Executive Summary

- An Emerging Markets ex China strategy offers greater exposure to smaller, promising markets.

- China’s dominance in the Emerging Markets index crowds out many attractive opportunities.

- A standalone China allocation allows investors to manage their China exposures separately.

1. Given the attractive valuations in China, is this the right time to invest in an Emerging Markets ex China (“EMs ex China”) strategy?

The fundamental reasons for an EMs ex China strategy still hold. China’s dominance in the EM index - where its weight is ~ 27%1 - continues to eclipse the growing opportunities in other EMs and diminishes the correlation benefits of a diversified portfolio. This runs counter to the rationale that investing in an EM portfolio allows one to capture the diverse return opportunities over time.

Concurrently, there are structural factors such as geopolitics, decarbonisation, and shifting economics that are driving supply chains shifts as businesses reduce their reliance on China. Foreign direct investments (FDIs) into China have been slowing while other competing countries have seen their share in global FDIs growing. An EMs ex China strategy is therefore best placed to tap the full potential arising from these supply chain shifts.

Nonetheless we acknowledge that at current valuations, China offers some compelling investment opportunities. To better manage diversification and allocate to less correlated assets investors may be better placed to manage a discrete allocation to China. Recent data points to improving economic conditions in China. However, the road ahead remains bumpy; the ongoing US-China tensions and the pressure from the West about China’s stance on the Russia-Ukraine conflict may continue to impact Chinese corporates. A standalone China allocation allows investors to manage their China exposures and risks separately as well as fully capture upside gains once the market rebounds.

2. Do supply chain shifts from China to other Emerging Markets offer long-term investment opportunities or is it just a short-term thematic play?

A great transition is underway, driven by shifting supply chains, renewed capex cycles across real economy sectors and the decarbonisation revolution. This is a long-term theme, and the transition will yield outsized opportunities for many economies and companies across Emerging Markets. The largest beneficiaries of this transition are likely to be in ASEAN, Latin America, India and EMEA - markets with cheap labour and decent manufacturing bases, and are major producers of key commodities. Most have a large and young population base, and a high economic growth potential which can be exploited by this great transition.

The combined manufacturing value add of these countries is less than half that of China. As such, a small shift of supply chains away from China adds a significant amount of manufacturing value add to these countries.

Moreover, over the last 10 years, companies in both the Developed and Emerging Markets have been under-investing in physical assets (property, plant and equipment) and directing the spending to intangibles, particularly in mergers and acquisitions. Since late 2020 there has been a reversal, and capex spending is on the rise. Historically there is a strong positive relationship between increasing capex spending and the performance of Emerging Markets, with markets outside China benefitting from increased exposure to materials, industrials, and financials.

With green infrastructure being more commodity intensive, there a huge demand for both old and new commodities, many of which can be found in Emerging Markets. As the green capex spend requirements increase, the new spend will be going to hard assets. Emerging Markets are well placed to benefit given that they are global manufacturing bases.

3. Is there sufficient market liquidity in an EMs ex China universe?

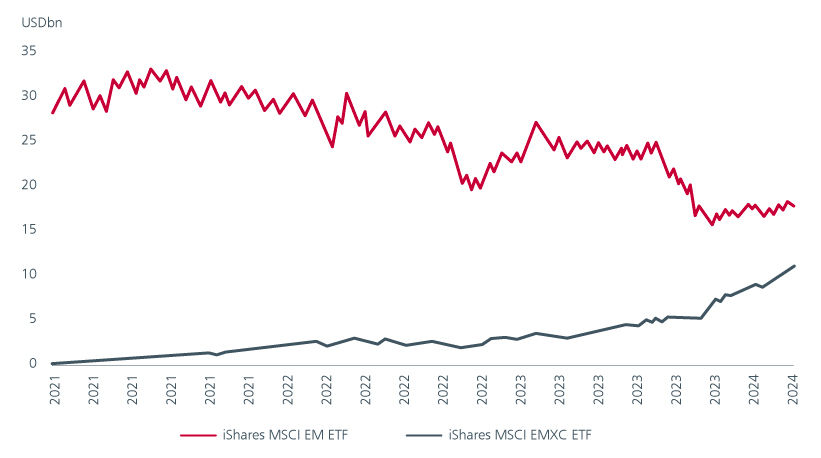

We have seen increasing allocation trends in the last year away from China mandates as investors rethink their positioning here, while we are seeing allocations to EMs ex China equities increase. The assets under management (AUM) of iShares MSCI EMXC ETF is now more than 50% of the AUM of the traditional ishares EM ETF.

