Summary

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us…” – Charles Dickens

Charles Dickens's famous quote serves as a powerful metaphor for the current investment landscape. It captures the essence of contrast and duality, mirroring the challenges and opportunities investors face today. In this article, we delve deeper into the outlook for market volatility and how investors can find resilience amidst uncertainty, drawing inspiration from Dickens' evocative words.

Concentration risks

The opening half of 2023 proved to be a momentous phase, characterised by significant occurrences such as the unfortunate failures of several major US regional banks, and the rescue of a 167-year-old Swiss bank, Credit Suisse, by a longstanding rival. Meanwhile, the German economy went through a phase of recession as inflation started to have a negative impact on consumers. Over in the United Kingdom, inflation not only showed stubbornness but also stayed persistently high. On the other side of the Atlantic, concerns about the debt ceiling resulted in a staggering surge in US credit default swaps1, skyrocketing from a mere 15 basis points to a whopping 175 basis points.

Despite the expected market turbulence caused by such upheavals, the CBOE Volatility Index (VIX), known as Wall Street's fear gauge, experienced a notable decrease, plunging to its lowest level since February 2020, before subsequently recovering some ground. Moreover, towards mid-June, US stocks reached a triumphant high point, the highest in over a year, offering a glimmer of optimism amidst the turbulent backdrop.

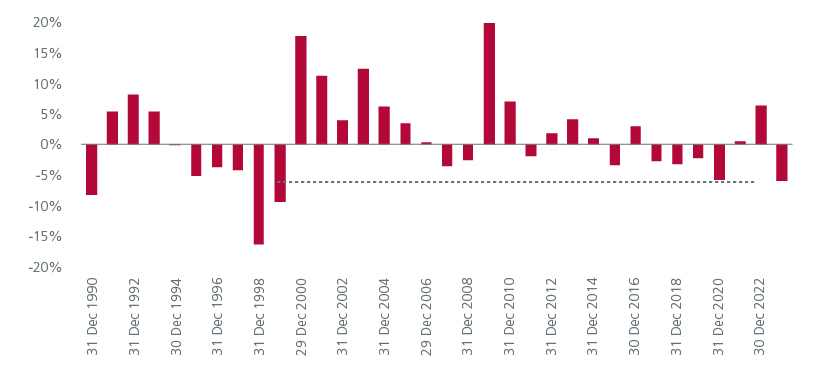

However, the gains observed so far this year have occurred in the absence of market breadth, lacking a broad-based rally in the market. Instead, they have been mainly fueled by a frenzy surrounding renewed enthusiasm for Artificial Intelligence (AI) related stocks. These stocks were not necessarily influenced by perspectives on economic recovery but rather by the potential benefits expected from the AI revolution, making it a rather narrow economic argument. These prominent market players have experienced substantial gains, thereby advancing the "market-cap-weighted" index to outperform its "equal-weighted" counterpart, as evidenced by Fig. 1.

Fig. 1: Equal weighted S&P 500 versus market cap weighted S&P 500

Source: Refinitiv Eikon, S&P Global, and Eastspring Investments, June 2023

This occurrence gives rise to several noteworthy implications. Primarily, it engenders sector and style biases, particularly within the Information Technology and Communication Services sectors. Interestingly, when we look through the transcripts of the 2023 earnings calls across the sectors within the S&P 500 Index, the performance of nearly all sectors can be directly accredited to an “AI” reference.

Fig. 2 below illustrates the extent to which the term “AI” is mentioned by companies during their earnings call in the first quarter of 2023, at the sector level, and it is measured by the percentage within a specific sector.

Fig. 2: % of companies mentioning “AI” on earnings calls: Q1 2023

Source: FactSet Earnings Insight report, Eastspring Investments, June 2023

As expected, media and communication stocks, tech names and online retailers are significantly involved in this field at the sector level. When we compare the distribution of returns across sectors year-to-date, there is a distinct positive correlation between the top-performing sectors and their reference to AI, highlighting a sector bias among the winners.

Sectors with limited association to AI citations are faring poorly this year, with some experiencing negative performance. Additionally, it exerts an influence on style factors such as Size and Momentum in a commensurate manner.

Furthermore, this prevailing trend of mega-cap stocks dominating the market significantly amplifies the concentration risk within the equity market with a heightened level of risk now associated with the market due to its concentrated nature.

