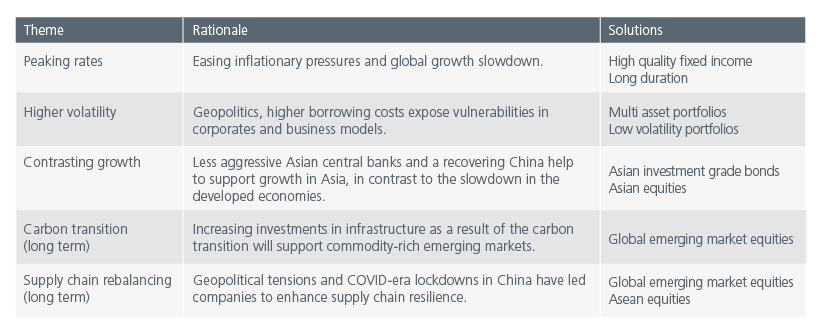

Summary

At the start of 2023, we wrote that we will be approaching peak Fed hawkishness and peak inflation in the second half of the year. The slowdown that we are currently seeing in the global economy suggests that we are close to the end of the rate hiking cycle in most economies.

It is inevitable that the sharp rise in interest rates, following more than a decade of easy money, would result in hidden issues rising to the surface across the global economy. Although this will drive short-term market volatility, the process of cleansing the system of companies and business models built on the foundation of cheap, plentiful money is a long-term positive. Well diversified and low volatility portfolios should fare better during periods of market downturns while the ensuing market volatility should present rewarding opportunities for active managers over the longer term.

- The odds of a US recession are rising. China’s economic recovery contrasts with the slowdown in the developed economies.

- Rising recession risks plus disinflationary trends globally may provide a more constructive backdrop for high-quality bonds and duration.

- Within Emerging Market (EM)/Asia equities, bouts of market volatility may present opportunities for investors to get exposure to the region’s longer-term supply chain rebalancing and carbon transition themes.

- Within EM/Asia bonds, the risk return dynamics continue to favour higher grade bonds where all-in yields remain elevated and reasonably attractive.

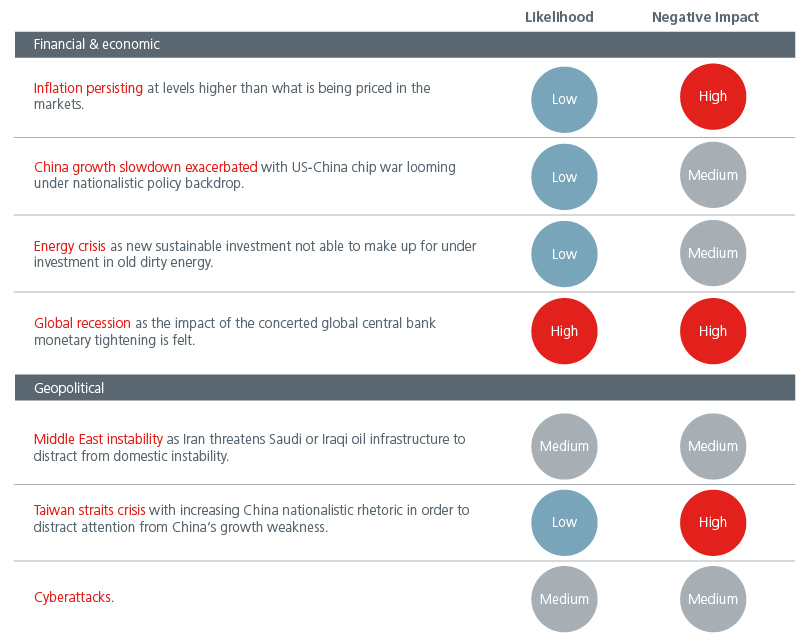

- The deteriorating global growth outlook remains a key risk for investors. In terms of geopolitical risks, the Taiwan straits crisis remains a low probability but high impact event in our view.

Investment implications

Source: Eastspring Investments. June 2023.

Macro: The odds of a US recession are rising

Having peaked in the second quarter of 2021, growth continues to decelerate in the G10 economies. Fig. 1. The leading variables that we monitor point to a US recession potentially in the next six to twelve months, as the US economy absorbs the full impact of the US Fed’s tightening. The tightening of financial conditions in the US has been further exacerbated by the recent volatility in the US banking system. That said, any recession is likely to be shallow as household and non-financial corporations’ balance sheets remain relatively healthy. Despite the recent troubles faced by the regional banks in the US, we continue to believe that this does not pose any systemic risk to the US banking system.

