Executive Summary

- Asia's economies are adapting to new challenges such as geoeconomic fragmentation and tech disruption, which will shape future growth and maintain the region's status as the world's fastest-growing area.

- The region's varied economic landscapes allow investors to balance risk and reward by investing in a mix of quality growth, emerging/structural growth, and cyclical growth opportunities.

- Despite its economic strengths, Asia is under represented in global financial indices and offers attractive entry points for investors to capitalise on the region's potential.

Asia has long been recognised as the world's fastest-growing region, with its growth model continuously evolving over the years. The region's diverse economies enable the rebalancing of existing growth models and the creation of new ones. Future growth will be shaped by geoeconomic fragmentation, tech disruption, demographics shifts and evolving consumption patterns. As Asia continues to transform, it is expected to contribute to 60% of global growth by 2030.1

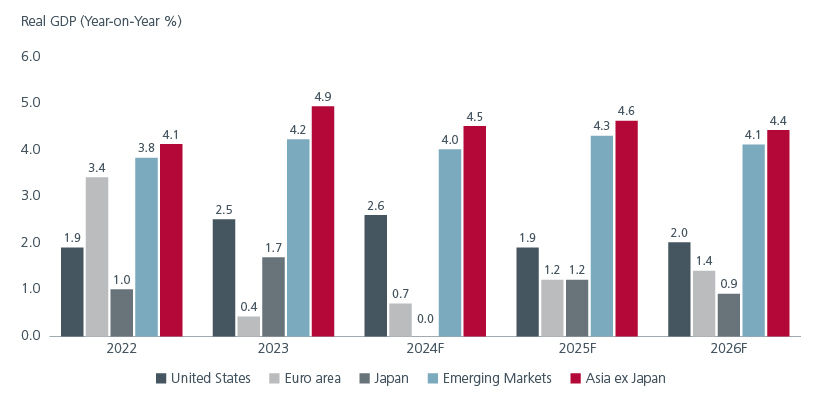

Asia ex-Japan is expected to maintain moderate growth in 2025. However, this growth could be affected if the new US administration's trade policies are implemented earlier than expected. That said, in the near term, the outlook for most economies in the region remains relatively stable given benign inflation and healthy macroeconomic indicators.

Fig 1: Asia’s remains the world’s fastest growing region

Source: Bloomberg, as of 5 Nov 2024

Underappreciated strengths

The case for long-term investing in Asia is compelling. GDP growth aside, Asia stands out in many other areas. Asia is the world’s largest trading region; accounting for 53% of the global goods trade in 2021. Asian countries are involved in 49 of the world’s 80 largest trade routes2 .

Meanwhile, Asia’s status as a significant supply chain hub continues to grow post the pandemic with companies adopting the China plus one strategy. The ASEAN region and India are clear beneficiaries, and this shift is expected to further underpin the region’s growth. Multinationals will find it beneficial to diversify their manufacturing bases and build out more supply chains that can leverage the differentiated strengths across Asia.

Asia’s population accounts for approximately 59% of the world's total, and the region’s rapidly growing middle class has made domestic consumption an increasingly important growth driver, especially for India and the Southeast Asian economies. According to a report by McKinsey, Asia will account for one of every two of the world’s upper-middle-income and above households in the period to 2030. The varying income levels in Asia create demand for different types of goods and services. Research suggests that 78% of total consumption in Asia is made up of basic goods, with “special treat” and “first luxury” items accounting for the remaining 17% and 5%.

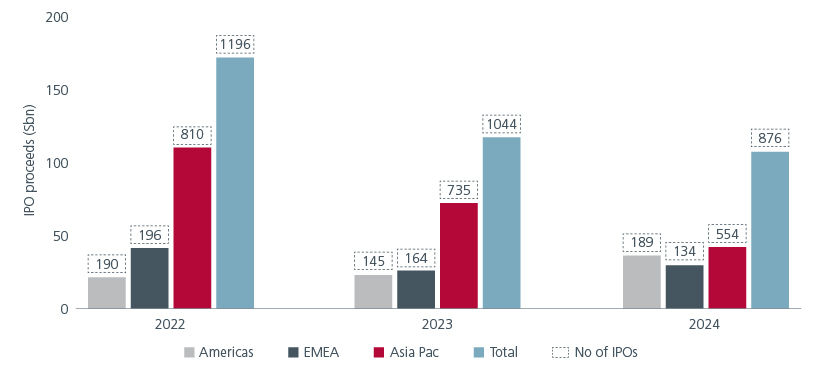

Asia is also becoming a hub for global technology and industrial innovation. For example, Asia’s fintech revenues are expected to be bigger than North America’s by 2030.3 This rapid growth in technological advances and innovation is driving the strong demand for growth capital. In 2024, the Asia Pacific region maintained its position as the largest region for initial public offerings (IPOs), both in proceeds and volume; India in particular was a standout.4

