Summary

Middle income households are expected to make up almost 30% of Vietnam’s population by 2026. Investing in the Vietnam equity market is one of the ways to tap into the sectors that benefit from Vietnam’s growing middle class, while local expertise can help to navigate the evolving market terrain and regulations.

Vietnam’s rising importance in the global supply chain and in turn, its growing manufacturing sector and exports have helped to drive the economy. From 2012 to 2022, Vietnam’s exports grew at an average rate of 12% p.a., 4x faster than the global rate1. Economic growth averaged 6% p.a. over the same period and is forecasted to reach 4.7% and 5.5% in 2023 and 2024 respectively2.

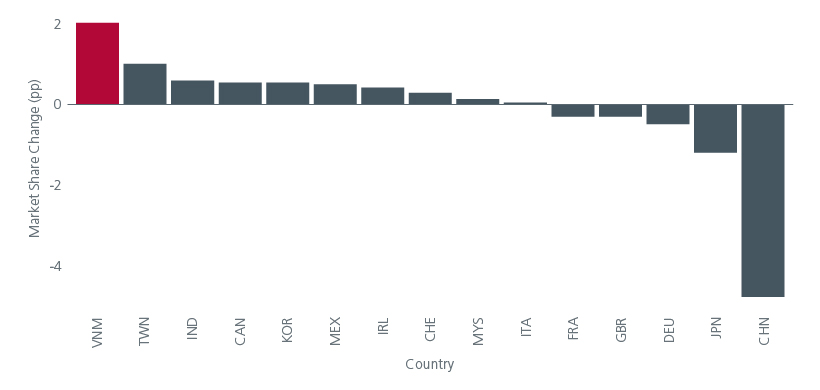

Companies such as Samsung, Google, Microsoft, and Apple have shifted portions of their supply chains to Vietnam in recent years as part of their “China plus one” strategies. Notably, Vietnam’s market share of US imports has gained 2% between 2017 to 2022. Fig. 1. Foreign Direct Investments in Vietnam reached a record high of USD22.4 bn in 2022 and is tracking USD20.21 bn for the first nine months of 2023, with the manufacturing and processing sectors receiving the largest share3.

Fig. 1. US import market share change for top 15 importing countries (2017 – 2022)

Source: UNComtrade. Data downloaded in April 2023.

Significant infrastructure investments over the years, plus Vietnam’s multiple free trade agreements have helped to facilitate manufacturing and trade. Public and private investments in infrastructure stand at 5.6% of GDP, the highest in Southeast Asia and the second highest in Asia after China4. The country’s economic reforms have further boosted economic growth by encouraging trade, private enterprise, and foreign investments. In September 2023, the US became the sixth country following China (2008), Russia (2012), Japan (2014), India (2016), and Korea (2022) to enter into a comprehensive strategic partnership with Vietnam.

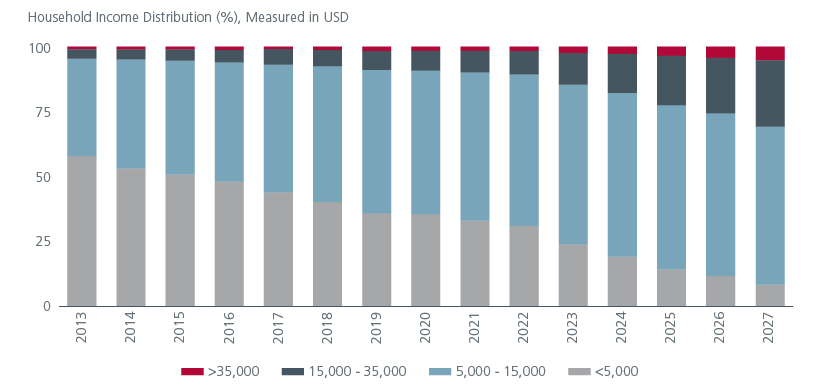

Strong economic growth and rising job opportunities have created a rapidly growing middle class. Fig. 2. Vietnam’s middle class currently accounts for 13% of the population (or 97 million) and is expected to double by 20265. Meanwhile, its income per capita is forecasted to reach USD7,500 by 20306.

Fig. 2. Vietnam’s growing middle class

Source: EIU Forecast; OOSGA Analytics. April 2023.

Vietnam’s growing equity market

Investing in the Vietnam equity market is one of the ways investors can tap into the sectors that benefit from Vietnam’s growing middle class.

