Executive Summary

- Indian government bonds are a stable source of carry/income. Its high yields, strong domestic demand and low foreign ownership level make Indian bonds less volatile than US bonds.

- Improved foreign investor accessibility, market liquidity and depth as well as better fiscal management have also contributed to the bonds’ attractiveness.

- In the near term, the outlook for India’s government bonds is supported by prospects of rate cuts by the Reserve Bank of India, given India’s moderating growth momentum and more controlled inflationary pressures.

The inclusion of Indian government bonds in the JP Morgan Global Emerging Market (EM) Bond Index was one of the biggest developments within the global emerging bond markets in 2024. Starting from 28 June 2024, the weightage of Indian governments bonds is set to increase by 1% each month until it accounts for 10% of the index. In 2024, Bloomberg and FTSE also announced that they will be adding Indian government bonds to the Bloomberg EM Local Currency Government Index plus related indices as well as in the FTSE EMs Government Bond Index starting from 31 January 2025 and September 2025 respectively.

Indian government bonds’ inclusion into the global bond indices is expected to attract substantial foreign investment, with estimates ranging from USD 20 to 40 billion1.

Coming of age

The inclusions into these global bond indices represent the coming of age for India’s bond market, which is the second largest in the world behind the US. As of September 2023, the government bond market size stands impressively at USD1.3 trillion, with corporate bonds at USD0.6 trillion. However, foreign portfolio investment in these markets is relatively modest at USD8.5 billion.

The inclusions are the result of years of efforts by the Indian government to improve foreign investor accessibility, market liquidity and depth, which includes:

- The Fully Accessible Route (FAR) framework, which was introduced in March 2020 allows non-residents to invest in specified government securities without investment caps.

- The Reserve Bank of India (RBI) has periodically adjusted the list of securities eligible under the FAR framework, thereby increasing the range of options for investors.

- Investments in market infrastructure, such as better trading platforms and more efficient settlement systems.

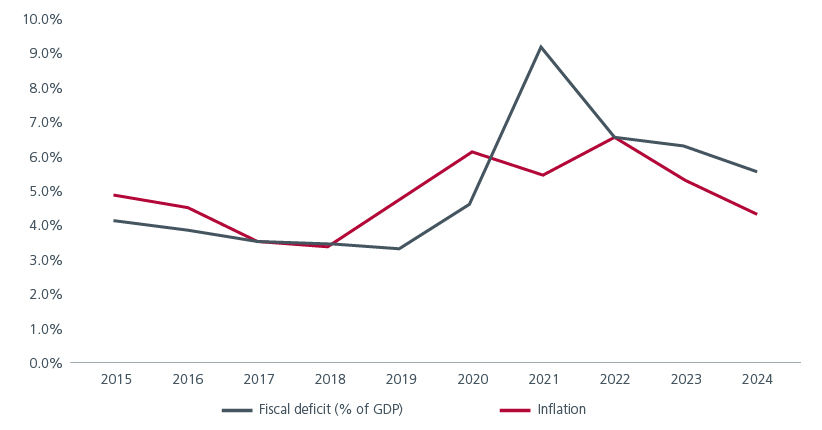

At the same time, better fiscal management, lower currency volatility and an improved inflation outlook in recent years have helped to increase the appeal of Indian government bonds. Over the last 10 years, India’s fiscal deficit has shown a trend of consolidation except for the COVID-19 pandemic period, when the deficit surged to around 9.5% of GDP on the back of increased government spending on relief measures and a decline in revenue. Meanwhile, India’s inflation has averaged between 4% to 6% over the same period. See Fig. 1.

Fig. 1. India’s fiscal deficit as a % of GDP and inflation

Source: Reserve Bank of India. January 2025.

The attractiveness of Indian government bonds

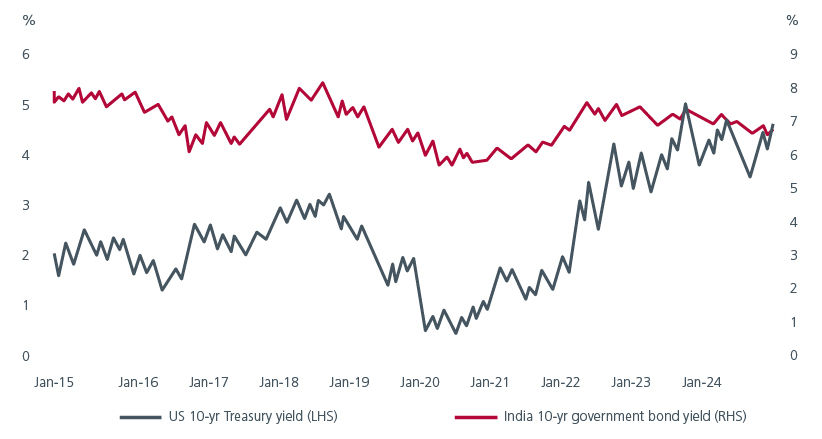

In our view, Indian government bonds provide stable income/carry. Indian government bonds offer relatively higher yields compared to bonds from many other emerging markets. In addition, given their still-low foreign ownership level (5%2) and strong demand from domestic insurance and pension funds, Indian government bond yields have demonstrated less volatility compared to US yields. See Fig. 2. The reduction in the face value of bonds ₹10,000 and the emergence of Online Bond Platform Providers have also made it easier for domestic retail investors to participate in the bond market, further boosting the demand for Indian government bonds.

Fig. 2. US vs India 10-year government bond yields (local currency terms)

Source: Bloomberg. January 2025.

Moreover, for equity investors with existing Indian equity exposure, adding Indian government bonds can help lower portfolio volatility while still benefiting from India’s long-term economic reforms.

With the inclusion enhancing India’s visibility and credibility in the international financial community, the government will need to maintain fiscal discipline or risk suffering foreign investor outflows. In addition, having a healthy government bond market will create positive spillover benefits for Indian corporates. Lower bond yields may lower borrowing costs and improve profitability. A robust government bond market may also free up the banking sector’s capacity to increase its lending to the private sector as well as provide funding for infrastructure projects, which can boost long-term economic growth.

Positive near-term outlook amid potential risks

In addition to the long-term drivers mentioned above, the near-term outlook for India’s government bonds appears promising. India’s growth momentum is moderating, and inflation is expected to be more contained in 2025 compared to prior years. Unlike other Asian central banks, the Reserve Bank of India (RBI) did not start cutting rates in 2024. This potentially gives the RBI more room to cut rates in 2025 when the opportunity arises, which should be supportive of bond prices.

That said, we are mindful of the potential risks posed by a strong USD and fluctuating US bond yields. Higher than expected spending by the Modi government to stimulate short-term economic growth could also challenge fiscal discipline and increase the supply of Indian government bonds. Despite these concerns, we believe that Indian government bond yields can trend lower over the medium term due to strong demand from both foreign and domestic investors, robust long-term economic fundamentals, and a strengthened banking sector. Active investing would be key to capitalise on the opportunities to extend duration when these market concerns are temporarily elevated.

Access expert analysis to help you stay ahead of markets.

Sources:

1 Bloomberg. June 2024.

2 Foreign ownership of FAR-designated bonds – which constitutes 40% of IGB issuance – as at June 2024. JP Morgan Research.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).