Fig 2: Asia Pacific maintains its IPO lead

Source: S&P Global Market Intelligence LLC, as of 30 Nov 2024, numbers in box refers to volume

Undervalued possibilities

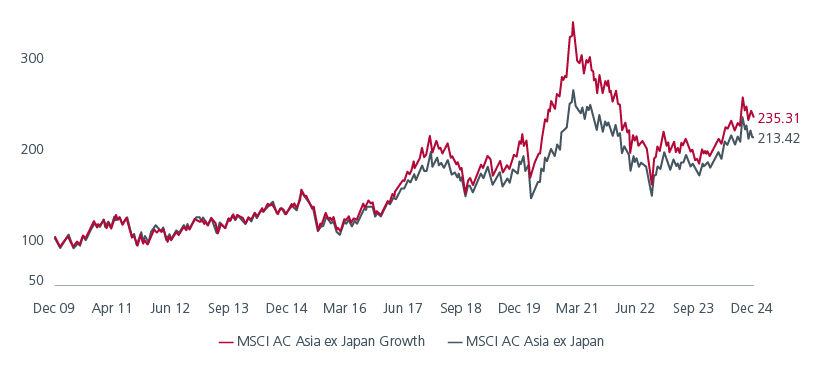

Despite being a powerhouse is many aspects, the region is under represented in global financial indices. As of June 2024, Asia ex-Japan equity markets comprised 9.38% of the MSCI AC World Index.5 Many of the Asian markets also offer attractive entry points at current valuations.

The MSCI AC Asia ex-Japan Index has close to 1,054 constituents while its growth subset i.e. the MSCI AC Asia ex-Japan Growth Index has close to 590 growth constituents. The three largest sectors in the growth index are the information technology, communication services and consumer discretionary sectors. Interestingly, the growth index has outperformed the broader index on a cumulative basis since 2017.

Fig 3: MSCI AC Asia ex-Japan growth outperforms the broader index

Source: MSCI indices as of 31 Dec 2024, Cumulative gross returns in USD (Dec 2009 – Dec 2024)

Varied choices

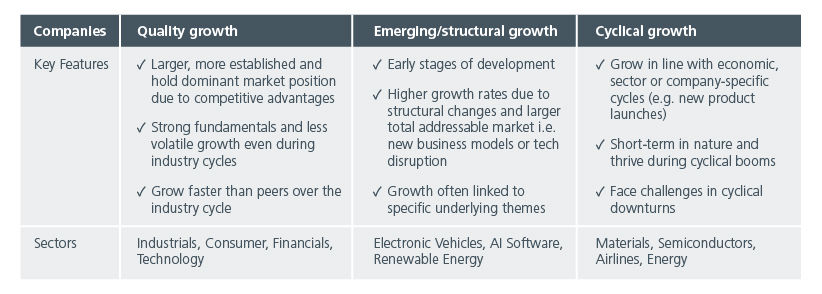

The region's diverse blend of mature, advanced economies and high-growth potential emerging economies offers dynamic and unparalleled opportunities. Investors can balance risk and reward by understanding the various economic landscapes and the growth profiles of companies, be it quality, emerging, or cyclical.

Fig 4: Companies fall into distinct growth buckets

Source: Eastspring Investments, Jan 2025

Quality growth companies tend to be the longest held, core positions within our portfolios as they provide stability in the underlying growth dynamics of the portfolios. That said, these companies may still be affected by idiosyncratic country economic cycles or industry specific cycles. In these cases, the actual active weights may vary depending on the timing of these cycles even though they are held as a core active position for extended periods. There is some overlap between this segment and cyclical growth companies as position sizes are determined by the timing of the cycle.

We strive to identify emerging/structural growth companies as early as possible in their growth cycle when there is the longest runway for growth and hence the highest appreciation potential. As a result, we typically hold the largest active positions in these companies earlier in their growth cycle as well and reduce them as these expectations are realised.

The key to doing well with cyclical growth companies is to time the industry cycle for their specific industries. This requires close monitoring of industry and company fundamentals and leverages our previous experience investing in these companies and sectors. We typically try to exit these companies in the upturn and not hold on to them in a downturn.

As growth investors, we seek to identify and invest in underappreciated growth opportunities that are trading at fair valuations. Where possible, we look for idiosyncratic growth ideas that are not well known or well understood by the public equity markets.

Access expert analysis to help you stay ahead of markets.

Sources:

1 https://www.weforum.org/agenda/2019/12/asia-economic-growth/

2 https://www.mckinsey.com/mgi/our-research/asia-on-the-cusp-of-a-new-era

3 https://www.weforum.org/stories/2024/06/why-asia-s-time-is-now-whats-fueling-asian-growth-and-what-does-it-mean-for-the-rest-of-the-world/

4 https://www.pwc.co.uk/services/audit/insights/global-ipo-watch.html

5https://www.msci.com/research-and-insights/visualizing-investment-data/acwi-imi-complete-geographic-breakdown

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).