Summary

Slowing global growth and declining price pressures in 2024 could herald a turning point for bonds. At the same time, continued market volatility makes the case for diversification, quality assets and low volatility strategies.

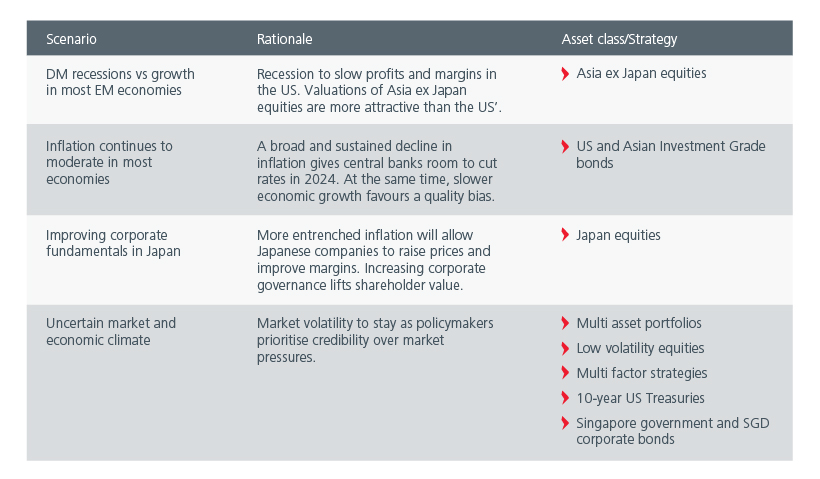

We expect global growth to slow going into 2024. The risk of a recession is higher over the next 6-12 months, as the lagged cumulative effects of policy tightening start to kick in. However, any recession is likely to be concentrated in the Developed Markets (DM). Most of the major Emerging Market (EM) economies should continue to see growth in the new year.

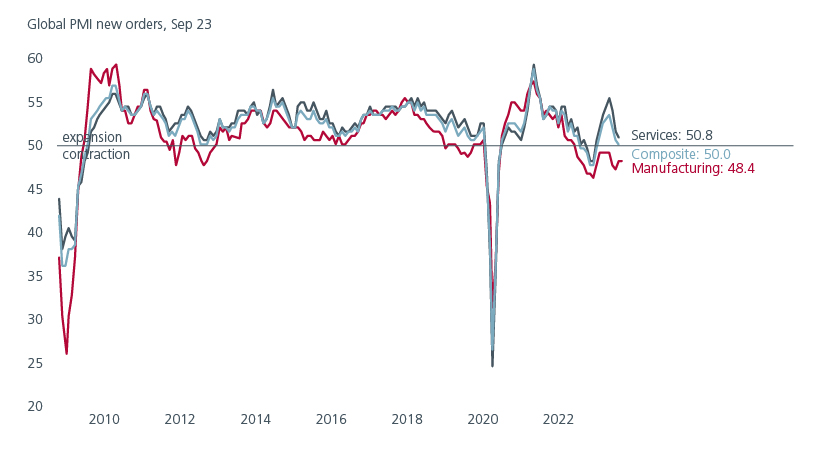

Services losing momentum

Source: LSEG Datastream, 4 Oct 2023. PMI = Purchasing Managers’ Index

In the US, the tailwind from COVID-related fiscal handouts is fading. Post-COVID household savings have been drawn down and the US savings rate is now materially below its long-term average. Nevertheless, a US recession is unlikely to be deep or protracted. The balance sheets of non-financial corporates look relatively strong and US household debt remains at manageable levels despite the recent drawdown in savings.

The Chinese government’s issuance of additional special central government bonds in the fourth quarter of 2023 raises the year’s fiscal deficit from 3% to 3.8% of GDP and signals policymakers’ intention to stabilise growth in 2024. The government is likely to set 2024’s GDP growth target at around 4.5% to 5%. Infrastructure investment, as well as a continued, albeit gradual, recovery in consumption should drive growth. Manufacturing investment will likely pick up, as re-stocking takes place in both the US and China. The property sector, on the other hand, will probably stay weak as new housing starts and home prices remain flat.

According to the Asian Development Bank, developing Asia is projected to grow 4.8% in 2024, marginally above the 4.7% expected in 2023. A slower China and recessions in the DMs are likely to weigh on the export-dependent economies within Asia, while countries with large domestic consumption may be more resilient. ASEAN, as well as India and Vietnam should continue to benefit from the ongoing global supply chain diversification.