Fig 1: Trend of asset flows to EMs and EMs ex China strategies

Source: Bloomberg; Goldman Sachs Global Investment Research, 5 Mar 2024

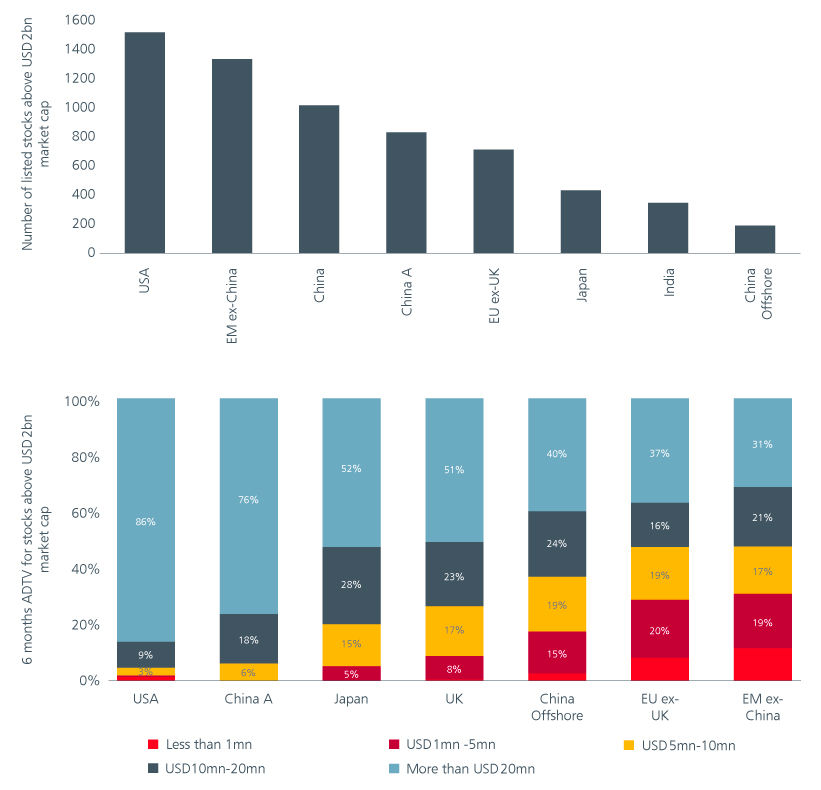

EMs ex China’s investible universe is sufficiently large with more than 1,200 listed stocks with a market capitalisation of more than USD2bn. This is significantly larger than the EU ex UK and Japan. Emerging Markets excluding China have exhibited comparable liquidity to other major markets with the average six monthly liquidity based on value traded on par with the EU ex UK.

Fig 2: Liquidity conditions in EMs ex China versus major markets

Source: Goldman Sachs Global Investment Research, 31 Mar 2024. ADVT=average daily turnover

4. With Artificial Intelligence driving recent stock market rallies, can an EMs ex China strategy also capitalise on this theme?

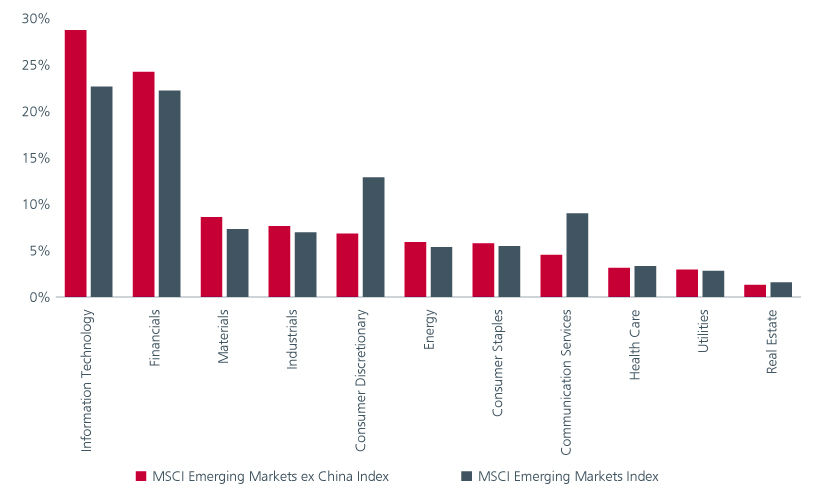

The growth and impact of Artificial Intelligence (AI) is one of the most talked about topics within the corporate world and across investment markets, driving positive sentiment for stocks with earnings related to this theme. AI is very well represented across the EMs ex China universe with substantial representation from the technology sector in the index.

Fig 3: Sector breakdown in the EMs and EMs ex China indices

Source: MSCI indices, 30 April 2024.

Our investment approach is driven by capturing value offered by mispriced stocks that have temporarily fallen out of favour with the market and therefore offer substantial upside potential. Many stocks in the AI universe are richly valued at this time given the popularity of the thematic, however we do find some less well-known stocks and indirect plays with AI-related activities that we believe can outperform over time.

5. Will election outcomes in major Emerging and Developed Markets impact this strategy?

Yes, election cycles can create very interesting investment opportunities for this strategy. Election cycles across Emerging and Developed Markets tend to create volatility in equity markets and EMs ex China are no exception. With elections in the US and India in the headlines during 2024 we would expect that fear of change and uncertainty induces market reactions and over reactions to potential outcomes.

Our approach is to monitor price opportunities in a disciplined fashion looking for those stocks that the market becomes too short-termist and emotional, leading to over selling. Our fundamental analysis focuses on long-term normalised earnings potential of these stocks, and we assess these long-term factors alongside the market’s short-term reaction.

Sources:

1 MSCI Emerging Markets Index, 30 Apr 2024

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).