Summary

Geopolitical tensions, trade barriers, and the COVID-19 pandemic fallout have triggered changes in international trading patterns and growth prospects. Global trade and capital flows are increasingly influenced by the need for national security and greater resilience. This is resulting in investment opportunities in countries across EMs and Asia.

The World Trade Organisation (WTO) forecasts that trade growth would rebound to 3.3% in 2024, up from 0.8% in 2023. According to WTO, such swings are not unusual given the sensitivity of goods to business cycles and does not spell a permanent decline of world trade. Similarly, WTO suggests that evidence of deglobalisation remains limited. The share of intermediate goods in world trade (an indicator of the extent of supply chains) has only fallen to 48.5% in the first half of 2023 compared to an average of 51% over the past three years.

Globalisation is changing, not receding. The change will depend on the alignment of national interests, economic structures, and a country’s natural endowments plus its peoples’ skill sets. We expect the current supply chain shifts and technological developments, in particular artificial intelligence, to drive future globalisation trends.

Supply chain transition winners

Exacerbated by events including the geopolitical conflict between the US and China, COVID-19 and Russia’s invasion of Ukraine, supply chain security and diversification are at the forefront of most companies’ medium-term investment plans. A structural recalibrating of global supply chains away from China and towards other markets is taking place. The beneficiaries of this move are spread across Latin America, EMEA, ASEAN and India. These countries possess cheap labour, have decent manufacturing bases and are producers of important commodities.

In Latin America, Mexico, the ‘nearshoring’ leader with geographical advantage to the US, has robust manufacturing capability, ample labour pool and important natural resources (energy, copper, lithium). The rest of Latin America is also rich in lithium and copper which are key materials for electric vehicles and renewable energy. Countries in EMEA (Poland, Hungary, Czech Republic and Turkey) have attractive demographics and competitive manufacturing bases which will benefit from ‘nearshoring’ trends of companies from advanced European economies and multinational companies.

ASEAN’s growing share of global Foreign Direct Investments (FDI) suggests that countries in the region are also benefiting from the supply chain shifts. Indonesia’s abundant nickel reserves and Thailand’s strong auto supply chain network make it ideal destinations for the electric vehicle supply chain. Likewise in the semiconductor supply chain, Malaysia has an edge in advanced packaging and testing while Singapore is a wafer fabrication hub. Vietnam’s relevance to the global supply chain is evidenced by the fact that companies such as Samsung, Google, Microsoft, and Apple have shifted portions of their supply chains there as part of their “China plus one” strategies. A fast-growing population and rising middle-income consumers add to the region’s appeal.

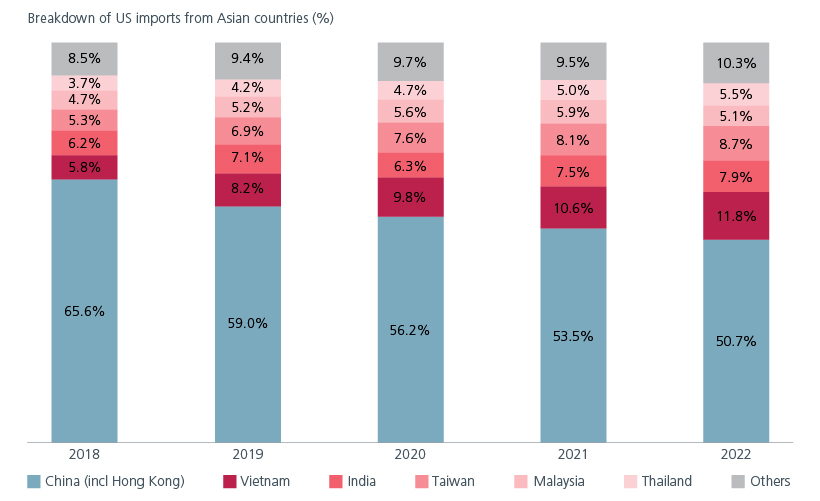

US is importing more from low-cost Asian countries

Source: Eastspring Investments, 2022 Kearney Annual Reshoring Index

India is yet another beneficiary of the supply chain relocation given that its labour cost is almost one-sixth that of China. The Indian manufacturing sector is already seeing robust growth and increasing FDI. Over the longer term, continued reforms and the revival of private capital expenditure will be key in sustaining India’s growth. There are early signs of private capex recovery in industries such as cement, residential and commercial real estate, industrial machinery, and electronics.

