Executive Summary

- Despite the strong rally in 2023, our Japan team believes there is more room for upside

- Structural reforms will be a multi-year theme that will drive a continued re-rating of the market

- Investors are still under allocated to Japan despite it being cheaper than developed peers

Japan equities outperformed in 2023; both the TOPIX and the Nikkei-225 indices posted annual returns of 25% and 28% respectively in yen terms, ending the year at 33-year highs. Investor sentiment has been supported by the ongoing corporate reforms and improving return on equities while the weak Yen helped to boost profits of Japanese exporters. In January 2024, the TOPIX climbed to a 34-year high, fuelled by continued bullishness. The key question is whether Japan equities can keep on delivering.

At the start of last year, we indicated that in our conversations with corporate CEOs, it felt like a new phase for Japan – with much improved focus on price discipline and improving profits. According to the Bank of Japan’s Tankan Survey, Japanese corporates have been able to pass on higher costs to consumers in 2023 than at any time in the last 20 years. Reassuringly, the forces driving this new phase seem persistent. As such we are observing a more normalised environment today than in recent years, where improving trend fundamentals are driving share prices.

Reforms will continue to underpin equities

Reforms over the last ten years have resulted in improving margins. This trend is likely to continue. Spurred by the fact that many companies are trading below 1x price-to-book ratio, the Tokyo Stock Exchange (TSE) requested listed companies to disclose their plans for improvement, adding pressure especially on management teams of poorly performing corporates. Dislike of being seen as a laggard means that many firms could fall in line.

The TSE corporate governance reforms and the potential for return on equity (ROE) improvements have a big effect on the ‘value’ end of the market. At the first stage, companies are looking at lower hanging fruits to improve ROE, like utilising excess cash and unwinding cross-shareholdings, which in turn are used for share buybacks. While multiple large cap companies have announced such plans, going forward we expect more of this to happen in the small and mid-cap space. Given so many of these stocks trade at less than 1x price-to-book and have healthy balance sheets, they are the largest potential beneficiaries of the recent TSE initiative.

The second stage of the corporate reform which is critical for continued balance sheet efficiency and long-term profitability involves spinning off underperforming business units and improving business prospects via cutting costs and better capital allocation. This is a multi-year structural theme, and we are only part way into the journey. Ultimately, improving ROEs should drive a continued re-rating.

Catalyst in place to shift savings to investments

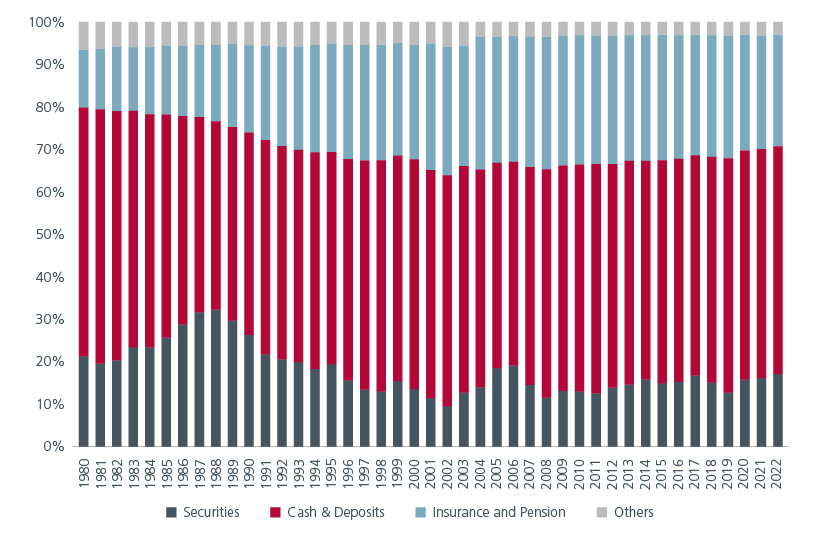

Japan’s high savings rate is renowned. More than half of Japanese household assets are held in cash and deposits. Allocation to other financial assets remains low compared to its developed market counterparts.

Fig 1: Distribution of Japanese household assets

Source: The Bank of Japan, Flow of funds statistics.

Over the years, the Japanese government’s efforts to encourage the shift of savings to investments have not been very fruitful. But a recent change in the Nippon Individual Savings Account (NISA) policy may spur investments. The revamped programme which expands annual investment limits and extends the tax-exempt period to an indefinite term should encourage retail investors to invest more.

Hopefully this will lead to changes in behaviours in the market, where brokerages and investment firms focus on long-term returns and corporates focus on continued profitability and corporate governance improvements.

