Executive Summary

- Our pulse survey of 150 senior executives across North America, Europe and Asia reveals that supply chain rebalancing is among the top priorities for businesses. As global supply chains evolve, businesses are rebalancing to not only mitigate risks but also capture opportunities.

- High costs and a lack of capabilities are the biggest obstacles to rebalancing. While rebalancing is costly, inaction is costlier.

- The markets that are expected to grow in importance for future supply chains have only small weightings in the global and regional equity market indices. Investors may need to take a more focused approach to exploit the alpha potential from the global rebalancing theme.

Supply chains matter for investors. We have seen how semiconductor chip shortages affected the share prices of automakers in 2022. We have also seen how global supply chain shifts have impacted economies and markets in recent years. The rebalancing of global supply chains is a long-term theme. Our whitepaper provides useful information for global investors looking to learn more about the evolving supply chain landscape and the new investment opportunities arising from these shifts.

We developed a survey-based whitepaper to highlight how business leaders in the automotives, electronics manufacturing, and pharmaceuticals and medical equipment sectors across North America, Europe, and Asia are rebalancing their priorities between driving growth and navigating supply chain issues.

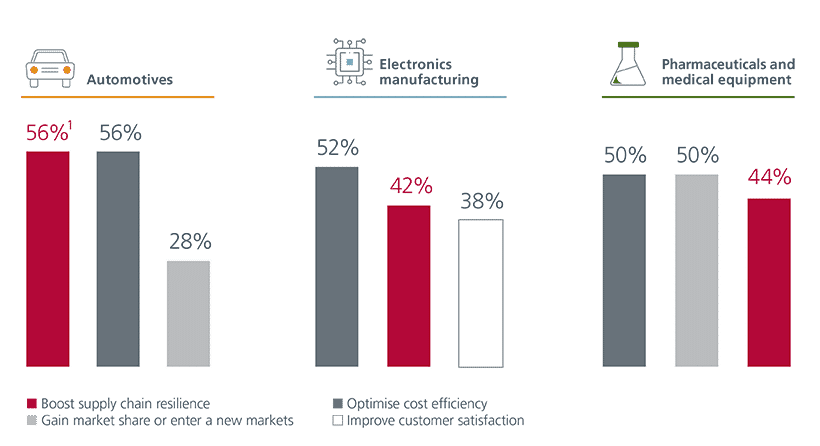

Boosting supply chain resilience is among the top priorities for business leaders across the three sectors

Q. Please rank the following business priorities from the highest to the lowest.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 19). 1. Percentages indicate the share of business leaders who ranked the given priority among the first or second priorities.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 19). 1. Percentages indicate the share of business leaders who ranked the given priority among the first or second priorities.

Global supply chain shifts are being driven by key structural factors such as geopolitics, trade disruptions, climate events, and costs. The series of disruptive events since 2020 has however accelerated these shifts and forced businesses to reevaluate their strategic priorities to stay resilient and competitive. Businesses are reevaluating their dependencies on single-supplier or single-market sourcing strategies, which, historically, were cost-effective but have become increasingly fragile.

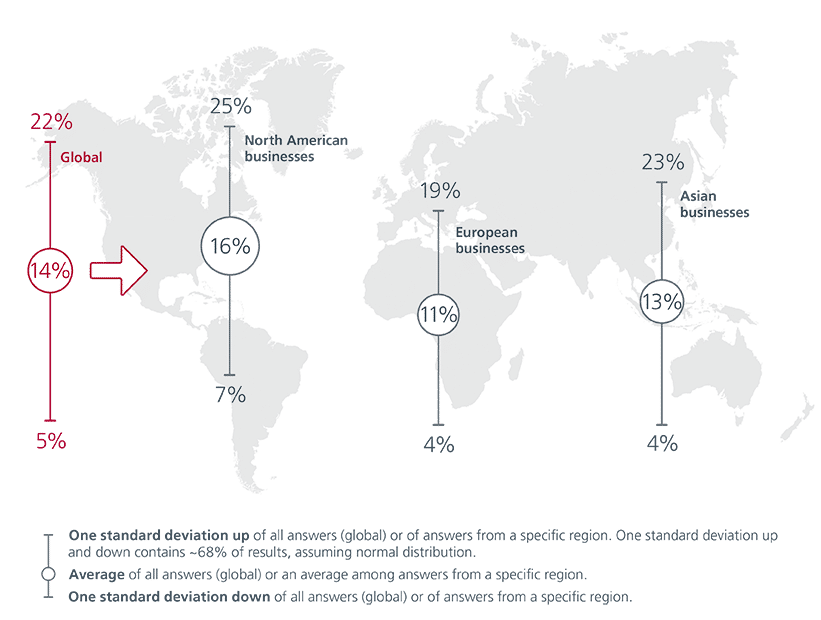

Across the three regions surveyed, rebalancing will be the most expensive for North American businesses

Q. Relative to your company’s average annual revenue over the past 3 years, what percentage must be invested over the medium term (3-5 years) to diversify/rebalance?

Source of chart: Whitepaper report – The rebalancing agenda (Pg 12).

Source of chart: Whitepaper report – The rebalancing agenda (Pg 12).

From investing in new plants to nurturing strategic partnerships with new suppliers, businesses globally are putting in significant efforts to rebalance their supply chains and boost resilience. This structural rewiring of global supply chains is, however, an expensive endeavour. According to our survey, business leaders believe that on average 14% of their company’s annual revenues will have to be invested into rebalancing over the medium term.

