Executive Summary

- Tariffs and rising protectionism have increased policy uncertainty, highlighting the need for defensive investment strategies

- A low volatility strategy has shown resilience during market turbulence, protecting against downside risks

- Active bets allow investors to capitalise on the market’s nature to distinguish between winners and losers during selloffs

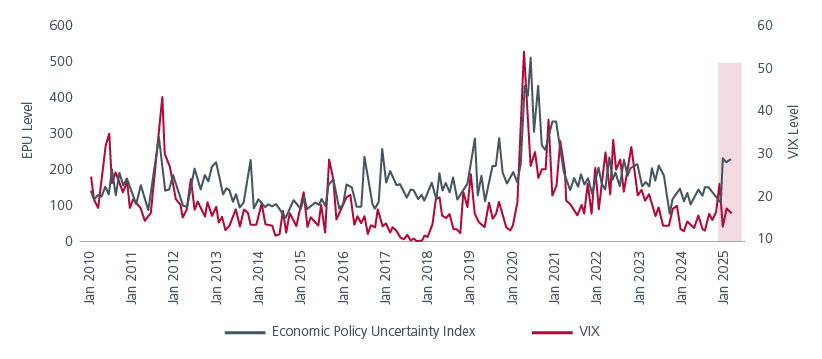

Recent tariffs, rising protectionism, and an uncertain inflation outlook all reflect the heightened policy uncertainty, as illustrated by the Economic Policy Uncertainty (EPU) Index. This index measures the frequency of articles in newspapers that contain terms related to economy, policy, and uncertainty, reflecting the growing concerns among businesses and investors. Interestingly, there is a notable disconnect between this uncertainty and financial market volatility. See Fig 1.

While there might be various reasons contributing to this, i.e. some investors still being in the “it’s just a negotiating strategy” camp or the market’s perception of Trump’s growth-friendly policies offsetting volatility, the fact remains that Trump's "weaponisation of uncertainty" has been dialled up in his second term. There is no doubt that the pain from tariffs will trigger a chain reaction at both the macroeconomic and corporate levels. Market volatility is thus likely to be a constant feature.

Fig 1: The disconnect between uncertainty and financial market volatility

Source: Bloomberg, Economic Policy Uncertainty, and Eastspring Investments, Feb 2025

Economists at Goldman Sachs have estimated that across-the-board tariffs on Canada and Mexico would result in a 0.7% increase in core inflation and a 0.4% reduction in gross domestic product1. The potential to drive up consumer prices is particularly concerning for investors, who fear a resurgence in inflation could prompt the US Federal Reserve (Fed) to halt its rate-cutting measures. As expected, the Fed paused its rate-cutting cycle in March, with Chair Powell stating that officials were 'waiting to see what policies are enacted' under the new president.

Enhancing portfolio resilience is key

To ensure resilience in an unpredictable economic environment, investors should diversify their investments and modify their portfolios to be more defensive. For example, adding a low volatility (low vol) strategy can enhance the defensiveness of an overall investment portfolio. A defensive portfolio typically aims to limit losses during market selloffs.

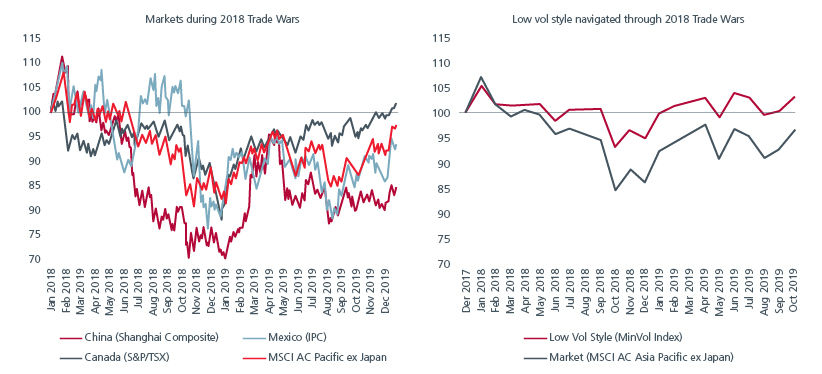

To understand it better, let’s look at how a low volatility style, using the MSCI AC Asia Pacific ex Japan Minimum Volatility index as a proxy, reacted during President Trump’s first term in office, when the administration imposed tariffs in 2018. Between Mar 2018 and Dec 2018, both the US and China engaged in a tit-for-tat move by imposing tariffs on a wide range of goods.

The imposition of tariffs on a wide range of goods led to increased uncertainty and volatility in the markets. Equity markets directly linked to the trade war experienced notable declines, particularly in the latter half of the year. See Fig 2. In contrast, the Asian low vol index provided downside protection and delivered resilient performance throughout this period.