While core PCE inflation, the Fed’s preferred gauge of price pressures, remains elevated in May at 4.7%, inflation should decline in the second half of the year due to high base effects among other factors. As such, we believe that we are close to the end of the Fed’s tightening cycle. Nevertheless, we continue to monitor the US labour market closely for inflation risks. Fig. 2.

Source: LHS: Refinitiv Datastream. May 2023. RHS: Bloomberg. May 2023.

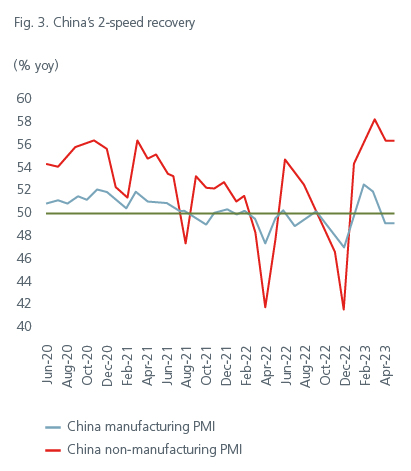

China’s economic recovery contrasts with the slowdown in the Developed Markets (DMs). That said, investor optimism surrounding China’s re-opening has been tempered as the rebound momentum appears to be easing. With export demand expected to remain subdued, domestic spending, especially on services, continues to be key in driving China’s recovery. Fig. 3. The government seems unlikely to roll out significant policy stimulus as the focus is on the “quality” of growth. The People’s Bank of China is widely expected to keep monetary policy accommodative as inflation remains subdued.

China’s consumption-led recovery will have limited positive spillovers for the rest of Asia although Thailand and Singapore should benefit from the higher tourist spend. Weak exports would weigh on South Korea and Taiwan, although supply-chain rebalancing should continue to benefit ASEAN and India. Fig. 4. Inflationary pressures have been more benign in Asia, helped by slower gains in goods and energy prices. Barring unforeseen shocks, the end of Asia’s rate hiking cycle seems in sight.

Source: Bloomberg. May 2023.

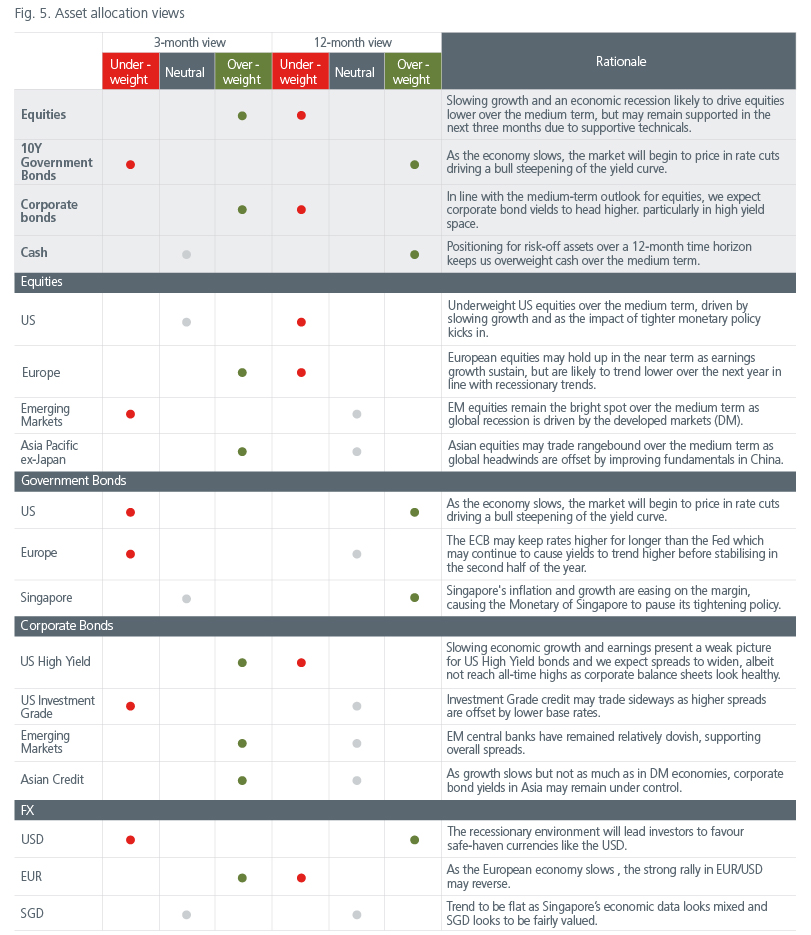

Asset Allocation and currencies: A more constructive backdrop for bonds and the USD

