Executive Summary

- Japan’s economy is expected to be impacted by US tariffs, with the trade uncertainty likely favouring domestic-oriented companies

- With nominal wage growth at its highest in 30 years, consumer spending could become a more reliable driver of growth for the economy in future

- On valuations and fundamentals, Japan continues to present an attractive investment proposition for investors amid the current global backdrop

1.Concerns over the fallout from the US tariffs have weighed on Japan equities. What is your outlook for Japan’s economy and market?

Should tariffs remain at this level (without any concessions/exemptions from negotiations), it is likely to weigh on Japan’s economic growth more than expected due to the potential global demand slowdown. Market participants have differing initial estimates on the extent to which tariffs will affect the overall economy, with preliminary figures suggesting a negative impact on GDP ranging from 0.2% to 0.7%. Although Japan will undoubtedly be affected, most expect the impact to be smaller compared to other countries and the US.

On the corporate front, preliminary estimates on TOPIX’s annual profits suggest that autos, steel, and machinery industries, which make up most of its export trade value to the US, are expected to take the biggest hits from tariffs. What is harder to predict is the possible ongoing/secondary impact on domestics and exporters’ profits from a potential US and global slowdown.

While Japanese companies managed to navigate tariffs relatively unscathed during the first Trump presidency, President Trump has thus far refused to offer any reprieve for the US’ traditional allies. However, in an encouraging turn of events, Prime Minister Ishiba and President Trump had a recent conference call to establish a forum for discussion on tariffs between the two countries. The US has also appeared to prioritise negotiations with Japan over other trading partners, providing a sliver of optimism for Japan’s key export industries.

Market reaction has been fairly indiscriminate during the selloff, but notable exceptions are domestics/ defensive names (e.g. land transportation, domestic retail, pharmaceuticals), which have been relatively resilient. Meanwhile, the Japanese Yen strengthened from Y149 to Y146 against the USD due to market concerns about US economic slowdown and its ability to avoid a hard landing. The yen appreciation further dampened sentiment on overall Japanese equities.

Looking ahead, should we see a softening in commodity prices along with a stronger yen, domestic cost-push inflation pressures may ease, and benefit industries tied to domestic consumption (e.g. domestic retail, railways, utilities) more than those reliant on exports and capex (e.g. autos, machinery, US-exposed retail). Reflation and the potential turn for real wage growth can provide some support for Japan’s domestic economy.

All said, we believe the overall impact on Japan’s economy is likely to be smaller compared to other countries (e.g. China, Mexico). Trade uncertainty is also likely to tilt market sentiment in favour of domestic-oriented companies, which have lagged over the past 12-18 months. Japanese small and mid-caps, which are more domestic-oriented, have also been overlooked in favour of large-caps in recent years and can benefit from this shift in market dynamics.

2.In light of the tariffs, do you expect the Bank of Japan (BoJ) to persist with its rate normalisation policy?

Since BoJ exited its negative interest rate policy in March 2024, core inflation has stayed above the 2% target, justifying continued rate normalisation. But given the potential disruption that tariffs may cause to Japan’s economic growth, expectations for an earlier rate hike have been dampened. BoJ will likely need time to closely assess how the tariffs will impact corporate earnings, wage negotiations and domestic inflation in the coming months before deciding on further rate normalisation. Nevertheless, the BoJ’s Deputy Governor recently stated that as long as the inflation target of 2% is achieved, BoJ will continue to pursue rate normalisation.

That said, one of the key considerations for BoJ is ensuring that any rate hike does not cause major disruptions to Japan’s recovery momentum or asset markets, as it did when the yen carry trade unwinding occurred in the wake of a surprise rate hike in July 2024. The yen’s fluctuations also play a significant role; a weaker yen boosts exports but raises the cost of imports, affecting inflation and domestic consumption.

Although BoJ’s cautious stance is understandable, maintaining low interest rates for an extended period could exacerbate price inflation, especially imported food due to a weak yen. This price inflation issue also led to a rarely seen political uncertainty in Japan last November, when voters voiced their dissatisfaction in the Lower House elections, resulting in the ruling Liberal Democratic Party coalition losing its majority for the first time since 2009.

We believe that BoJ must maintain its rate-hike stance to prevent further yen depreciation, whilst carefully managing the pace of hikes and market expectations through transparent communication to avoid dampening demand. The pace and timing will ultimately be dependent on economic data and global macro developments.

3.What economic policies and reforms are in place to support Japanese equities?

We believe that retaliation is unlikely given Japan and US’ strategic alliance. There could be a) more concessions/negotiations to increase imports from the US to reduce trade deficit, b) increase in investments in the US (i.e. Japanese automakers can consider building more factories in the US to reduce impact of tariffs), and c) reduction in non-tariff barriers (e.g. Japan-specific standards and testing requirements for goods, import license requirements, cultural importance of business and personal relationships).

On the domestic front, this year’s Shunto wage negotiations resulted in a 5.46% nominal increase, the highest wage hike in over 30 years. Improving wage growth will result in higher disposable incomes and spur consumer spending, historically a weak link in Japan’s economy. This could become a more reliable growth engine for the economy and support domestic-oriented industries.

