Executive Summary

- With the market positioning for a Fed pivot, investors in money market funds face the risks of declining returns and not meeting their investment objectives. Bonds offer the opportunity to lock in current attractive yields plus the potential for capital upside. That said, investors should watch out for not-so-straight-forward duration plays and the market’s deemed “sweet spots”.

- The hype over ESG investing may be ebbing, but we feel that ESG risks are still underrated. Understanding and harnessing these risks can be a potential source of alpha.

- Active bond managers can turn risks into opportunities through nimble duration management, deep credit research and continuous ESG engagement.

Fed chairman Powell sealed the deal for a September rate cut at the Jackson Hole meeting in August as he warned that the downside risks to the US labour market had increased. At the point of writing1, the bond market is pricing in 100 bps of rate cuts for the rest of 2024, but the bond market tends to get ahead of itself - at the start of 2024, the market was pricing in 7 rate cuts.

Go long and strong

With the market positioning for a Fed pivot, one of the biggest risks potentially confronting investors are the declining returns from their monies that are parked in money market funds. It is reported that there is currently USD6.2 trillion in money market funds globally2. Bonds, especially longer duration bonds, stand to benefit from capital gains as central banks cut rates. Over in Asia, decade-high bond yields also present investors with attractive income streams.

That said, while longer duration bonds appear to be a straightforward trade, we caution that much uncertainty still lies in the months ahead. A broader conflict in the Middle East could result in an oil supply shock and trigger inflation concerns again. The shifting dynamics of the US election could also affect market confidence and risk premia. As the Fed treads a fine line between avoiding a recession on the one hand and managing a resurgence in inflation on the other, periods of market volatility cannot be ruled out.

The longer-term picture is further complicated by the US budget deficit. There is a risk of more fiscal spending if the Republicans were to gain control of the House, Senate and Presidency in the upcoming election. This can pressure yields to go higher. As market narratives can change quickly, duration positions need to be managed in a nimble manner. At the same time, a bias towards quality within bond portfolios should help investors navigate market volatility better.

Hunt for the real sweet spots

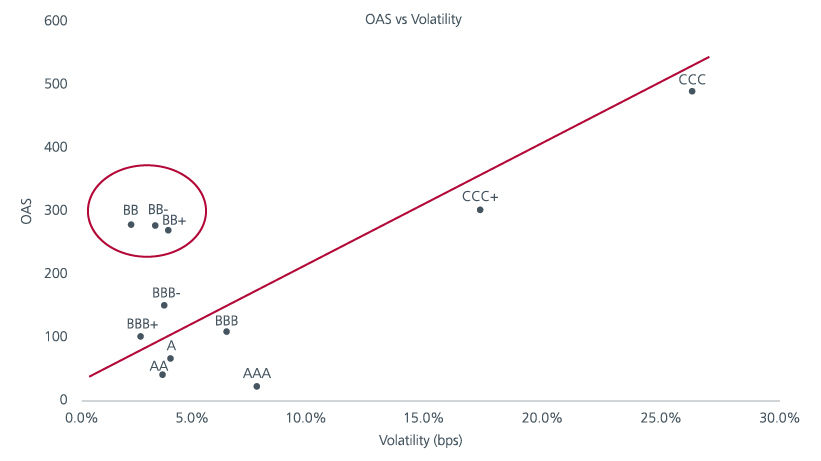

As investors move to lock in yields, the BB-rated credits within the Asian bond universe have been viewed by some as a sweet spot. BB bonds lie below the investment grade bonds on the ratings band, and while they are non-investment grade, many of these bonds are viewed to have stable fundamentals with rating upgrade potential. As such, the yield pick-up which they offer above investment grade credits, which can range between 100 to 150 bp, looks attractive, especially when considered against their low volatility. Based on our analysis, BB bonds appear to have even lower volatility than BBB-rated bonds. See Fig. 1.

Fig. 1. Option adjusted versus volatility

Source: As of end June 2024. Analysis based on Eastspring’s Asian Fixed Income team’s Internal Credit Ratings and over the period of end June 2022 to end June 2024 (last 2 years).

Scratching beneath the surface, we find reasons for the low volatility nature of BB-rated bonds in Asia. The current BB universe is dominated by Indian credits that are underpinned by India’s strong structural growth narrative and flush domestic liquidity, and hence trade more like Investment Grade bonds.