Global equities may still benefit from a decent growth environment in the near term, but downwards earnings revisions could be a risk. Rising recession risks in the US and some parts of the developed economies plus disinflationary trends globally may provide a more constructive backdrop for high-quality bonds and duration in the second half of the year. Fig. 5.

Higher yielding local currency EM sovereigns also look attractive if the interest rate cycle peaks, although investors will need to be selective. Within EMs, bouts of market volatility may present opportunities for investors to get exposure to the region’s longer-term supply chain rebalancing and carbon transition themes. The recessionary environment will drive investors to safe-haven currencies such as the US dollar.

Source: Eastspring Investments. Multi Asset Portfolio Solutions team. Asset class views are as of the team’s most recent monthly meeting in June 2023, and should not be taken as a recommendation. The information provided herein is subject to change at the discretion of the Investment Manager without prior notice.

Emerging market/Asia equities: Pockets of opportunities across markets

Year-to-date, Asia ex Japan equities have underperformed other regions, dragged by China. Individually, however, Korea and Taiwan equities outperformed on tech optimism while Indonesian shares rose on strong economic data. Still the region1 continues to be a bright spot; growth is expected to increase this year to 4.6 percent, from 3.8 percent in 2022. Generally healthy macroeconomic fundamentals and medium-term earnings drivers such as supply chain rebalancing, a pickup in capex in real economy sectors, and increased decarbonisation and infrastructure spending bode well for the region.

That said, many Asia ex Japan markets are still trading below their 5-year averages and remain underrepresented in global indices. Fig 6. Valuation dispersion also suggests there is still a huge opportunity to exploit for bottom-up value managers.

Japan equities hit a 33-year high in May, underpinned by strong corporate earnings and renewed interest from foreign investors encouraged by growing expectations for accelerated corporate reforms. Tailwinds from the domestic re-opening post COVID, the normalisation of the Chinese economy and supply chains, and the recent price increases have boosted profits. Ongoing corporate restructuring continues to enhance shareholder value. The long-term upward trajectory for earnings and margins remains intact. Fig. 7. We see many opportunities on a bottom-up basis in this market that still trades at very attractive valuations versus global peers.

Source: LHS: Factset, MSCI, GS Global ECS Research as of 30 April 2023. RHS: Refinitiv Datastream and MOF as of 31 March 2023 Current profits in JPY of all Japanese incorporated enterprises’ industries (except finance and insurance)

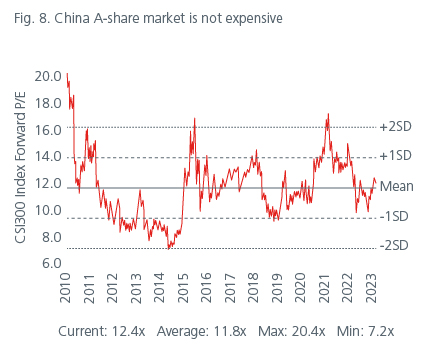

Potential earnings upside and further investor inflows should be supportive of the Chinese equity market. The China A-share market is flat for the year2 and valuations are currently not expensive. Fig. 8. We continue to be optimistic about the opportunities in China’s high-end manufacturing industry including medical equipment and semiconductors, which are in line with the government’s goal of achieving technological self-independence. We are also positive on the new economy sectors including new energy, energy storage and information security.

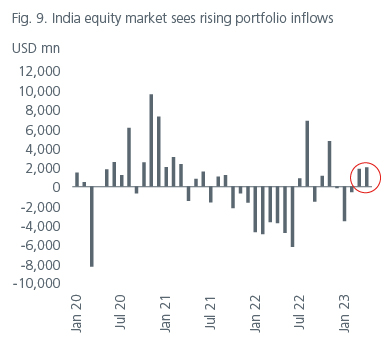

India is on track to be the fastest growing major economy this year. India’s manufacturing purchasing managers’ index hit a 31-month high in May as factory orders surged. A prudent fiscal stance and lower commodity prices should help keep inflation contained. The rupee is expected to stay steady given the positive trend in the balance of payments data. As the market remains expensive relative to its peers, stock picking is key in identifying the market’s most attractive opportunities. The Indian equity market is up 1.7% in USD terms for the year2 and has been enjoying rising portfolio inflows in recent months. Fig. 9.

