Executive Summary

- Recent events are a strong reminder that volatility spikes are likely to continue and the need for downside protection can be effectively addressed via a low volatility strategy.

- Low volatility portfolios focus on stocks with historical price stability rather than size or growth potential, avoiding overvalued, hype-driven sectors.

- Adopting a low volatility investment approach can help achieve smoother returns and mitigate severe market downturns, offering a risk-aware alternative in today’s complex market.

A summer that was predicted to create historic growth records for global markets has instead been punctuated by disturbing turbulence. As part of the most intense global market correction since the onset of the pandemic in early-2020, the Tokyo Stock Price Index (TOPIX) suffered its steepest decline in nearly four decades (in August), whilst Wall Street’s fear gauge, the CBOE Volatility Index, experienced a historic swing before calming down.

Weak US jobs data delivered on 2nd August may have provided the spark for the market’s sell-off, while later, the unexpected rise in Japanese interest rates and yen strength continued the unwind of the Japanese yen carry trade, causing widespread unease. The large tech companies that had driven much of this year’s market rally were among the worst hit during this violent sell-off. In fact, throughout the recent earnings season, these tech giants were already struggling, as this sector failed to deliver on investors’ elevated expectations. The tech-heavy NASDAQ Composite index fell by 3.4% in the last week of July, and since its all-time high on 11th July, the NASDAQ has declined by more than 10% into the close on 5th August.

Violent volatility is here to stay

The combination of recent events serves as a strong reminder that rapid asset price swings and volatility spikes are likely to continue, especially during times when both macro risks, such as questions on the likelihood of a recession as well as how markets were caught off-guard by U.S. economic data, and geopolitical risks dominate headlines. Geopolitical risks, including the potential market impact of a Middle Eastern conflict, further contribute to market uncertainty, which is emphasised by the upcoming US presidential election on 5th November.

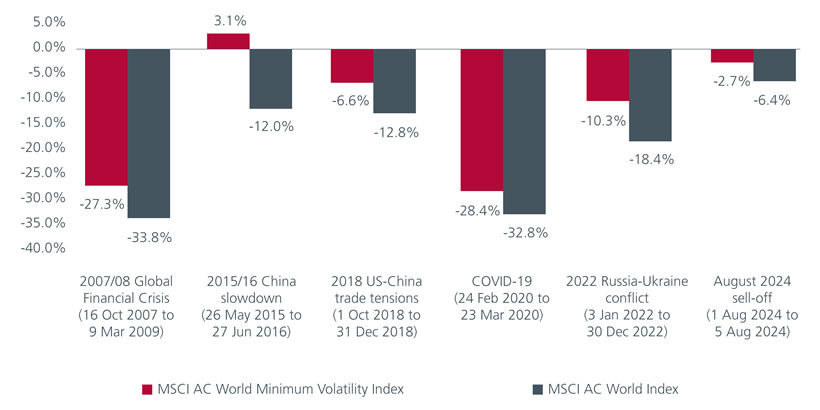

Fig 1: Impact of turbulent events on indices

Source: Eastspring Investments, MSCI as of August 2024

Continually, the increased requirement for downside protection is also accentuated from these recent events, with such a demand being able to be fulfilled through the utility of a low volatility strategy.

Stretched valuations are a concern

As of June 2024, we find ourselves in a market where faith in future growth expectations has reached staggering levels. As we see in Fig 2, five of the world's ten largest stocks are valued so highly that an investor would need to receive all of the company's sales revenue for over a decade with the business operating for free to break even. If you look at only earnings, the horizon of profitability stretches out even further into the future, in some cases into the 22nd century!

Some argue that these companies can grow into their valuations, but many of these companies operate in highly competitive, cyclical sectors, requiring substantial R&D investments. They are already near, or past, record sales levels, and as the largest companies in the world, doubling or tripling their revenues is no small feat.

Fig 2: Breakeven years for top ten MSCI ACWI stocks at current revenues and earnings

Source: MSCI as of 28 Jun 2024.

