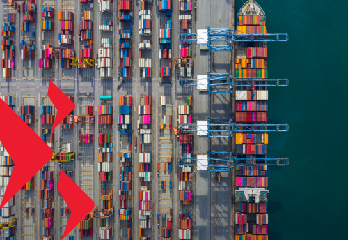

Fixed income

We leverage our experience and extensive on-the-ground presence to exploit pricing inefficiencies in the Asian bond market.

In-depth knowledge

Our more than 50-member strong Fixed Income teams, based across 9 Asian markets, offer in-depth knowledge of Asian bond markets.

Alpha capture

We seek to capture market opportunities at cyclical turning points when interest rates or credit spreads are at their extremes.

Enhanced returns

We aim to enhance returns by actively managing our interest rate positions, credit selection and currency allocation.

Strategies

We offer a full suite of solutions in US dollars and local currencies.

Global emerging markets

The interplay of currency and interest rate movements, and credit spreads within the emerging markets of the world offers multiple opportunities for active investors.

Asia ex Japan

Asia’s sizeable bond market offers increased diversification, compelling yields, and attractive risk-adjusted returns.

ESG

Asia’s growing sustainable bond market is key to funding the region’s climate challenges and will present increasing opportunities for investors.