Summary

Eastspring’s multi asset team expects global growth in 2024 to slow, with the risk of a US recession remaining over the next 6 to 12 months. While inflation has been sticky, the team sees lower inflation in the US from mid to late 2024. They are positive risk assets in the short term but expects a more meaningful slowdown in US growth to drive equity valuations lower over a 12- month horizon.

Market update

Equities: Global equities continued to rise in March. MSCI US rose by 3.20%. Notably, the new Gang of Four (including Nvidia, Microsoft, Meta Platforms, and Amazon.com) contributed to 47% of the YTD return. European markets also posted decent performance with MSCI Europe up 3.9%, as the ECB signaled that rate cuts are on the way. Japan equities rose 3.2% as a weak yen, corporate governance reforms, and Japan’s exit from deflation, contributed to improved corporate bottom lines. Within Asia, Taiwan outperformed with MSCI Taiwan gaining 7.7% (in USD terms) in March, driven by the AI rally.

Fixed Income: Government bonds posted modest gains in March. Yields on the 2- year US Treasury note stayed relatively flat but yields fell by 3.3bps and 5bps for the 5-year and 10-year US Treasury notes to 4.21% and 4.20% respectively. US corporate credit spreads narrowed in March given robust economic data. The Bloomberg Barclays Global Aggregate Index was up 0.6%. The US high yield market (proxied by ICE BofA U.S. High Yield Constrained Index) gained 1.2% while the Asian credit market (proxied by J.P. Morgan Asia Credit Index) returned 1.1%.

Macro overview

Growth: The US economy added a higher than expected 303,000 jobs in March with the unemployment rate falling to 3.8%. Meanwhile, Japan avoided a technical recession after it revised its annualized 4Q GDP growth up to 0.4%. China’s economy showed signs of improvement as its manufacturing PMI, an economic indicator on the conditions of its manufacturing sector, reached 50.8 in March, the highest in six months. Nevertheless, we expect global growth in 2024 to slow, with the risk of a US recession remaining over the next 6 to 12 months. While the multi asset team is positive on risk assets in the short term, the team expects US growth to slow more meaningfully over the longer term, which should drive equity valuations lower.

Inflation: US consumer prices rose by 3.5% in the year to March, up from 3.2% in February, driven higher by gasoline and shelter costs. Core inflation increased by 0.4% month on month. Given the stronger than expected inflation readings, the futures market is now expecting only one to two quarter-point rate cuts in the US for the remainder of the year. The team expects to see lower inflation in the US from mid to late 2024. US wages is one of the key drivers in determining the future path of inflation.

Monetary Policy: The Federal Reserve and the European Central Bank (ECB) left rates unchanged in March, but ECB President Lagarde hinted that the ECB could start cutting rates in June. Bucking the trend, Bank of Japan formally exited its negative interest rate policy and raised rates for the first time in 17 years. The Fed is trying to balance between keeping cutting rates and risk stoking inflation versus keeping rates high and causing economic growth to slow down excessively. At this stage, with growth remaining strong and inflation not falling rapidly, the Fed is unlikely to cut interest rates in the first half of the year.

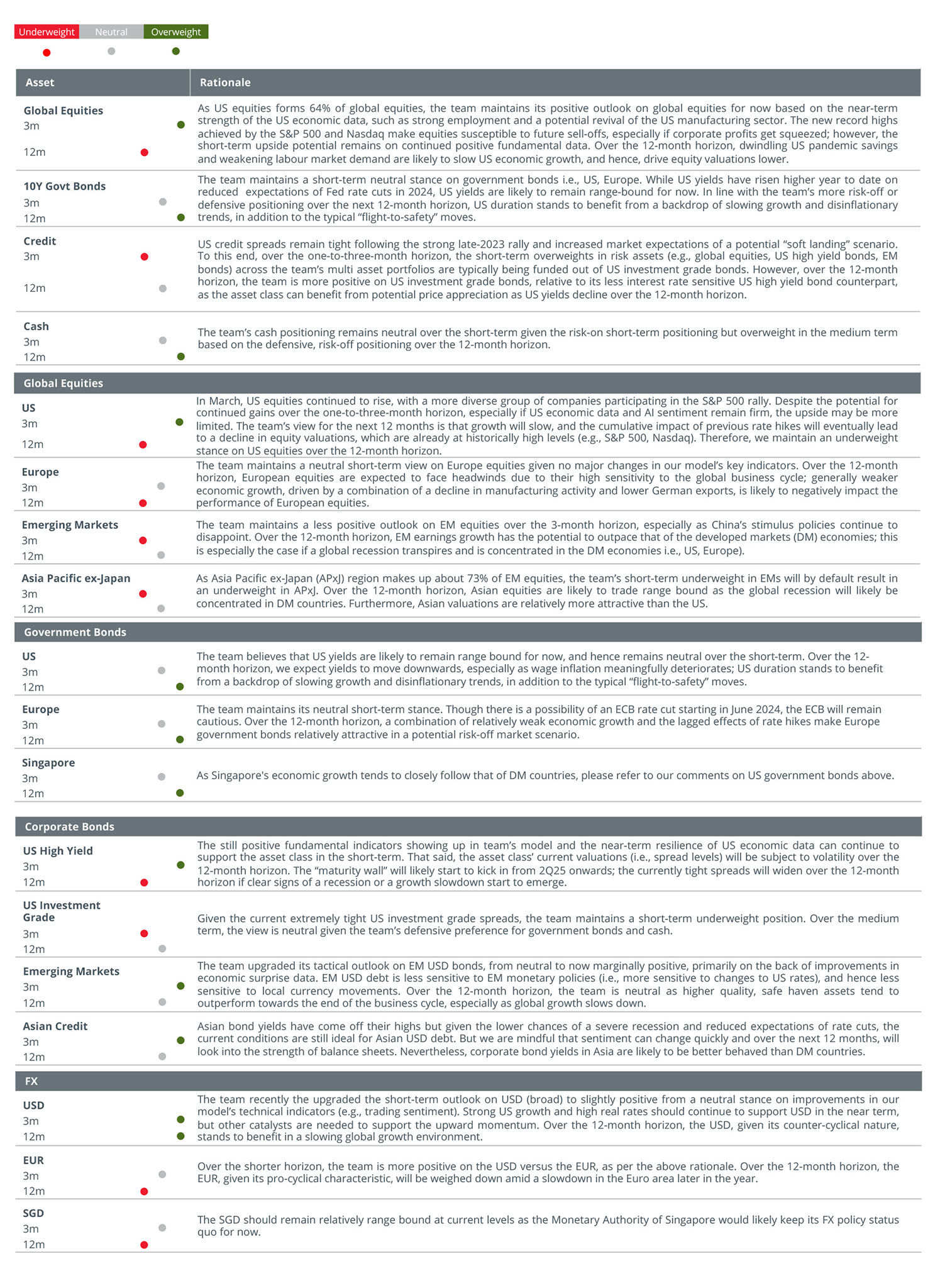

Asset class views

Source: Multi Asset Portfolio Solutions team. Asset class views are as of the team’s most recent monthly meeting in April 2024 and should not be taken as a recommendation. 3m = 3-month view. 12m = 12-month view. The information provided here is subject to change at the discretion of the Investment Manager without prior notice.

Please download report for a discussion on key risks.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).