Although these valuations are most extreme in the technology sector, in Fig 3 you can see that other sectors have also been affected and that, compared to the past, there are more stocks above the historic median (red line) which have a higher weight in the index. This means that investors are paying higher prices for an ever-larger proportion of their portfolio.

To put it in 20th century terms they are investing in the jazz era for a payoff at best in the rock and roll era and in some cases in the Disco, Grunge or even early Taylor Swift era!

Even this relies on two very unusual things happening until you recoup your investment

- That the company would return you all their earnings as dividends

- That their earnings will stay the same or increase.

We can see from Fig 2 that the first assumption is incorrect, in the top ten, no stock returns all their earnings and just one stock returns over half their earnings as dividends which means that the second assumption is the thing investors are pinning all their hopes on. Whilst it is true that you could also sell the stock, as many dotcom investors found out, you may not be able to get anything like the price you paid when you want to sell.

Fig: 3 Breakeven years for investors if they could receive all earnings

Source: MSCI Price to Earnings Ratio as of 28 June 2024

Compounding these valuation challenges is the meteoric rise of passive investment strategies. Index funds and ETFs, which buy stocks based on their market capitalisation rather than their fundamental value, have become increasingly popular over the past two decades. While these strategies offer low-cost diversification, they have also introduced a new dynamic to the market. As more money flows into these passive vehicles, they indiscriminately purchase shares of the largest companies, regardless of their valuation or growth prospects.

This "buy regardless of price" approach has exacerbated the problem of overvaluation, particularly for the largest stocks in the market. It creates a self-reinforcing cycle where the most valuable companies continue to attract more investment simply by virtue of their size, potentially indiscriminately inflating their valuations beyond what traditional metrics would justify. This trend has contributed to the concentration of market value in a handful of mega-cap stocks, further distorting the overall market picture and potentially increasing systemic risks.

Is low volatility an antidote to the extremes?

Unlike market cap-weighted strategies, low volatility portfolios are constructed based on the historical price stability of stocks, not their size or perceived growth potential. This methodology inherently steers investors away from overvalued, hype-driven sectors and towards more fairly valued, stable companies. Low volatility strategies tend to concentrate in sectors that are often overlooked in the current growth-obsessed market, such as utilities, consumer staples, and healthcare. These sectors typically offer more consistent earnings and dividends, providing a counterbalance to the speculative fervour seen in high-flying tech stocks. Moreover, the low volatility approach’s natural aversion to market manias can serve as a safeguard against the irrational exuberance that often leads to bubble formations.

If we do the same comparison of the top ten names in the MSCI ACWI index (Fig 2) with the ACWI Minimum Volatility Index (Fig 4) you can see that the breakeven years are much earlier, and the individual weights are lower, showing a more balanced and less expensive portfolio overall.

Fig 4: Breakeven years of the top ten holdings of the MSCI ACWI Minimum Volatility Index

Source: MSCI as of 28 Jun 2024

Is it really different this time?

We can observe that the financial landscape has shifted dramatically. From blue-chip stocks to high-risk tech startups, and from traditional equities and bonds to alternative investments like cryptocurrencies, from dividend-focused stocks to growth-at-all-costs companies, the way investors perceive and measure value continues to evolve.

As investors navigate this new terrain, it is crucial to balance the allure of potential growth with the reality of tangible returns. That is not to say that AI or the weight loss drug innovations are not revolutionary, but, as we learned in the dot com bubble, you can be right about a technological change but still be wrong about which companies will profit from it or how much you should pay for them. While the stock market may not return to its dividend-focused past, pendulums rarely swing only in one direction.

In light of these market distortions, moving some assets to a low volatility investment approach can provide investors a useful alternative. By focusing on stocks with lower price fluctuations, investors can potentially achieve smoother returns over time, reducing the impact of severe market downturns. In an era where passive strategies inadvertently amplify market inefficiencies, a low volatility approach offers a thoughtful, risk-aware alternative that may be better suited to navigate the complexities of today’s financial landscape.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).