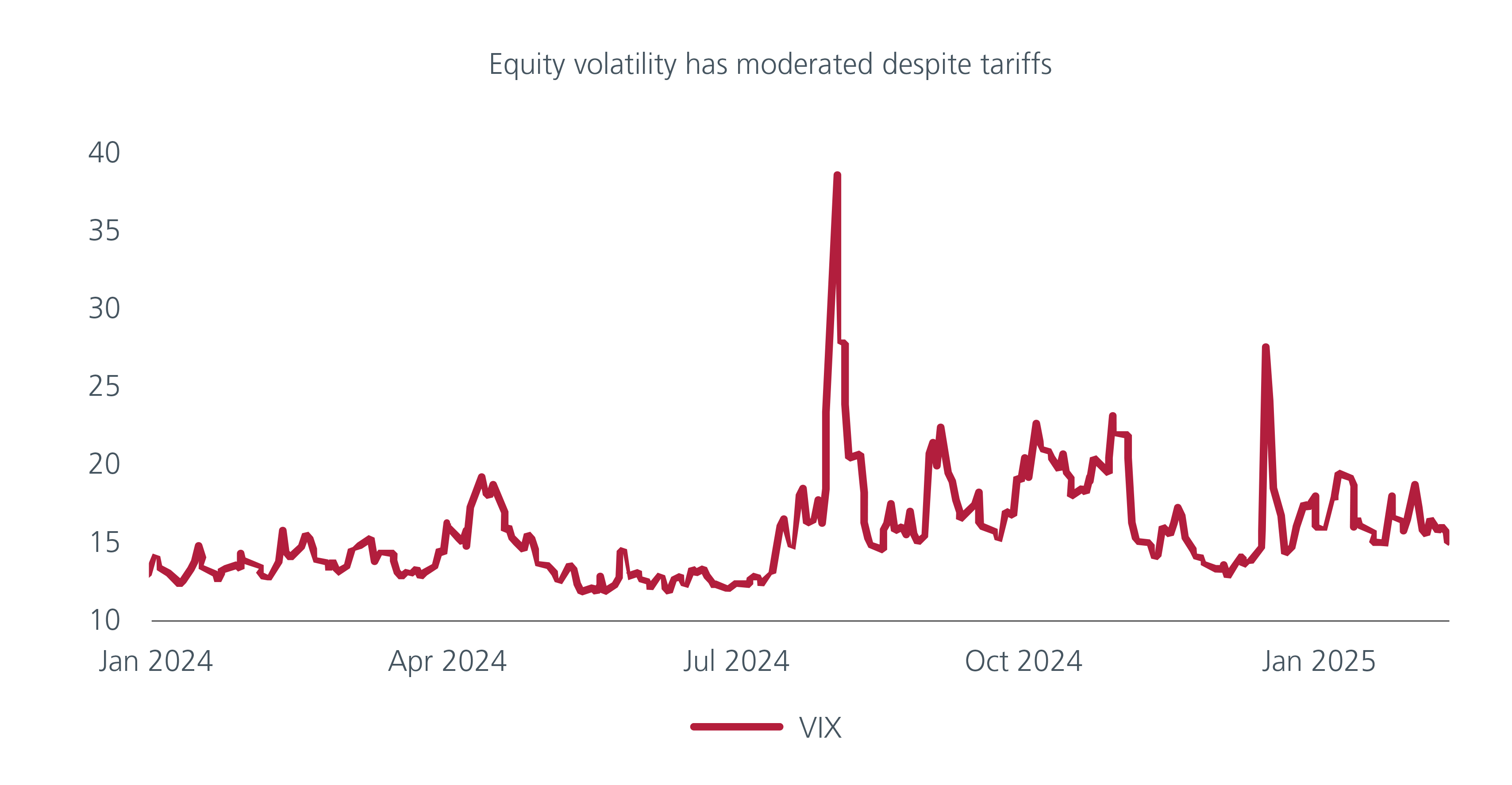

Higher than expected US inflation in January has added to the uncertainty created by the Trump Administration's vacillations over tariffs. However, better than expected earnings have allowed asset market returns to remain positive and equity and bond volatility to moderate somewhat. With 383 constituents of the S&P 500 having reported at the time of writing, earnings are beating estimates by 6.5% with consumer discretionary and finance beating by 15.6% and 10.6% respectively. The recent fall in US initial jobless claims suggests that US employment and income growth will remain healthy in February, supporting real consumption growth of 3% - 4% in Q1 and so earnings growth. Similarly, faster than expected wage growth in Japan in December and expectations for a strong Shunto are helping Japanese earnings estimates to grind higher. In China, enthusiasm for new AI models has spurred a bounce up in earnings estimates

We think these trends should remain intact for the next couple of months. President Trump appears to be willing to delay most tariffs while he negotiates various issues with Mexico, Canada, and perhaps China. However, the clear risk is that if these break down he could choose to implement tariffs quickly. We estimate that tariffs on the scale that Trump has announced will slow both US and global growth, push up inflation, and cause further delays in Fed interest rate cuts.

Good earnings have helped equity returns and volatility

China gets good news on property and AI

Markets are currently giving China the benefit of the doubt on two fronts. First and most important for equities, the announcement of Deepseek and the subsequent announcement that Apple will use Alibaba AI for its phones in China have spurred upgrades to earnings estimates for China's tech sector. This should be a durable, although sector and company specific trend.