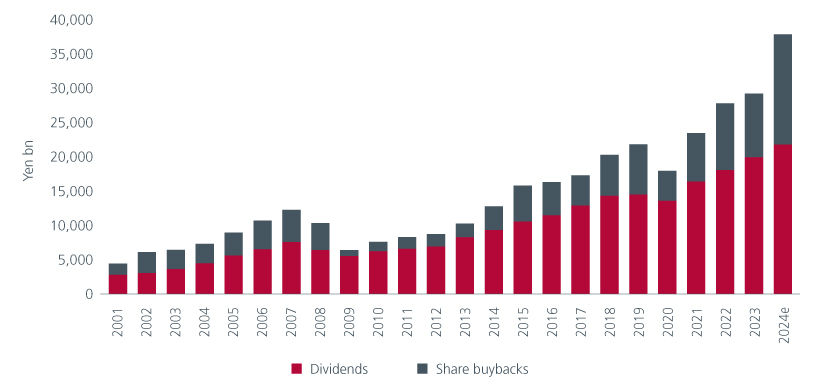

Separately, corporate reforms provide an idiosyncratic, uncorrelated source of alpha for Japanese companies. The reforms continue to accelerate with share buybacks surging by nearly 75% in 2024 compared to 2023. Many Japanese companies, including small and mid-cap firms, still hold large cash reserves, which suggests that the strong trend for share buybacks and other corporate actions is likely to continue in 2025 and drive returns.

Fig 1: Dividends and share buybacks are rising

Source: Nomura, 5 March 2025

This focus on corporate governance reforms is expected to continue, as both the government and corporates seek to attract foreign investments. Moreover, Japanese companies still lag their US and European counterparts in terms of return on equity, making shareholder return improvements a top priority for management teams.

4.How are you positioning your portfolio given the current economic landscape?

As patient, valuation-driven investors, we intend to use the current market episode in the coming days and weeks to our advantage by: 1) potentially topping up positions where our assessment of their fair value targets remain unchanged, which means their relative upside have increased; and 2) using our screens to search for potential new investment opportunities in underperforming pockets of the market.

Japan's current economic environment offers a blend of growth prospects and challenges, and we remain vigilant about the implications across different sectors.

A pocket of opportunity lies within the industrials and chemicals spaces, where many of the names have come under pressure over the past year as earnings were dragged down by cyclical weakness in their end markets. As a result, our analysis indicates they have become cheap on a through-cycle basis, with strong upside potential should we see a demand recovery in the end markets.

While exporters may face headwinds in the near term from a stronger yen and trade uncertainties, some companies’ valuations have become more attractive due to the recent sentiment shift. Meanwhile, reflation and potential real wage growth should support consumption and provide tailwinds for domestic companies. As such, we believe maintaining a balance in both export and domestic companies, based on fundamentals and valuation, is key to capturing opportunities in both segments.

5.What are the long-term benefits of staying invested in Japanese equities despite the current volatility?

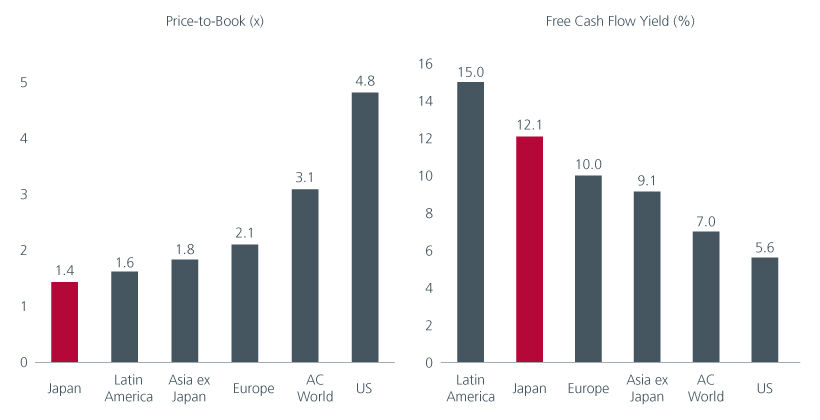

Despite strong returns in recent years, broad market indices in Japan have maintained stable forward price-to-earnings (P/E) ratios over the past decade. From a price-to-book standpoint, Japan is trading at a reasonable level of 1.4x, compared to 2.1x for European equities, 3.1x for global equities and 4.8x for U.S. equities1.

Just as importantly, the Japan market has a higher free cash flow ratio than Europe, global and US equities. In other words, Japanese companies are producing more cash relative to their earnings, an encouraging sign on their fundamentals and their ability to issue dividends and buy back shares.

Despite facing more severe tariffs than expected, initial estimates of their impact on Japan's economy may not be as severe as other countries or as market's reaction would suggest. At the same time, corporate reform continues to provide an idiosyncratic, uncorrelated source of alpha for Japanese companies.

Fig 2: Japan’s cash earnings are not priced in by the market

Source: Eastspring Investments, MSCI indices, Refinitiv Datastream as at 31 Mar 2025. Indices used are MSCI Japan, MSCI Europe, MSCI AC Asia Pacific ex Japan, MSCI EM Latin America, MSCI AC World, MSCI USA

History has shown us repeatedly that during market volatility, it is often counterproductive to attempt to anticipate short-term movements of stocks or sectors. Market episodes like this can often lead to new undervalued opportunities for the long term, and this time will be no exception.

Besides, considering the current economic and geopolitical uncertainties, being cautious with what you are paying for investment opportunities is essential. Hence, for investors who are wary of overpaying, Japan remains an attractive investment option based on valuations and fundamentals.

Access expert analysis to help you stay ahead of markets.

Sources:

1 Price-to-book ratios of respective MSCI Indices as at 31 Mar 2025

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).