Summary

In light of the recent tariff announcements, we foresee a significant slowdown in US growth, while recession risk has risen meaningfully. We have turned more cautious on US equities and believe that over the short term, non-US regions, especially Europe and emerging markets can continue to outperform the US market. We are more constructive on government bonds (i.e., duration), especially in US Treasuries, as a possible safeguard against a recession, particularly considering that while tariffs may have short-term inflationary effects, they are likely to impede long-term global growth.

This is an extract of our Q2 2025 Market Outlook. Click here to download the full report which includes a special feature “Trump’s tariff tango: Is there an end-game?”.

Macro: Persistent high tariff uncertainty implies rising downside risks to global growth outlook

Our analysis suggests that the Trump Administration's policies, including, but not limited to reduced immigration, cuts in Federal spending and employment, and an approximate 20% rise in the US' effective tariff rate, are projected to lower US growth to below 1% this year.

In Asia, India stands out as being-well positioned to weather the tariff shock in 2025. The outlook for China is admittedly tricky for investors because of the large headwind to growth arising from tariffs. Meanwhile, although tariffs could hurt Japan’s growth potential this year, rising wage growth could boost consumption and offset some of the adverse impact from tariffs.

Trump's tariffs effectively act as a supply shock on the US economy, potentially leading to a substantial increase in US inflation over the near-term. We estimate that this could drive the headline US CPI inflation to around 4.5% year-on-year or even higher by the fourth quarter of this year.

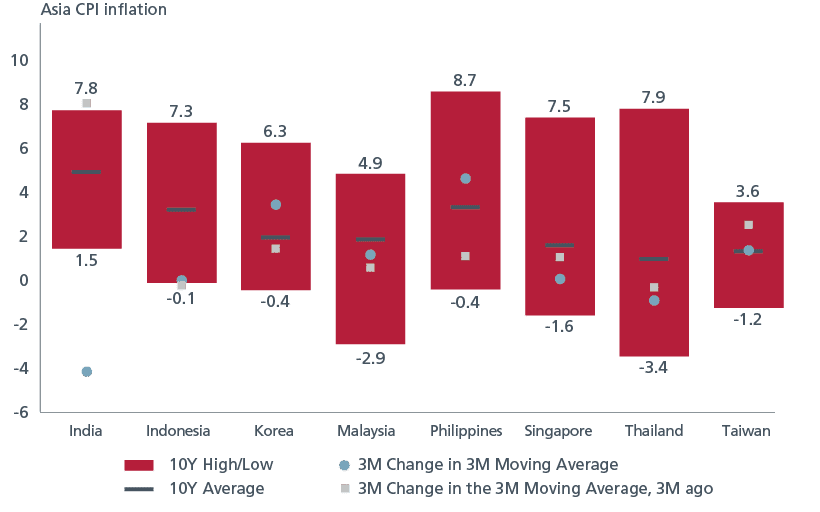

For countries in Asia (excluding China), the US tariffs are akin to a negative demand shock that is poised to dampen inflation in the region by impeding growth. The downward pressure on inflation is further exacerbated by reduced prices of fuel and hard commodities. This should in turn provide Asia with more scope to ease monetary policy.

Low Asian inflation leaves room for rate cuts and lower yields

Asset Allocation: Adjusting allocations towards safety amid market uncertainties

Given rising downside risks to global growth, especially on the back of recent US tariff announcements, we have downgraded US equities given their near-term risks. Europe and emerging markets may continue to outperform the US, given better-than-expected economic data and more attractive relative valuations.

We favour government bonds and cash, as a safeguard against recession, and look to increase duration exposure if economic data clearly indicates a downturn. Corporate bonds will underperform if the economic outlook worsens materially, but US investment grade credits are expected to outperform their US high yield counterpart.

Over the near-term, we prefer Emerging Market USD bonds over US credits given their attractive valuations and the potential benefits from US dollar depreciation. Additionally, Asian USD bonds may be supported by the region’s more stable fundamentals and net negative supply in 2025.

Over the medium term, predicting market outcomes in an increasingly volatile global landscape is becoming more challenging (if not impossible), unless significant clarity emerges. As such, we maintain a defensive stance towards risk assets, while being more constructive on government bonds as a hedge against higher odds of recessionary economic conditions.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).