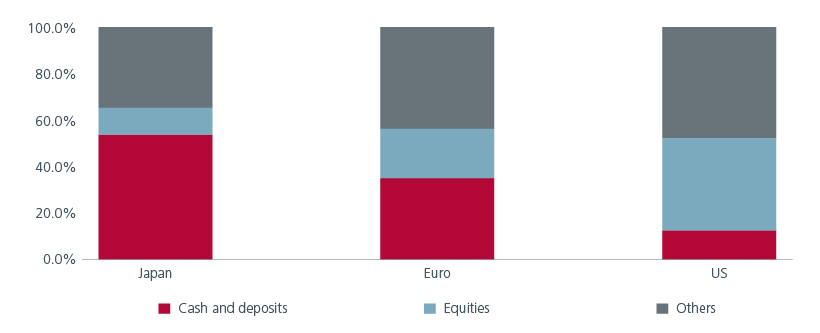

Fig 2: Individuals’ financial assets across regions

Source: 1Q23 data from Bank of Japan, JP Morgan

Normalising rates seen as a supportive factor

Japan appears to be transitioning to a higher growth environment as domestic demand and inflation pick up. The good news is that pricing pressures from transitory factors such as imported inflation in 2022 are giving way to more persistent services price inflation. While real wages have lagged in recent years, this dynamic could turn in 2024 with cost push inflation easing. There is also an indication that the upcoming spring wage negotiations will follow up on the strong wage growth of last year in an environment of increasing labour shortages.

The Bank of Japan is expected to end its negative interest rate policy and cap on long-term bond yields in 2024. It will still be sometime before rates become restrictive and as such monetary policy will continue to be accommodative and favourable for Japanese corporates. Moreover, normalising rates should be seen as a sign of a healthy economy.

As for the Yen, its current 20-year low versus the US dollar has been driven by the diverging monetary policy responses of the US and Japan. The interest rate differential could likely close as the Bank of Japan becomes more hawkish and the US Fed more dovish. A stronger Yen may be a headwind for some export-dependent companies, but we expect price and margin increases to be able to offset this. These concerns seem to be somewhat priced in the market, judging from the valuation support of companies we invest in, where our long-term trend profit assumptions assume normalised Yen levels of 115-120. This is consistent with the Yen’s longer-term average level versus the US dollar.

More upside for value stocks

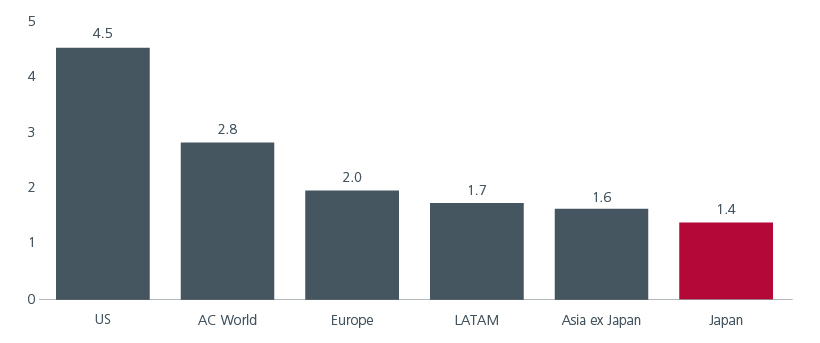

Japanese equities re-rated in 2023 on strong demand from foreign investors with the price-to-book rising from 1.2x to 1.4x. Despite the re-rating, Japan remains cheap versus global peers. According to JPMorgan, foreign investors are still significantly underweight in their Japan allocations, and both higher inflation and the new NISA program could spur domestic investors back into equities this year.

Fig 3: Japan valuations are attractive

Source: Eastspring Investments, IBES MSCI Indices, Refinitiv Datastream, as at 31 December 2023. Indices used: MSCI Japan Index, MSCI Europe Index, MSCI AC Asia Pacific ex-Japan, MSCI EM Latin America Index, MSCI AC World Index and MSCI USA Index.

While the market’s price-to-earnings ratio valuation is currently more in line with historical averages, this does not price in the potential change in corporate behaviour from reforms. It is incumbent on us as investors to continue the engagement with corporates and turn the current impetus for improvement to a sustainable one.

Much of 2023’s rally was driven by value stocks although growth stocks made a comeback in 4Q23. We believe the value story is far from over as there is still room for significant profitability improvement, idiosyncratic to Japan. We find good valuation outliers in domestics and materials, sectors where pricing discipline and structural reforms could challenge past ingrained beliefs around deflation and a lack of discipline.

We also observe many small and mid-cap stocks which offer good value as they have higher levels of cash, and increased potential for reform and restructuring. Japanese small caps have materially underperformed large caps since 2018 and are at a significant historical valuation discount to large caps.

Consensus is predominantly calling for a slowing global growth. While we have little edge in forecasting macro trends,if this risk does materialise, this could put pressure on cyclical profit growth in the short term. Our focus remains on the bottom-up, underlying trend of improving corporate behaviour towards returns and investments with a focus on areas of strengths. This is what makes us optimistic that the Japan market will continue to deliver strong idiosyncratic returns in the years ahead.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).