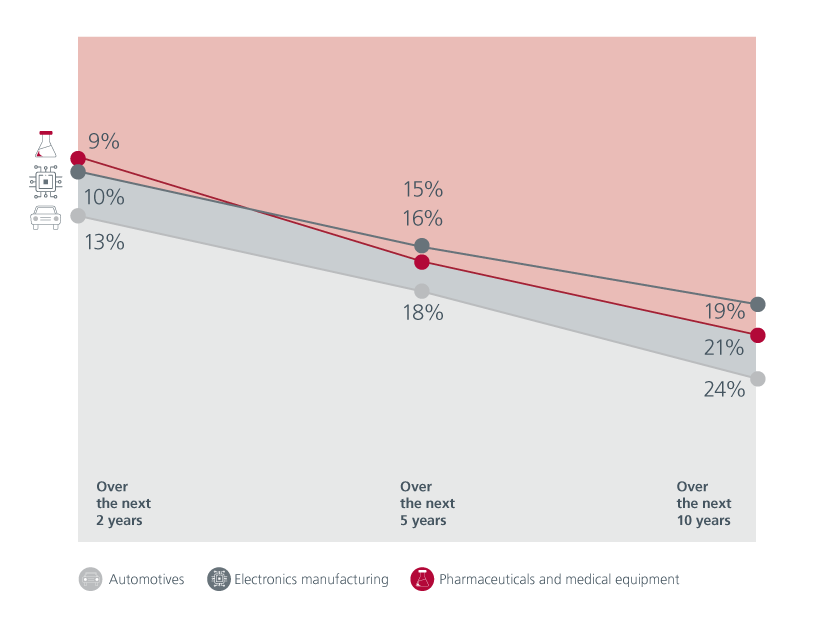

Failure to rebalance will have a significant impact on profits

Q. If your company’s current supply chain remains unchanged, what percentage of profit could be negatively impacted / at risk over the following time periods?

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 20). Percentages indicate the average profit at risk for the sector indicated.

Source of chart: Whitepaper report – The rebalancing roadmap (Pg 20). Percentages indicate the average profit at risk for the sector indicated.

Although the cost of rebalancing is high, 75% of business leaders believe that inaction will cost more than rebalancing. Depending on the sector, failure to rebalance could put 19 –24% of profits at risk over the next 10 years. The biggest obstacles to rebalancing are high costs and a lack of capabilities. Additionally, bureaucratic hurdles, lack of technology, trade rules and supply scarcities also hinder the process.

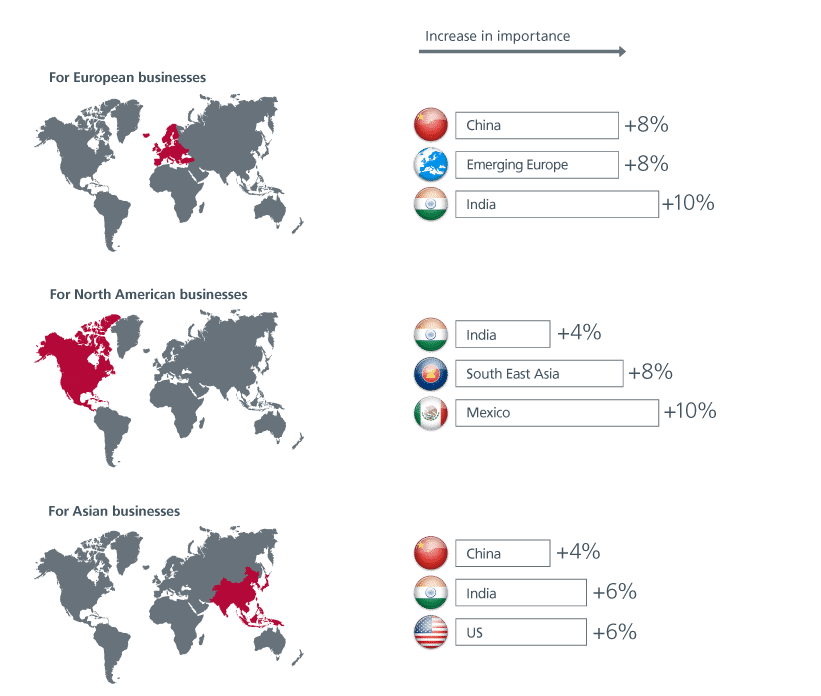

Supply chain networks are shifting – European businesses are still bullish on Asia

Q. Which are the supply chain locations with the largest increase in importance for businesses (currently and in 5 to 10 years)?

Source of chart: Whitepaper report – The rebalancing agenda (Pg 9). Percentages indicate the changes between now and the future, in the share of business leaders within their respective geography who ranked these markets as either the first or second most important locations for their supply chains.

Source of chart: Whitepaper report – The rebalancing agenda (Pg 9). Percentages indicate the changes between now and the future, in the share of business leaders within their respective geography who ranked these markets as either the first or second most important locations for their supply chains.

Although the markets that currently dominate global supply chains i.e. US and China are expected to remain important in the future, their relative importance to different regions will change, mirroring the shift in geopolitical considerations. Our survey shows that India, Mexico, and markets in South East Asia, Emerging Europe and South America are expected to grow in importance for future supply chains.

Investment implications

The markets that are likely to benefit from the global supply chain shifts only have small weightings in the global and regional equity market indices. Emerging Markets (EMs) have a 10% weight in the MSCI AC World Index, while ASEAN accounts for only 1%. Meanwhile, India and ASEAN make up 13% and 6% respectively of the MSCI EM Index.

As such, these market capitalisation-weighted indices only provide modest exposure to the countries that are expected to benefit most from the global supply chain rebalancing. These indices also tend to be biased towards the widely held, larger capitalisation stocks, which potentially reduces diversification and alpha benefits in a portfolio. Therefore, investors may want to consider a more focused approach to exploit the alpha potential from the global rebalancing theme.

This is an extract from our whitepaper “New anchors reshaping supply chains: Opportunities for investors”. Please click here to download the full report.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).