Risk assets such as global equities are likely to move lower in the medium term on the back of deteriorating global growth. We are constructive on Asia ex Japan equities as the global slowdown is concentrated in the developed economies. More supportive policies by the Chinese government are helping to stabilise the Chinese economy, which is positive for the region. Asian equities also offer better value with a forward price to earnings ratio at 11.7x compared to 18.4x in the US1.

Falling inflation and a turning point for bonds?

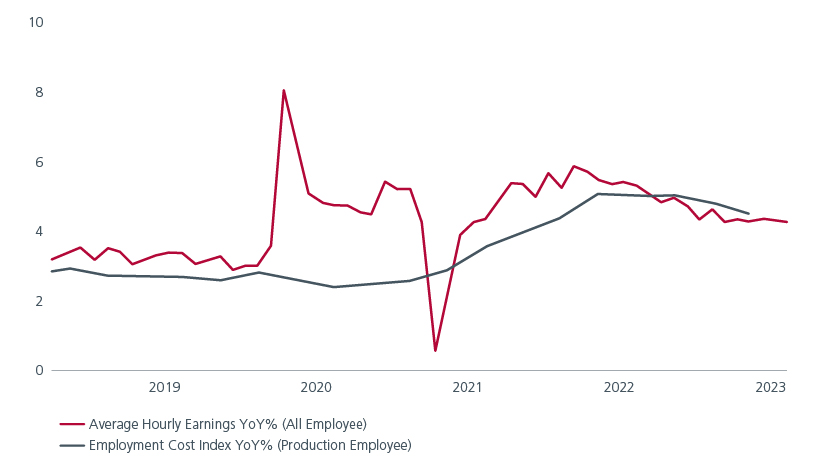

Inflation should continue to trend downwards in 2024 barring a commodity price shock. The bar for further rate hikes appears high and the accumulated drag of the rate hikes should eventually slow the US labour market and allow the Federal Reserve (Fed) to start cutting rates. Wage growth needs to fall convincingly for core inflation to start decreasing meaningfully. Historically it has taken three to seven quarters for higher interest rates to slow US wage growth and the labour market.

Falling US wage growth is key to Fed policy

Source: LSEG Datastream, 4 Oct 2023

Average inflation in Asia is back at target levels in most economies. China’s economic weakness is likely to contribute to further disinflationary pressures in the region. Nevertheless, Asian central banks’ easing prospects are likely to be influenced by the Fed’s timetable in 2024.

Recent events in the Middle East are a potential risk to oil prices. A sustained run-up in oil prices would keep inflation high, challenge central banks and be an adverse shock to the global economy. Food inflation may continue to be a concern for Asia in 2024 too, as climate change and supply disruptions affect agricultural output, especially that of rice.

One country that would welcome more sustained inflation is Japan. The country’s labour market is tighter than it has been in many years, placing upward pressure on wages. More entrenched inflation in Japan would allow companies to raise prices and improve margins. The Bank of Japan will have room to unwind its yield curve control and negative interest rate policy. In our view, Japan has a once-in-a-generation opportunity to move out of its deflationary era, which would be positive for Japanese businesses and investors.

US Treasury yields are at multi-year highs across the curve, which makes US Treasuries look attractive over a 12-month horizon. They will likely regain their roles as effective diversifiers against equities, especially in a recessionary environment. Given our base case scenario of a recession in the US, we remain defensively positioned within the US credit space, favouring US Investment Grade (IG) over High Yield (HY) corporate bonds. While defaults have been contained within US HYs, corporate refinancing risks may be underpriced as the maturity wall swells in the next few years.

The USD is expected to be supported by “higher for longer” interest rates and still wide interest rate differentials. The dollar’s counter-cyclical nature also tends to help it outperform during recessions.

Emerging Market bondsHeightened geopolitical tensions in the Middle East should keep the region’s risk premium elevated. EM economies have held up relatively well with some EM central banks keen to ease rates, which should help support economic growth. The fiscal profiles in some parts of Emerging Europe may improve over the year. Given differing growth and inflation dynamics, bond opportunities in the region will vary. At the point of writing, we favour Asia as well as the LATAM countries where real rates are high.