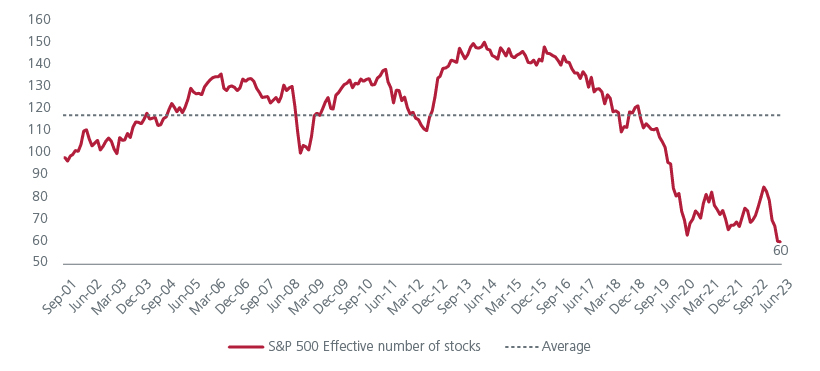

To gauge the extent of market concentration, we can utilise the concept of the effective number of stocks. This metric provides a simple quantification of index concentration, ranging from 1 (indicating the entire index weight is concentrated in a single stock) to n, representing the total number of constituents in the index. In essence, a low effective number of constituents suggests a high level of index concentration. To calculate this measure, we take the inverse of the Herfindahl-Hirschman Index (HHI)2, a widely used economic indicator that is often used to identify monopolistic producers in a specific industry.

As shown in Fig. 3, when examining a comprehensive market index such as the S&P 500 index, the long-term average effective number of companies is around 120. However, since March 2018, this average has been surpassed by a persistent decline. By June 2023, the index reached an unprecedented low of merely 60 effective stocks, significantly below the pre-pandemic low of 96 recorded during the peak of the dot-com bubble period. This present market state reveals a diminished level of diversification, emphasizing the critical need to meticulously evaluate concentration risks.

Fig. 3: Historical low hit of effective number of stocks

Source: Bloomberg, S&P Dow Jones Indices, and Eastspring Investments

Overstretched valuations

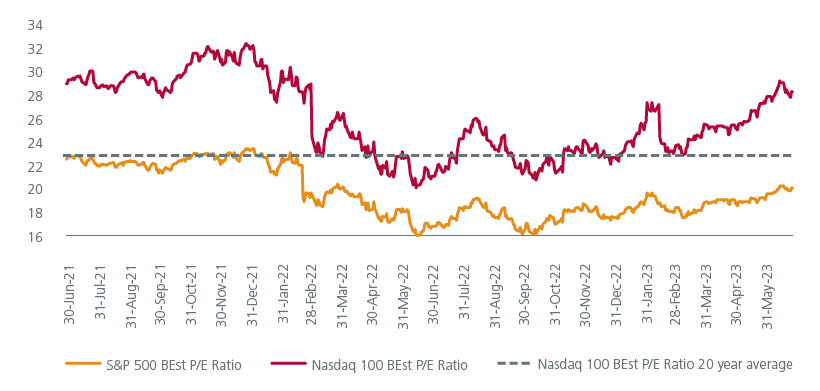

Whilst the market-cap-weighted S&P 500 Index as a whole presents a forward price-to-earnings (P/E) ratio of around 19, the Nasdaq 100's P/E ratio surpasses 25, as shown in Fig. 4. Interestingly, the top 10 stocks within the S&P exhibit an average ratio of 32, while some of the AI stocks such as NVIDIA reached an astonishing level of 84 in mid-June3 this year. This situation poses a risk as these inflated valuations heavily rely on low interest rates, which tend to amplify the perceived value of these companies' future earnings, thereby enticing investors.

Should the US Federal Reserve (“Fed”) opt to maintain higher policy rates for an extended duration, the index may become more susceptible to fluctuations in interest rates, potentially resulting in heightened volatility beyond the expectations of many investors. In fact, Fed Chairman Jerome Powell recently stated to the House committee that it is appropriate to raise interest rates a further two times this year. Moreover, inflationary pressures continue to remain elevated, and the process of bringing inflation back down to the targeted 2% level still has a considerable way to go.

Fig. 4: Stretched valuation fueled by AI mirage

Source: Bloomberg, S&P Dow Jones Indices, NASDAQ and Eastspring Investments

Earnings recession

While AI may contribute to the growth of certain individual stocks, it might not be sufficient to change the trajectory of the overall cyclical earnings trend. As long-term investors, we ought to consider the limitations and potential risks associated with the assumption that AI alone will drive a significant rebound in earnings. Furthermore, the most recent data concerning the strength of the US labour market has highlighted some uncertainty.

Jobs growth has been weaker than predicted for the second consecutive month as of July. This might indicate a gradual reduction in the tightness of the labour market and an economy moving towards a gentle landing. However, the unemployment rate and wage growth have both turned out to be stronger than anticipated. This could suggest that the Fed might still need to take a more assertive stance. Given that policymakers are currently highly sensitive to economic data releases, even small pieces of information about the economy's health can trigger significant market reactions; the Financial Times accurately stated, "a soft landing is still a landing”.

Any deceleration is likely to affect secular growth stocks which have been the driving force behind the S&P 500's recent ascent. Companies have been able to benefit from the ability to raise selling prices and maintain them at higher levels despite a decline in input costs. However, as inflation recedes, companies may experience a waning of their pricing power and face challenges in preserving their profit margins.