Fig 2: Impact of tariffs during the 2018 US-China trade war

Source: LSEG DataStream, MSCI, S&P, Eastspring Investments, Feb 2025

A low vol strategy is inherently defensive

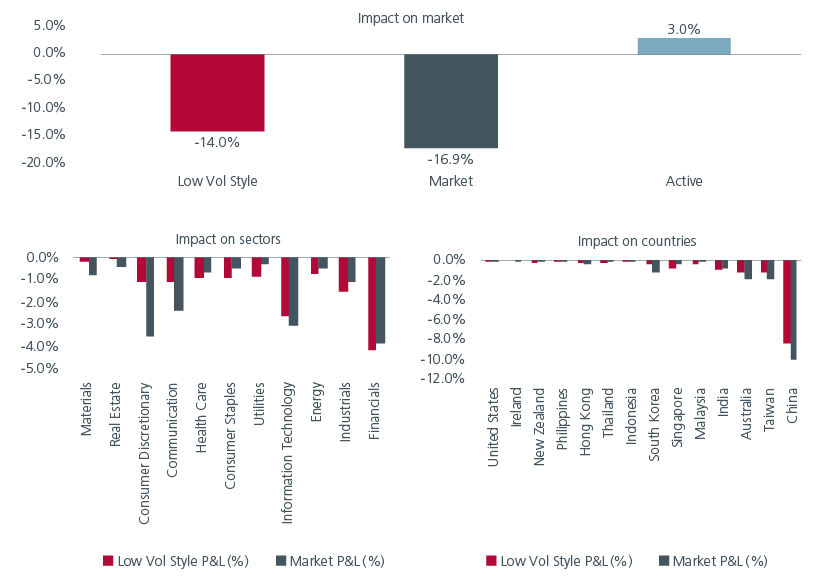

Given the evolving global economic landscape, we conducted a stress test to evaluate the potential impact of tariffs on a low vol portfolio. We utilised the Aladdin risk management systems' Global Trade Protectionism scenario to assess the impact of significant tariffs on global trade, inflation, interest rates, including retaliatory actions from affected countries. The test assumes that additional tariffs will result in higher domestic inflation, leading to increased interest rates and a stronger dollar, and considers potential selloffs in US companies which have supply chains heavily dependent on non-US inputs.

The results suggest that a low vol defensive style continues to protect the downside and deliver approximately 3% excess performance due to its defensive positions. See Fig 3. That said, we are fully aware that markets are forward-looking, and the macroeconomic and market impact from the Trump administration are likely to change from time to time.

Fig 3: Profit and loss impact from global trade protectionism

Source: BlackRock Aladdin, Eastspring Investments. Low vol style based on Min Vol Index, Feb 2025

Active bets can help navigate idiosyncratic risks

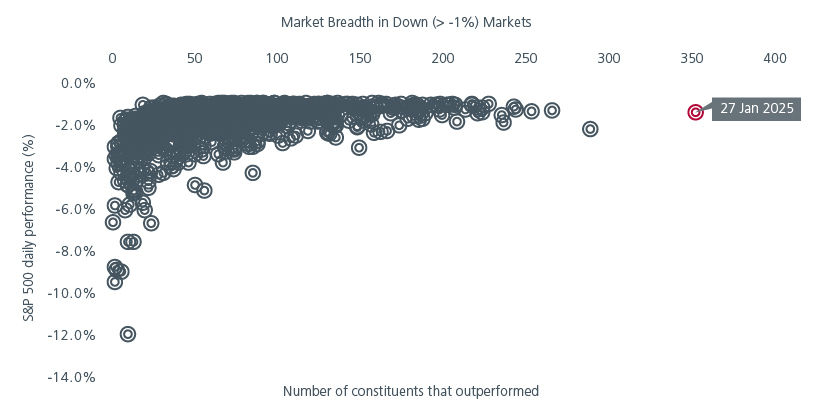

Besides policy uncertainty, markets have also been rattled by the sudden emergence of China's DeepSeek Artificial Intelligence (AI) model with technology stocks impacted the most. When the news broke on Jan 27th, the Nasdaq 100 index tumbled by 3% while Nvidia experienced a sharp drawdown of 17%, one of the largest losses in market history. This event is a black swan for the AI industry, as DeepSeek's open-source model presents a direct challenge to proprietary AI offerings from US-dominated major players like Google (Gemini) and Microsoft (OpenAI).

Apart from its disruptive nature to the AI industry, this idiosyncratic event ironically highlights the need for diversification. Despite the overall decline in major market indices, under the surface, 351 stocks within the S&P 500, or approximately 70% of the constituents, ended the day higher. This is the highest number of stocks delivering positive performance when the overall market, as measured by the S&P 500, declined more than 1% since 2000. It was unprecedented over the past 25 years!

This type of price action further emphasises the importance of having a diversified portfolio. Making active bets across more than 350 positions allow investors to benefit from the fact that the selloff has not been indiscriminate, with markets distinguishing between winners and losers. Furthermore, a portfolio that diversified across sectors, countries, and importantly, investment styles, can ultimately deliver a resilient performance. Enhancing portfolio buffers with low volatility equity strategies can help cushion against downside risks and contribute to more stable returns in 2025.

Fig 4: Number of stocks that outperformed in down markets

Source: Bloomberg, S&P and Eastspring Investments, Jan 2025

Sources:

1 Global Markets Comment: Market Thoughts on Trade War 2.0. www.gs.com/research/

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).