Summary

US growth is strong but faces policy uncertainty, especially around tariffs. China's growth is volatile but supported by policy measures. Japan is experiencing sustainable reflation, and India is moving towards monetary easing to boost GDP growth.

What’s top of investors’ minds

The year opens with strong US growth, but high uncertainty over policy.

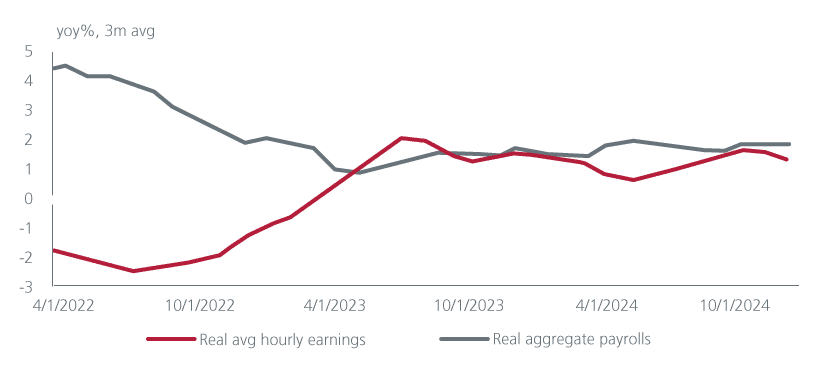

We expect US growth of about 2.5% in Q4 to sustain above 2% in H1. Aggregate payroll growth of 5.4% supports robust consumption growth and the Fed’s Beige Book suggests corporate hiring and investment plans have improved. However, much of this “US Exceptionalism” is already in lofty US valuations. This leads us to look for relative performance hedges in the form of less expensive markets. We also think that with the rise in yields incorporating some Fed rate hike risk that we think is unlikely, some elements of fixed income also offer interesting risk-return distributions.

A key uncertainty in this otherwise benign background is about what tariff policy President-elect Trump will announce following his January 20 inauguration. The market expectation for smaller, targeted, and phased in tariffs would likely pose only a small impact on US growth and inflation. In contrast, a broad, aggressive approach – for example 60% on most imports from China and 10% - 20% on most other countries - would be more negative for US and global growth and would risk higher inflation and global rates. Our concern is that Trump’s history and choice of advisors points toward higher and broader tariffs than the market expects. However, uncertainty is so high that positioning is probably better via hedges than directional trades.

US payroll earnings

China’s growth is likely to remain volatile.

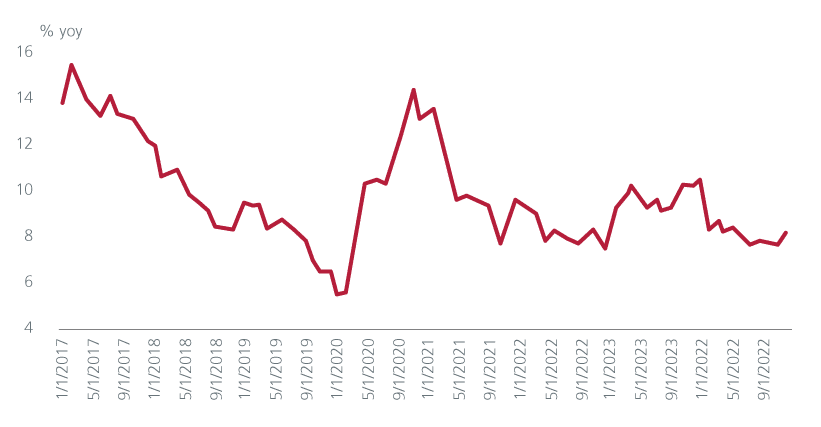

Policy, however, is committed to its target of close to 5% GDP growth this year. The export jump of Q4 may sustain in Q1 as companies try to front run US tariffs, but the consumption bounce from subsidies for consumer goods trade-ins is likely to fade. Property prices are continuing to fall, depressing household wealth, and employment income growth is weak. The collapse in credit growth suggests low-capacity utilisation rates are restraining investment.

China’s government has announced a framework to counter this likely slowing but appears to be taking a reactive rather than proactive approach. The Ministry of Finance’s January press gave rhetorical support for press reports that the government will increase the budget deficit to 4% of GDP, increase ultra-long term bond issuance by about 2tn yuan, increase the local government special bond quota, and issue bonds to fund some recapitalisation of large state banks. These lead us to expect China’s augmented fiscal deficit to increase by an economically meaningful 1.5% - 1.8% of GDP. However, officials have made clear that formal specifics will wait for the “dual sessions” government meetings in March. This implies a delay in spending until Q2.

Crucially, the government has still not suggested it will embark on a widespread carve out of the excess housing inventory that is driving China’s balance sheet deflation. We expect bouts of growth weakness to trigger temporary fiscal stimulus aimed at getting close to the 5% GDP growth target but are less optimistic that policy will reverse deflationary pressures.

China real social financing

What’s next for the Indian economy?

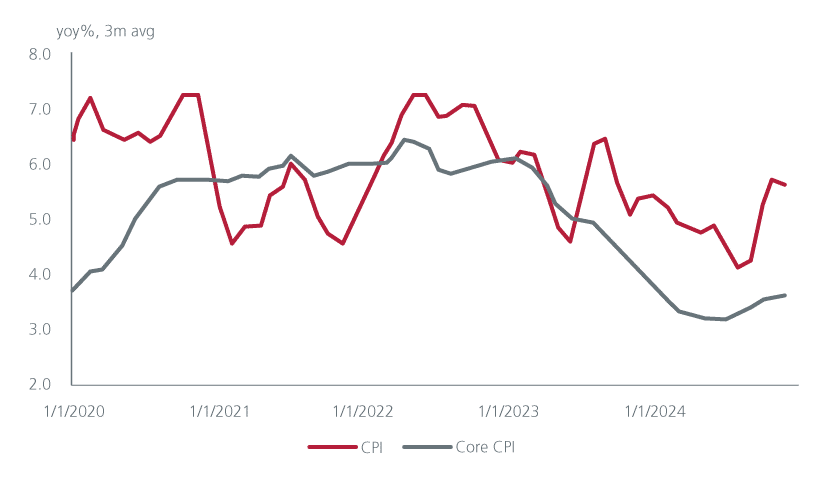

We think India is approaching a turn in monetary policy toward easing that should drive a cyclical recovery in GDP growth and better conditions for asset prices from H2. Headline inflation softened to 5.2% yoy in December a second consecutive month below the Reserve Bank of India’s (RBI) 6% ceiling while the core inflation run rate fell to 3.9% yoy from a high of 4.6% yoy earlier in the year. Credit growth, a key RBI concern early last year, has also slowed sharply. Importantly, the worst of the unexpected contraction in the government’s budget deficit is close to over.

India inflation

Higher wage growth to sustain real incomes in Japan.

Japan looks more sustainably reflationary with an outlook for real GDP growth to accelerate to about 1% this year from a contraction of about 0.2 in 2024. Wage growth is turning household income growth positive in real terms. This year’s Shunto is likely to give labour a 3% - 3.5% wage increase, sustaining growth in real incomes. This should stimulate consumption growth and keep inflation gradually rising, justifying the Bank of Japan hiking rates in Q1 and again in late Q2 or Q3. These hikes should combine with the Fed returning to rate cuts to create room for the yen to recover somewhat. Importantly, higher wage growth and a return to growth should support continued corporate reform to improve RoEs.

Please download full report to read more.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).