This scenario becomes even more critical in light of a potential deceleration in consumer spending. Companies in this category, particularly those dependent on consumer spending and personal incomes, are unlikely to remain unaffected during this regime. Moreover, the repercussions of the Fed's interest rate increases on the economy and the yet-to-be-seen impact on financial conditions further add to the vulnerability of profits.

The companies in the S&P 500 were heading towards a collective 5.2%4 drop in earnings by 4th August, their weakest performance since 2020. As we are still finishing up the Q2 earnings season, if the actual decline for the quarter remains at -5.2%, it will be the biggest year-on-year earnings dip for the index since Q3 2020 (-5.7%). This will also be the third consecutive quarter where the index has seen a year-on-year fall in earnings.

Whilst the United States confronts an impending corporate contraction, the Asia-Pacific region has embarked on a divergent trajectory, thereby emphasizing the pivotal role of diversification, and unveiling resilient growth prospects in Asia, as illustrated in Fig. 5.

Fig. 5: MSCI AC Asia ex Japan’s earnings per share growth (yoy %)

Source: Bloomberg, FactSet, MSCI, Goldman Sachs Global Investment Research and Eastspring Investments

Resilience remains key

In conclusion, amidst the contrasting dynamics and challenges in the current investment landscape, it is crucial to recognise the significance of downside protection and resilience. Charles Dickens’ poignant quote serves as a fitting metaphor for the market's duality, capturing the essence of uncertainty and opportunity. Despite the concentration of investments in large-cap and momentum-driven stocks, diversification remains a crucial element for achieving consistency in portfolio performance. Even the legendary investor, Warren Buffett, has recognised the value of diversification by adding Japanese trading company holdings to his portfolio.

There are several approaches to achieving diversification in different areas of the market. To diversify growth in developed markets, investors may consider exploring opportunities in Asia's growth markets. Although the global economic recovery may be sluggish, regional disparities will play a significant role in determining investment prospects. Asia, in particular, is poised to experience stronger growth, lower inflation, and more accommodating monetary policies compared to the United States, United Kingdom, and Europe.

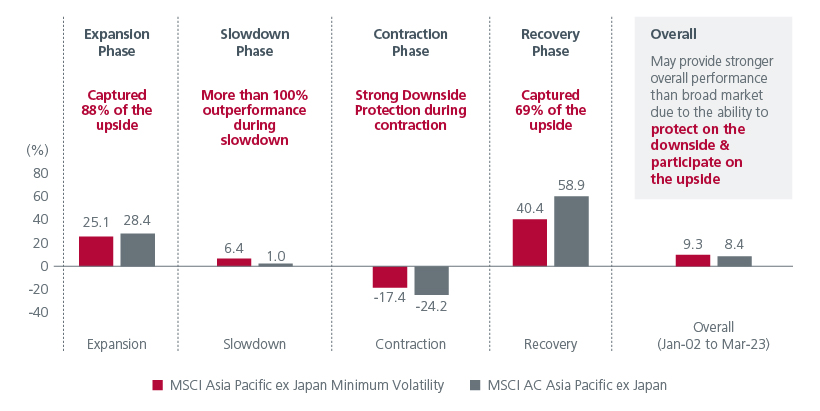

When it comes to diversifying exposure to high-growth, volatile technology companies, investors could turn their attention to defensive stocks which can provide potential downside protection. Over the full market cycles, stocks with lower volatility and correlation tend to deliver returns comparable to the broader equity market, but with reduced fluctuations and lower drawdowns, as shown in Fig. 6.

Fig. 6: Participation in up markets and protection during down markets

Source: Eastspring Investments, Bloomberg, OECD (G20) for business cycles, data from January 2002 to March 2023.

Furthermore, consistent income from dividends plays a vital role in total returns. In times of declining stock prices, stable dividends with higher yields can offer meaningful protection. This becomes particularly enticing when borrowing rates are high, as investors seek current income rather than relying solely on potential stock appreciation.

Throughout market cycles, excessive optimism can result in inflated asset valuations, ultimately leading to a correction and downward pressure on prices. Conversely, during downward market cycles, excessive pessimism drives down asset valuations, setting the stage for eventual price recovery.

As investors face the prospect of shrinking central bank balance sheets and restrictive monetary policies to combat inflation, it becomes imperative to consider defensive strategies and their role in asset allocation. By maintaining a focus on downside protection and resilience, investors can navigate the market's challenges and capitalise on the opportunities presented by the evolving investment landscape.

Access expert analysis to help you stay ahead of markets.

Sources:

1 Spreads on U.S. government one-year credit default swaps (CDS), https://www.reuters.com/markets/us/us-credit-default-swaps-flash-default-warning-speculators-rush-2023-05-25/

2 The Herfindahl-Hirschman Index is calculated by squaring the market share of each firm competing in the market and then summing the resulting numbers.

3 Data reading from Refinitiv on 14th June 2023

4 As reported by FactSet on 4th August, https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_080423.pdf

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).