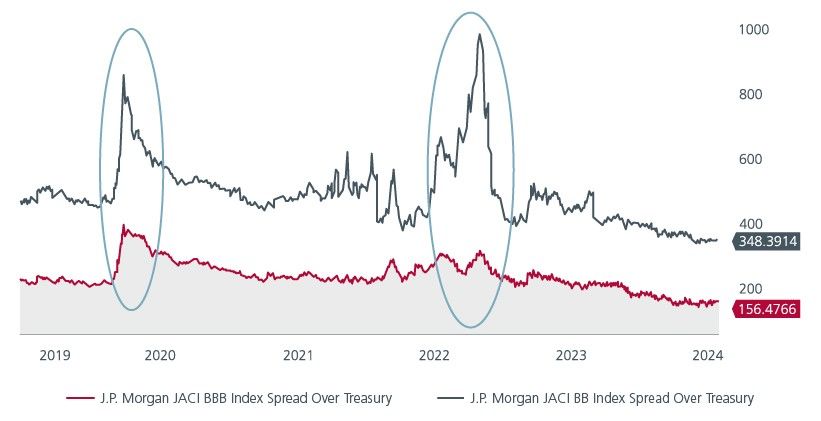

The above analysis is also distorted by the long periods of low volatility in the bond market, which tends to create a favourable environment for BB-rated credits. However, if we were to consider two recent periods that were marked by high bond volatility – such as during the COVID-19 pandemic outbreak and during the second half of 2022, when the Fed began its latest and aggressive rate hike cycle, BB-rated bonds sold off much more than their BBB-rated counterparts. Fig. 2.

Fig. 2. Spread performance Asia BB and BBB rated bonds

Source: Bloomberg. As of 31 July 2024. JACIBBBS : J.P. Morgan JACI BBB Index Spread Over Treasury, JACIBBBB : J.P. Morgan JACI BB Index Spread Over Treasury

Therefore, caveat emptor. This is not to say that there are no attractive BB-rated bonds but clearly not all BB credits are created equal, and we remain strong advocates of deep credit research and robust due diligence.

Navigate ESG risks for alpha

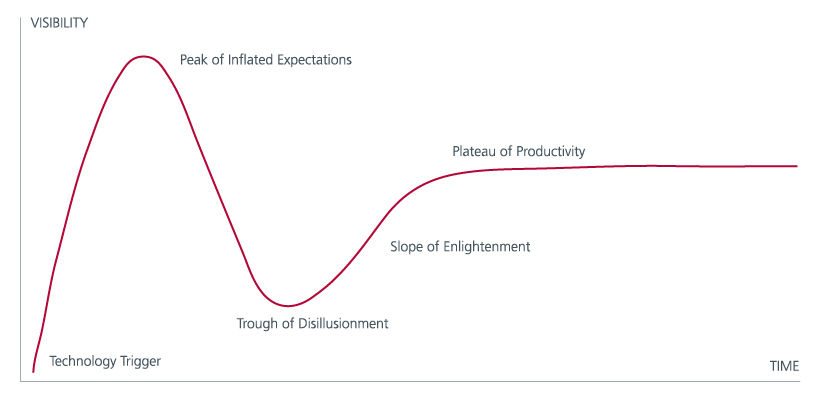

While investors ponder over duration, credit and currency risks, one risk that is perhaps still underrated by investors is financially material Environmental, Social and Governance (ESG) risk. If we apply the Gartner hype cycle, which tracks the over-enthusiasm and disillusionment of how new technologies or innovation matures, to ESG investing, ESG investing appears to be past the hype and investors may be in a period of general disenchantment3 following greenwashing concerns and the backlash on ESG activism. Fig. 3.

Fig. 3. Gartner hype cycle

Source: Gartner.

We view the decline in hype over ESG investing as positive and an opportunity for conversations on financially material ESG risks. The reality is that climate, social and governance risks deliver real financial impact to companies and affect their economic viability and profitability over the medium term. In recent months, labour disputes have disrupted operations at a few automakers in Asia. Meanwhile, water scarcity can increase operating stress on businesses that are highly reliant on water as an input. Besides agriculture and food & beverage industries, it would also affect textile, steel production and pharmaceuticals industries. Extreme climate events like flooding can also significantly impair asset values. Understanding these risks, their materiality as well as how companies are adapting their business models to address these risks can help deliver superior returns to investors over the medium to long term.

Converting risks to opportunities

The different risks described in this article are by no means exhaustive. However, all risks present the opportunity for active bond investors to generate alpha, through credit analysis, duration , currency and liquidity management. This is especially key in the coming months as market volatility is expected to remain elevated and the US embarks on a new interest rate regime. Navigating ESG risks and opportunities can also be an important source of alpha. Beyond simple exclusion and avoidance of companies which may face regulatory sanctions, social issues and governance failures, it is also about uncovering undervalued opportunities through active engagement and identifying companies that are committed to assessing and addressing the financially material ESG risks they face. With transition bonds, which help high carbon emitting companies finance their shift towards more sustainable practices, expected to grow rapidly given the region’s high potential for accelerated energy transition4, there should be plenty of room for active bond managers to turn risks into opportunities.

Access expert analysis to help you stay ahead of markets.

Sources:

1 As at 27 August 2024

2 Bloomberg. As of August 2024.

3 https://www.weforum.org/agenda/2023/08/heres-where-we-are-in-the-esg-investing-hype-cycle/

4 https://www.theasset.com/article/52120/global-sustainable-bond-issuance-falls-20-in-q2

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).