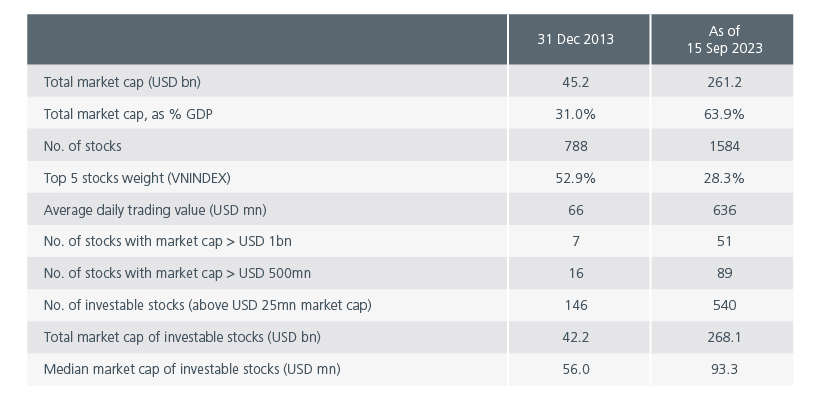

The Vietnam equity market has grown largely in line with Vietnam’s economic dynamism. Since December 2013, total market capitalisation has increased more than five-fold in USD terms and almost doubled as a percentage of GDP. The market has also become more diversified with the top 5 stocks accounting for 23% of the Vietnam Ho Chi Minh Stock Index (VNINDEX), down from 53% ten years ago. See Fig. 3. Meanwhile, earnings have grown by a compounded average growth rate of 16.2% p.a. over 2013 to 20227.

Fig. 3. Vietnam equity market overview

Source: Bloomberg data, computed by EIVN. As of 15 September 2023.

The VNindex is trading at undemanding valuations of 13.5x trailing price to earnings8 , close to 1 standard deviation below its historical average. Meanwhile, the market’s 12-month forward price to earnings ratio stands at 10x, close to 2 standard deviations below its historical average. Leverage levels appear manageable with the debt-to-equity ratio for the non-financials sectors around 60-70%.

Opportunities from the middle-income boom

Financials - Vietnam’s rapidly expanding middle-class should drive the penetration rate of retail banking products and services. This, together with the strong loans demand from Vietnam’s manufacturing sector, is expected to lift loans growth. Total loans are forecasted to grow at a compounded average growth rate (CAGR) of 12% p.a. between 2021 and 2030, to reach USD1.3 bn9. We expect higher net interest margins, lower costs, and higher fee revenue to drive the financial sector’s earnings over the long term.

Consumer - Vietnam’s rising middle class will also drive consumption growth, with total retail sales value expected to increase at a CAGR of 6.4% from 2021 to 2027, reaching USD167 bn. Online sales channels are expected to remain important, with e-commerce sales expected to account for 19% of retail sales in 2027, up from 11% in 2021. We expect earnings in the consumer sector to be driven by more profitable product mix and revenues from alternative sales channels.

Real Estate - Urbanisation and population growth in Vietnam are expected to drive the demand for residential real estate over the coming years. With its urban population doubling over the last thirty years, Vietnam has undergone one of the most intensive urban transitions in the world. Vietnam’s urbanisation rate since 2010 is estimated to be about 3% per year, higher than the Southeast Asian average of 2.5%. The UN’s latest projections suggest that half of Vietnam’s population will be urban by 2039 up from 39% in 2022, and that figure will reach 60% by 2050.

As in most emerging economies, the growth trajectory is seldom smooth. For example, Vietnam’s real estate market is currently facing challenges from tight liquidity and subdued sales, which could drive the banks’ non-performing loans ratio higher. Consumer companies in Vietnam are also having to work harder to retain brand loyalty. A recent survey10 conducted by McKinsey & Company shows that 66% of Vietnamese consumers have switched brands post COVID in search for better value. Vietnamese consumers are also placing greater emphasis on quality (43%) and sustainability (12%). Investing in these sectors will require an active approach in order to identify the long-term winners.

It pays to be early

Vietnam aspires to upgrade its stock market from “frontier” to “emerging” in at least one major index by 2025. The reclassification could potentially result in inflows of USD1 to 3 billion from passive funds alone11. Increased foreign participation can also improve market liquidity and efficiency. Currently, two major challenges stand in the way of this reclassification - i) the requirement to pre-fund equity purchases and ii) Vietnam’s foreign ownership limits.

The government is seeking ways to address these challenges. A new stock trading system, targeted to be implemented by the end of 2023, is expected to bring new products, trading, and payment solutions, bringing the market one step closer to emerging status. Vietnam also plans to establish a clearing house that is aligned to the central counterparty model. With this new clearing and settlement model, Vietnam hopes to address the current requirement to pre-fund equity purchases. Meanwhile, the introduction of non-voting depository receipts may improve market accessibility for foreign investors by providing a way around the market’s foreign ownership limits.

The Vietnam equity market offers investors the opportunity to benefit from the country’s middle- income boom. With the market still at an early stage of development, first movers (investors) in the market can potentially reap attractive returns over the longer term, although they may face uncertainties and regulatory changes along the way. Given the less comprehensive research coverage compared to more developed markets, investors would need to spend more time and resources on fundamental research and analysis. However, less research coverage may present greater alpha opportunities. On the ground expertise and an understanding of local nuances can help investors balance the opportunities and risks of investing in Vietnam.

Sources:

1 World Bank. Data as of August 2023.

2 World Bank. October 2023.

3 Foreign Investment Agency. Ministry of Planning and Investment, Vietnam.

4 Open Development Vietnam.

5 OECD. Under pressure: The squeezed middle class.

6 Enterprise Singapore August 2023.

7 Fiinpro. August 2023.

8 Finpro platform. As of 18 October 2023.

9 Fitch Solutions. 2023.

10 Vietnamese consumer sentiment heading into 2023. McKinsey & Company.

11 CFA Institute. The Emerging Asia Pacific Capital Markets: Vietnam. April 2021.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).