About the whitepaper

Asia continues to transform, powered by digitalisation, rising technological capabilities and deeper connectivity. Eastspring Investments and PwC Singapore have developed a whitepaper that examines why Asia’s next transformation will be different from the last, and the new opportunities for investors.

This whitepaper is based on a survey of 100 C-suite executives of global corporations across multiple industries, interviews with senior executives from some of Asia’s leading companies, and in-depth research. It offers perspectives on diverse opportunities in the nine selected markets in the region.

Asia’s transformation story

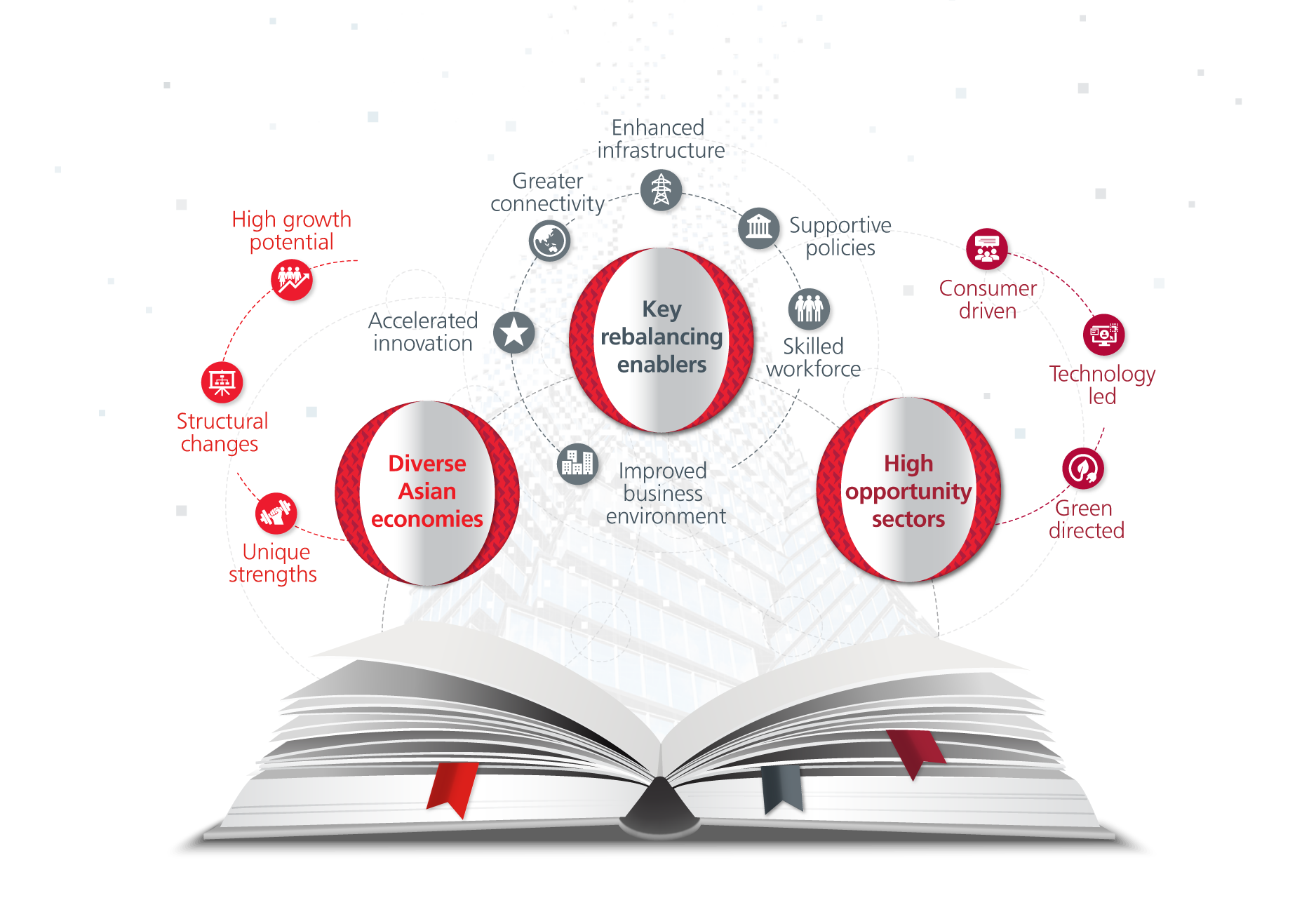

Asia’s transformation is happening across three key dimensions. Diverse economies can support businesses in rebalancing and building new growth models. This will lead to new opportunities across multiple sectors given the region’s expanding consumer base, technological advancement and green transition. Improving infrastructure, government initiatives, and a growing skilled talent pool are some of the enablers facilitating these opportunities.

Additional reads

Resource-rich Asia supports new growth areas

As Asia progresses on its path to achieve sustainable development, opportunities will emerge across a wide range of sectors.

Unlock the value in Asia’s supply chains

Supportive policies and country comparative advantages will see Asia’s global and regional production share expand over time.

Tapping the potential of the new Asian Consumer

The behaviour of Asian consumers is changing, resulting in both challenges and opportunities for consumer companies.

The case for Asia

Asia will continue to be the fastest growing region in the world as new drivers emerge..

Bond investing in Asia: Peaking bond yields..

Peaking bond yields, measured rate hikes in Asia and still healthy credit fundamentals..

Value investing in Asia: A multi-year opportunity

Strategic shifts towards decarbonisation and dual supply chains..