Asian bondsAsian local currency bond yields exhibit good value at current levels and present an attractive entry point for investors looking to position themselves for the start of the rate cutting cycle. The Korean central bank may be the first Asian central bank to cut rates. Meanwhile, low beta markets such as Thailand and Malaysia are likely to be more resilient if bond volatility rises. Singapore government bonds stand out for their attractive yields compared to other AAA-rated sovereigns. Equally, SGD corporate bonds offer investors quality and relative stability given the SGD’s safe haven currency status.

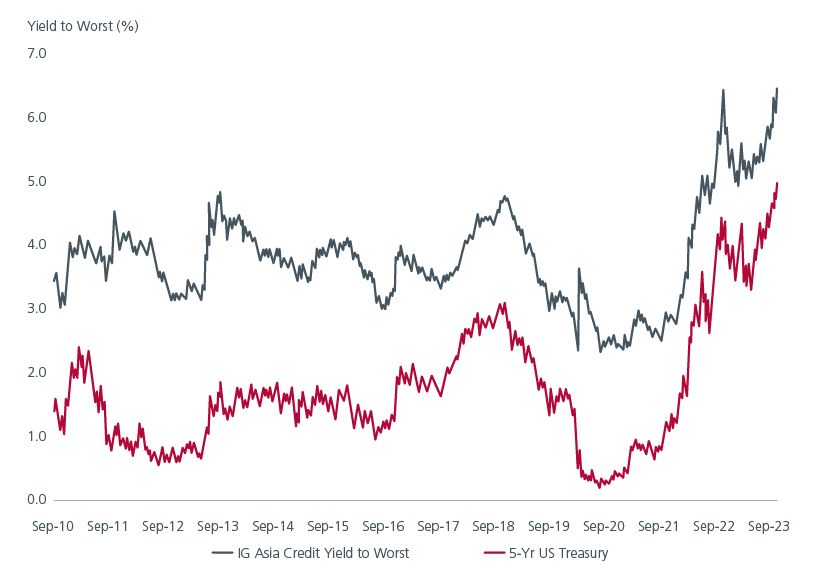

Asia Investment Grade bonds’ higher yields may appeal

Source: JP Morgan (JACI Investment Grade Index), Bloomberg, 23 Oct 2023

Asian IG corporate bonds’ high absolute yields may appeal to some investors. As we enter the late stage of the economic cycle, we are biased towards quality although HY credits with good fundamentals may offer selective opportunities. As valuations for longer-dated bonds have improved significantly, we look to moderately increase our duration within high quality bonds.

Asian currencies are likely to trade defensively as they are caught in the cross currents of EUR, JPY, and CNY weakness. The CNY, one of the biggest drivers of Asian currencies, is weighed down by China’s weak economic growth and reduced investment flows. Higher yielding currencies such as the IDR are likely to be vulnerable to increased volatility or risk-off sentiment.

Key risks

There are several key elections in 2024, including the US Presidential election in November. Economic fundamentals will continue to drive markets in the first half of 2024 as it is still too early to assess the impact of the elections.

Sentiment towards China is currently extremely bearish. If the Chinese government’s stimulus measures surprise on the upside, this could potentially have a very positive impact on how Chinese consumers feel and how investors view Chinese assets.

The US’ ballooning fiscal deficit and the Fed’s Quantitative Tightening programme are causing demand-supply imbalances in the US Treasury market. Nevertheless, we believe that inflation and growth trends would drive treasury yields in the medium term. That said, renewed bond market volatility cannot be ruled out.

In general, investors would need to get used to volatility in both the equity and bond markets. Diversification remains an important component in investors’ tool kits. Investors who want exposure to equities can also use multi factor and low volatility strategies to navigate the uncertain market and economic climate. Multi factor strategies offer diversified exposure to different factors that capture economic changes. Meanwhile, low volatility strategies provide stability by mitigating the downside risk in investor portfolios.

Investment implications

Contributors: Nupur Gupta, Chaitanya Shrivastava, Goh Rong Ren, Leong Wai Mei, Cheong Wei Ming, Eric Fang, Jamie Tay, Weng Jingjing, Ben Dunn, Michael Sun, Ivailo Dikov, Oliver Lee

Related insights

Sources:

1 LSEG Datastream, 7 November 2023. IBES 12-month forward price to earnings ratio.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).