Another key positive has been a larger than expected government intervention into a large property developer in an effort to prevent it defaulting on maturing debt. If this proves successful it could become a blueprint for further, new government intervention into the property market. To be sure, this possibility remains highly uncertain at this stage.

Away from these, early indications for consumption growth during the Chinese New Year holiday season look mixed and overall slightly soft. We continue to think that deflationary pressure from China's property market will continue to weigh on the economy in absence of new fiscal stimulus. The government has signaled it will expand the public fiscal deficit this year meaningfully – we estimate by about 1.5% of GDP – but is choosing to wait to announce this at the "Two Sessions" in March and implement this stimulus in the following months. We judge this to imply indicators of domestic growth will slow somewhat in Q1 from the pick-up in Q4 even if export growth remains robust as companies try to front run US tariffs.

AI hopes boost Chinese equities

Monetary reflation has begun in India

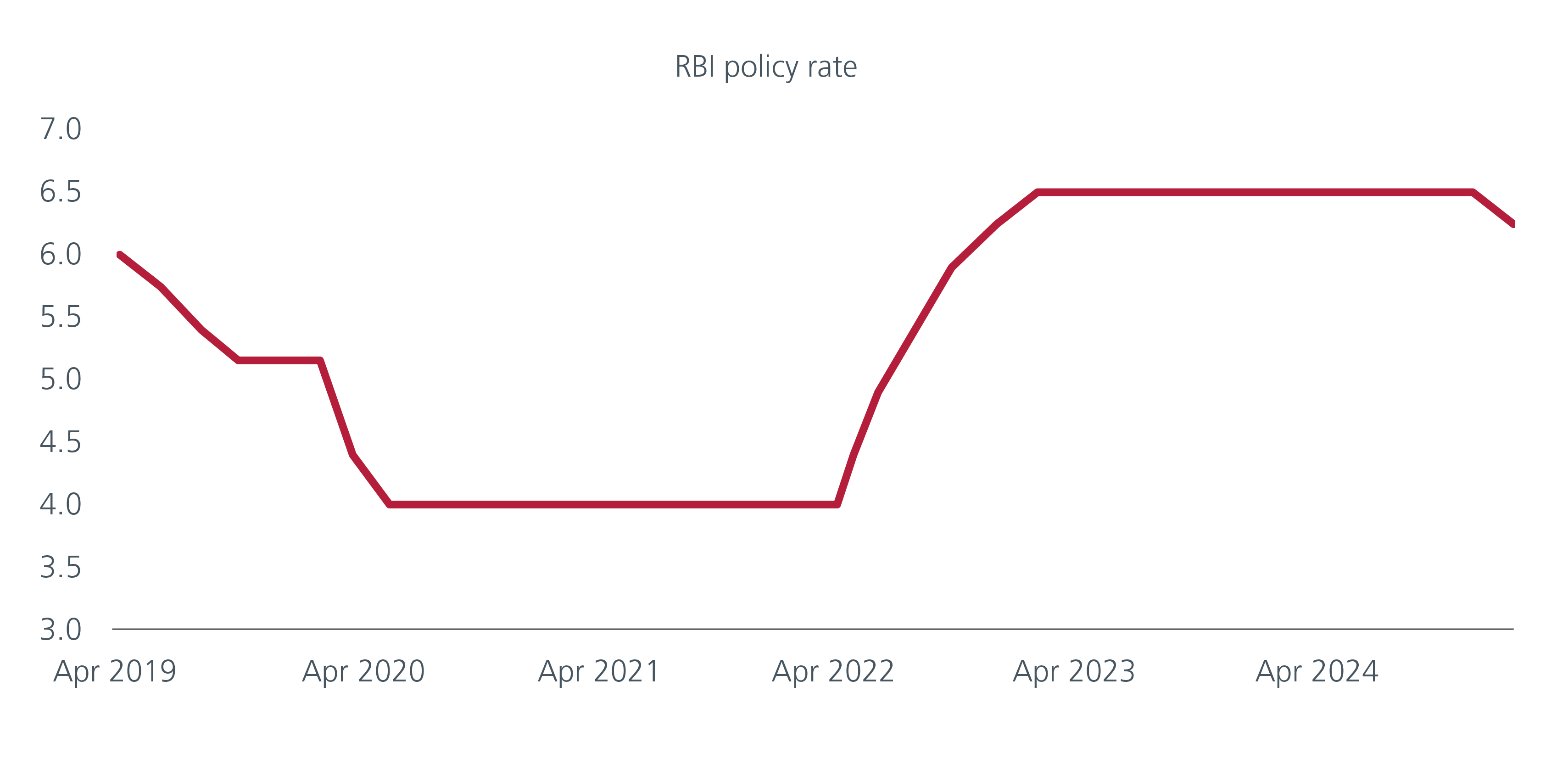

The Reserve Bank of India cut its policy rate 25bps at its February meeting, as expected, and is continuing to inject liquidity into the financial system. We judge the RBI Governor Malhotra as biased to support growth with further easing and expect another 50bps of rate cuts this year with 75bps possible. Prime Minister Modi's rapid engagement of US President Trump also increases the likelihood that India will avoid significant US tariffs. Monetary easing needs to extend further with another cut in the next several months before it will impart a meaningful boost to growth. Our expectation is that Indian GDP will remain soft in Q1, begin to stabilise in Q2 and then begin to recover in Q3. We expect fixed income returns to benefit from easing ahead of equity returns, but remain constructive on the outlook for Indian equities over the course of the year.

More rate cuts needed to boost growth

Please download full report to read more.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).