DISCLAIMER

This document is solely for information and may not be published, circulated, reproduced or distributed in whole or part to any other person without the prior written consent of Eastspring Investments (Singapore) Limited (“Eastspring Singapore”) (Company Reg No. 199407631H). This document is not an offer, solicitation of an offer, or a recommendation to transact in the investment units in the Fund(s), in shares of securities or any financial instruments. The information contained herein does not have any regards to the specific investment objectives, financial situation or particular needs of any person.

A prospectus in relation to the Fund(s) is available and a copy of the prospectus may be obtained from Eastspring Singapore and its distribution partners.

In relation to SICAV funds, Eastspring Investments (Singapore) Limited is the appointed Singapore Representative and agent for service of process in Singapore. The Fund is a sub-fund of Eastspring Investments, an open-ended investment company with variable capital (Société d’Investissement à Capital Variable or SICAV) registered in the Grand Duchy of Luxembourg, which qualifies as an Undertaking for Collective in Transferable Securities (“UCITS”) under relevant EU legislation. The Management Company of the SICAV is Eastspring Investments (Luxembourg) S.A., Grand-Duchy of Luxembourg.

All transactions into the Fund should be based on the Singapore Prospectus and Product Highlights Sheet (“PHS”). Such documents, together with the articles of incorporation of the SICAV and the most recent financial reports, may be obtained free of charge from Eastspring Investments (Luxembourg) S.A., or at relevant Eastspring Investments business units/website and their distribution partners.

Investors should read the prospectus and seek professional advice before making any investment decision. In the event that investor chooses not to seek advice, he should consider carefully whether the Fund in question is suitable for him. The value of units in the Fund(s) and the income accruing to the units, if any, may fall or rise. An investment in the Fund(s) is subject to investment risks, including the possible loss of the principal amount invested. The value of shares in the Fund and the income accruing to the shares, if any, may fall or rise. Where an investment is denominated in a currency other than the base currency of the Fund, exchange rates may have an adverse effect on the value price or income of that investment.

Past performance of the Fund(s)/manager is not necessarily indicative of the future performance. Past performance and any prediction, projection or forecast on the economy, securities markets or the economic trends of the markets targeted by the Fund(s) is not necessarily indicative of the future performance of the Fund(s). There are limitations to the use of indices as proxies for the past performance in the respective asset classes/sector.

The Fund(s)/ underlying Fund(s) may use derivative instruments for efficient portfolio management and hedging purposes.

Distributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future trends, which may be lower. Distribution payouts and its frequency are determined by the Manager/ Board of Directors, and can be made out of (a) income; or (b) net capital gains; or (c) capital of the Fund or a combination of (a) and/or (b) and/or (c). The payment of distributions should not be confused with the Fund’s performance, rate of return or yield. Any payment of distributions by the Fund will result in an immediate reduction in the net asset value per unit/ share.

The preceding paragraph is only applicable if the Fund intends to pay dividends / distributions.

Whilst Eastspring Singapore has taken all reasonable care to ensure that the information contained in this document is not untrue or misleading at the time of publication, Eastspring Singapore cannot guarantee its accuracy or completeness. Any opinion or estimate contained in this document is subject to change without notice.

This advertisement has not been reviewed by the Monetary Authority of Singapore. Eastspring Singapore is an ultimately wholly-owned subsidiary of Prudential plc of the United Kingdom. Eastspring Singapore and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc, a company incorporated in the United Kingdom.

Eastspring Investments provides investors with regular investment insights to help them on their investment journey. Stay on top of market news and get investment insights that matter most.

- Your profile

- Institutional investors

- Individual investors

- Financial Intermediary

- China

- Hong Kong, SAR China

- Indonesia

- Japan

- Korea (South)

- Singapore

- Luxembourg

- Malaysia

- Taiwan, Republic of China

- Thailand

- United States of America

- Viet Nam

- Afghanistan

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Central African Republic

- Chad

- Chile

- Macao, SAR China

- Colombia

- Comoros

- Congo (Brazzaville)

- Congo, (Kinshasa)

- Costa Rica

- Côte d'Ivoire

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Holy See (Vatican City State)

- Honduras

- Hungary

- Iceland

- India

- Iran, Islamic Republic of

- Iraq

- Ireland

- Italy

- Jamaica

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Korea (North)

- Kuwait

- Kyrgyzstan

- Lao PDR

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Macedonia, Republic of

- Madagascar

- Malawi

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mexico

- Micronesia, Federated States of

- Moldova

- Monaco

- Mongolia

- Montenegro

- Montserrat

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestinian Territory

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Pitcairn

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russian Federation

- Rwanda

- Saint Kitts and Nevis

- Saint Lucia

- Saint Vincent and Grenadines

- Samoa

- San Marino

- Sao Tome and Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic (Syria)

- Tajikistan

- Tanzania, United Republic of

- Timor-Leste

- Togo

- Tonga

- Trinidad and Tobago

- Tunisia

- Turkey

- Turkmenistan

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- Uruguay

- Uzbekistan

- Vanuatu

- Venezuela (Bolivarian Republic)

- Virgin Islands, US

- Yemen

- Zambia

- Zimbabwe

- Others

By providing your details you are agreeing to receive emails from Eastspring Investment. All emails include an unsubscribe link and you may opt out at any time. For more information, please read Eastspring Privacy Policy.

Thanks for

subscribing!

Thanks for subscribing!