All said, we do not expect China to be decimated by the supply chain relocations, but we do see friendshoring and nearshoring creating outsized opportunities for domestic manufacturers and suppliers in some EMs. However, a point to note is that it will likely add to inflationary pressures for global consumers.

China is rebalancing, not retreating

Despite the challenges, China is unlikely to lose its manufacturing edge. Decoupling from China will be a daunting task for multinational companies given the country’s excellent infrastructure and connectivity, and extensive networks of reliable suppliers. Besides, China is also moving up the manufacturing value chain facilitated by huge investments in technology, big data, robotics, and artificial intelligence. Manufacturers also locate their factories in China to tap into China’s big consumer market more easily.

For sure, 2023 has been difficult. The downbeat sentiment on Chinese equities lingers, given slower than expected growth, lesser than expected stimulus support and the continued weakness in the property sector. In October, the government announced that it will issue an additional RMB 1 trillion special central government bonds in the fourth quarter of 2023. This significant move indicates the government’s priority to maintain steady growth in 2024.

Nevertheless, given the muted market reaction to previous stimulus measures, the focus has shifted to “whether another round of massive easing will work”. Still there are some positive signs; on a quarter-on-quarter basis, 3Q2023 GDP grew by 1.3%, exceeding the 1.0% forecast, industrial output grew by 4.6% in October 2023 from a year earlier versus the forecast of 4.4%, and consumption also beat expectations. But given that the property weakness may persist for longer, China’s headline growth will grind lower.

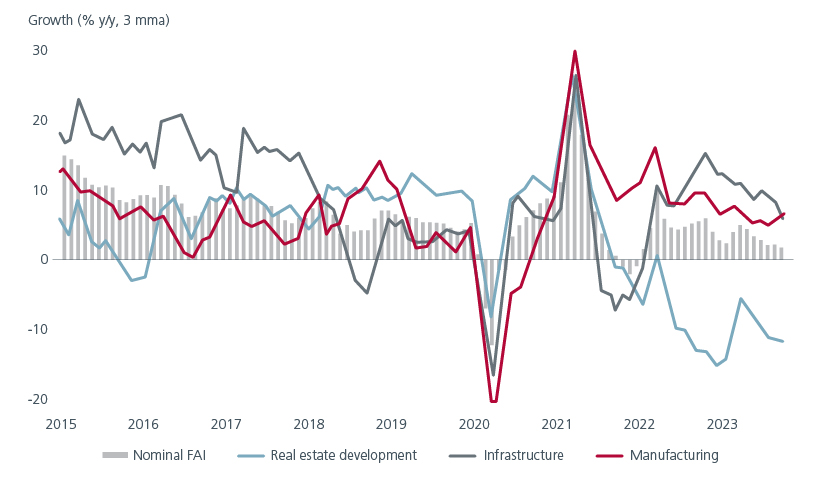

China’s manufacturing investment picks up

Source: Eastspring Investments, NBS, UBS; as of October 2023. FAI = Fixed Asset Investment.

It is however worth noting that China’s move to rebalance its growth model from investment-led to consumption-based is taking place at a faster pace. In the first three quarters of 2023, consumption contributed 83.2% to the headline GDP growth compared to 58.6% in 2019. Overall, there are structural opportunities in sectors that will gain from policy support and the consumption tilt such as advanced manufacturing, health care and consumer.