Source: LHS: Bloomberg. May 2023. RHS: Source: IIF. May 2023. Variable definition: Net non-resident purchases of stocks ("portfolio equity flows") in USD million. Proxy for portfolio flows as measured in the balance of payments.

Emerging market/Asia bonds: Risk reward dynamics favour high quality duration

2023 is shaping up to be a better year for fixed income. Much of the improved performance is due to moderating inflation, ongoing recession fears and major central banks nearing the tail end of their hiking cycles. The US Fed has signalled a potential pause in rates if inflation continues to ease. In Asia, the monetary cycle seems to be topping out as inflation has undershot expectations in many markets. Fig. 10. For now, there seems to be little in terms of domestic cyclical pressures to compel Asian central banks to rush into easing cycles. While the US Fed policy has a large impact on Asian central bank behaviour, we expect some to start easing should the balance of risks tilt from inflation to recession.

Against this backdrop, Asian fixed income performance has been mixed; investment grade bonds (IGs) delivered positive returns of 3.4%3 year-to-date, and IGs’ credit ratings have stabilised in 1Q23 back to pre-COVID levels. On the other hand, high yield bonds (HYs) posted more muted returns and continue to be pulled down by poor China real estate sentiment. The recovery in China’s property sector still has some way to go both in terms of physical demand and developers gaining access to sufficient financing. HYs continue to see a deterioration in credit ratings. Fig. 11. On a positive note, HY default rates have eased from 2022 levels and are expected to decline further.

Source: LHS: Deutsche Bank, Haver Analytics, Bloomberg Finance LP, May 2023. RHS: Moodys, S&P and Fitch ratings, March 2023

Valuations for Asian bonds vary across the rating curve with the AA and A names looking cheap compared to AAAs and BBBs/BBs. We see the most value in Asian financials and selective HY names. Asian banking systems have been resilient in the face of the US regional banking stresses. Meanwhile the valuations of Asian local bonds are improving amid moderating inflation and peaking rates. In particular, we find Singapore government bonds attractive for a AAA-rated sovereign. We also like SGD credits for their relatively low volatility and stable credit fundamentals.

On Asian currencies, the high USD yields post a hurdle for investors to hold long Asia foreign exchange positions. Only the Indian rupee, Philippine peso, and Indonesian rupiah have slightly higher yields. Fig. 12. Asian currencies are also unlikely to be immune to the deteriorating global growth outlook in which case the high yielding Indonesian rupiah and Indian rupee are likely to fare better than the low yielding currencies such as the Taiwan dollar and Thai baht.

We expect Asia and Gulf Cooperation Council countries to dominate the EM bond recovery and broadly prefer sovereigns over corporates. Moreover the 2023/2024 GDP growth forecasts4 for EMs, including Asia, surpass those in the DMs. This would encourage more inflows to EMs vis-à-vis DMs and help to keep default rates modest in EMs in the next few years. Equally, Asia’s stable economic and policy fundamentals as well as tailwinds from China’s re-opening and recovery, albeit an uneven one, will continue to underpin the demand for Asian bonds. Technicals too are positive given that the net supply of new Asian USD issuances will likely be flat or negative in 2023.

The risk return dynamics continue to favour higher grade bonds where all-in yields remain elevated and reasonably attractive. Fig 13. High yield names with strong fundamentals and those that have sufficient liquidity and financing are potential alpha sources.

Source: LHS: Bloomberg, HSBC, May 2023. RHS: Bloomberg and Barclays Research as of 13 April 2023. YTW = Yield to worst

Risks: The deteriorating global growth outlook is a key risk for investors

Source: Eastspring Investments Multi Asset Portfolio Solutions. May 2023.

Key themes

Sources:

1 Asia and Pacific from IMF report May 2023.

2 Bloomberg. Sensex Index as at 22 May 2023.

3 JPM JACI Investment Grade from Refinitiv Datastream as of 18 May 2023

4 IMF April 2023

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).