Summary

Markets are pricing in the impact of Trump's tariff war on US growth. This implies US equity underperformance, while countries like China, India, and Japan implement expansionary policies to offset tariffs.

What’s top of investors’ minds

Look for outperformance from policy stimulus

Markets have begun trying to price the extent to which US President Trump’s tariff war will slow economic growth, damage earnings, and perhaps lead to Fed rate cuts. Complicating matters is Trump’s daily and at times intra-day vacillations about which countries and products will be affected and when. However, Trump’s rhetoric increasingly suggests that he will go through with significant and broad tariffs despite stock market weakness and risks to growth. We judge this commitment to tariffs to combine with his tighter immigration policy to point to US GDP growth slowing from 2.5% last year to 1.6% - 1.8% this year with risk to the downside if he follows through with reciprocal tariffs in early April.

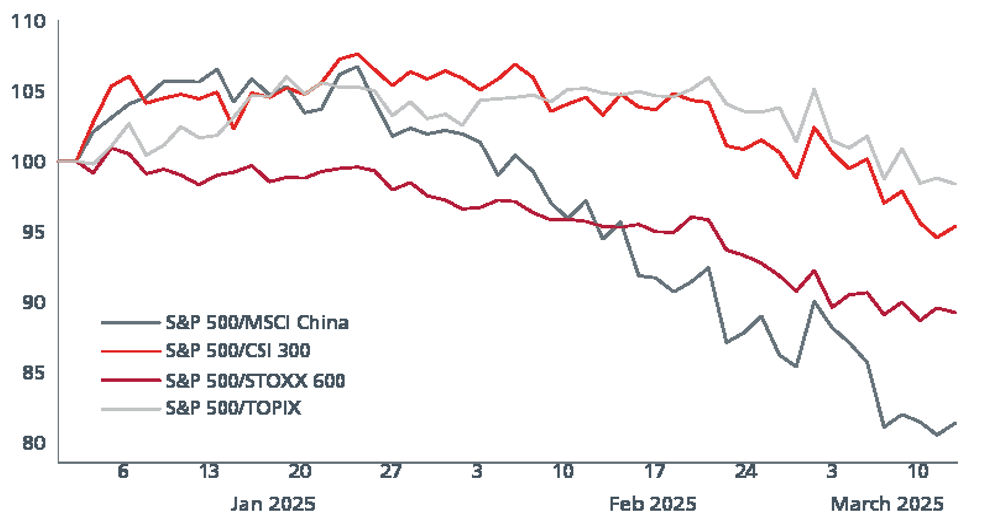

For markets this implies continued US equity underperformance particularly relative to countries where policy is turning expansionary to offset the impact of tariffs. In Asia, China stands out, just having confirmed a fiscal stimulus worth about 2% of GDP. We expect India to increasingly qualify as the Reserve Bank of India accelerates interest rate cuts in the coming months. Japan’s pro-wage growth policy should also work to insulate Japan’s domestic economy from weaker exports to some extent. Further afield, Germany’s new government has proposed a large new fiscal stimulus, although this faces political challenges for passage.

The US Federal reserve is likely to be slow to respond to any weakening of US growth because tariffs are likely to be inflationary. This implies that although the directional bias for US Treasury yields will be down, duration is likely to remain volatile. A mix of rising concerns about growth and higher equity volatility is likely to introduce pressure to US credit products in favour of EM credit where central banks will likely be faster to cut rates.

Markets tend to punish bad policy and reward good policy

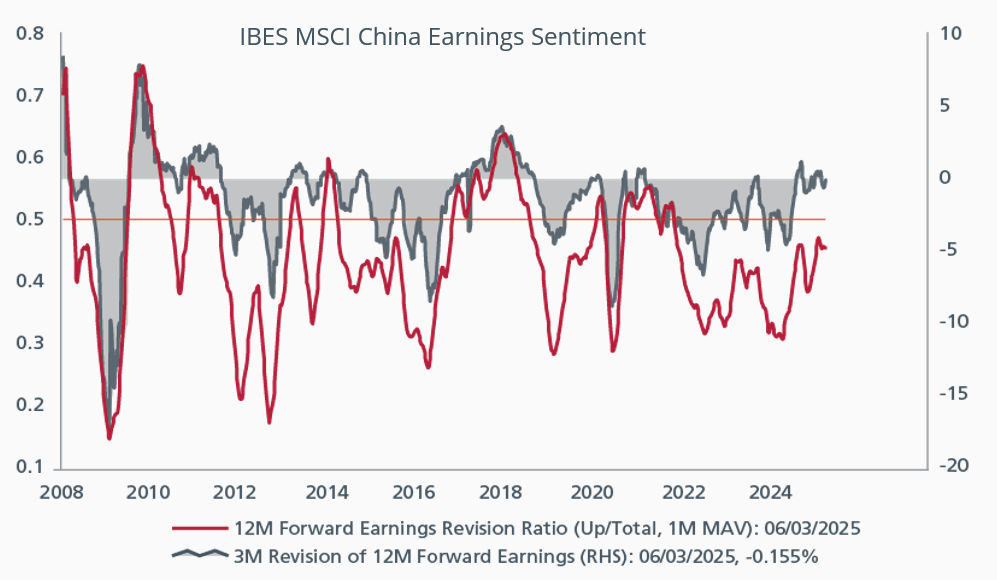

Chinese policy shifts to stimulus

China’s NPC ushered in an important policy shift back towards stimulus that will support China’s markets, in our view. Policy announced so far points to an increase in the in-budget deficit of 2.2% of GDP to about 9.9% on a cash basis and an increase in the broad, “augmented” deficit of about 1.7%-1.8% of GDP to roughly 15% of GDP. Although that was in-line with well expectations, officials suggested that the government had further policy measures in reserve if necessary. Local governments appear likely to gain new discretion over the amount of their bond quota they can use to buy excess housing and land inventory and, crucially, the price at which they can bid.

Officials suggested new support for private sector businesses in terms of cracking down on local government tax farming, increased pressure on local governments to settle arrearages to private companies and granting greater access to government contracts. China’s central bank also appears likely to cut interest rates and bank reserve requirements at least 50bps. This should boost liquidity and improve the attractiveness of property relative to interest rate products.

In sum, we expect that Beijing will spend whatever it takes to keep GDP growth above 4.5% in all but worst-case scenarios of the US raising its tariff rates on China to 50% - 60%.

Fiscal and monetary stimulus should support earnings revisions

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).