AI will transform the global landscape

Technological innovations over the years have triggered new waves of globalisation. It has not only led to the rise in the digital workforce in the manufacturing and services sectors but also a rise in overall productivity. Equally, advancements in technology can replace jobs and lead to economic problems.

The current buzz is over Generative Artificial Intelligence (AI) and how it will be the next game changer for globalisation. Generative AI technologies have the potential to transform or disrupt many industries, which have profound implications for productivity, growth, and profitability. Moreover, open-source AI models are more affordable and accessible than proprietary ones and as such likely to become more popular in the future.

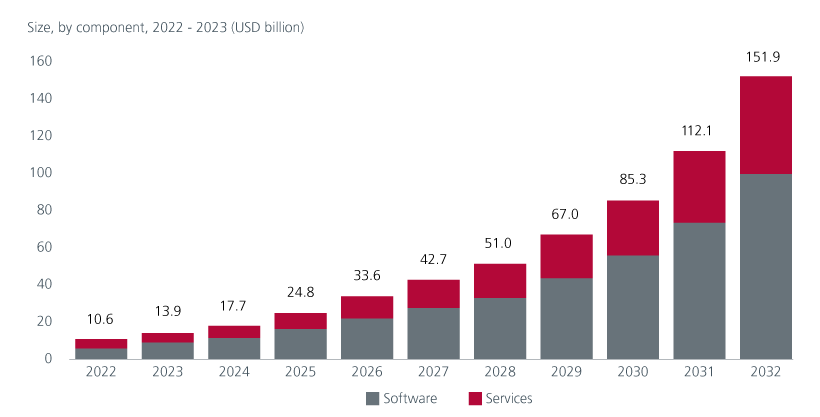

Global Generative AI market

Source: Market US report as of October 2023.

Advancements in AI are very much dependent on high-end semiconductor chips which have the power to process and analyse data. In Asia, the clear beneficiaries are Taiwan and Korea. Taiwan has the full industrial supply chain to support current and future AI industry trends. Taiwanese companies that manufacture key components such as thermal/power/printed circuit boards, etc. can also benefit by providing a complete component supply chain. Korean fabs that are developing the next generation High Bandwidth Memory chip will also benefit from the widespread adoption of AI. Other Asian companies within the semiconductor supply chain such as advanced packaging and testing players in Malaysia should also benefit.

Generative AI can be used in fields such as content creation for games, movies, music, virtual reality (VR) and augmented reality (AR), etc. It can also stimulate the development of cloud computing and edge computing, and reshape industries outside of tech. These include transport (driverless cars) and healthcare (virtual doctors), education (personalised learning) and retail (inventory management). These new application areas will create additional demand for memory semiconductors. Asian gaming companies, electric vehicle manufacturers, e-commerce players and cloud providers are embracing Generative AI to enhance their offerings and improve their competitive edge.

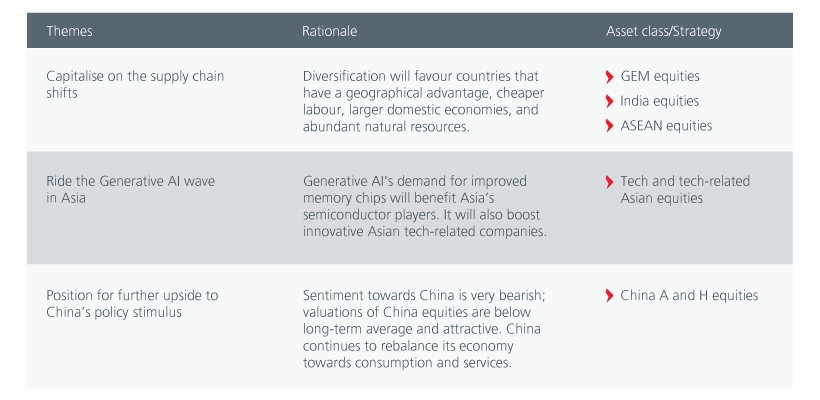

Investment implications

Related insights

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).