Executive Summary

- The Indian consumer market is positioned to become the world’s third largest by 2027, presenting significant opportunities for investors who can tap into this potential.

- Growing affluence and high levels of mobile penetration are driving consumption growth and changing consumer behaviour.

- India’s rapid pace of urbanisation and the emergence of peri-urban spaces are also creating unique opportunities for consumer companies, and therefore investors.

India became the world’s most populous country in April 2023. With a population of above 1.428 billion, and a working-age cohort that is expected to exceed 1 billion by the next decade, consumer spending in India is forecasted to surpass USD4 trillion by 2030. This will push India’s consumer market, currently the world’s 5th largest, up the ranks to become the third largest by 20271. This creates significant opportunities for investors that can tap into India’s growing consumption potential.

There are several factors driving India’s consumption spending:

Growing and more discerning

India’s strong economic growth is transforming household spending. India’s annual GDP averaged 6.21% from 2006 – 2023, among the world’s highest. For FY2024, the World Bank forecasts that India’s economy will grow by 6.4%. By 2027, around 25.8% of Indian households will have an annual disposable income of USD10,000. On the back of such strong economic growth, the spending by Indian households is growing rapidly. In 2021, India’s household spending per capita grew 7.1% versus 5.2% for ASEAN and is forecasted to grow by an average of 7.8% p.a. going forward2.

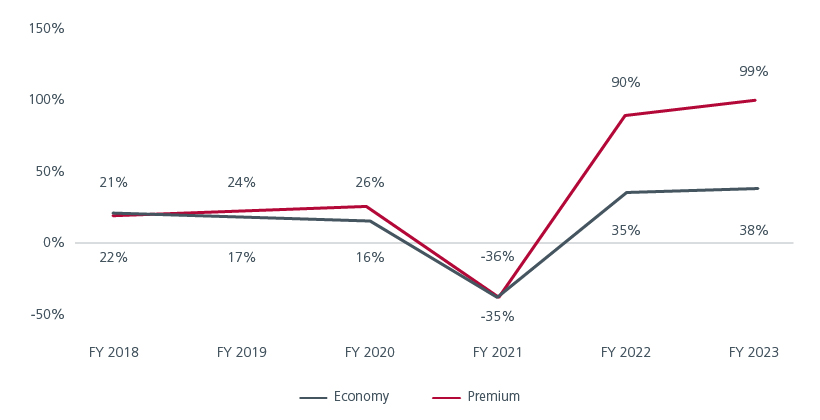

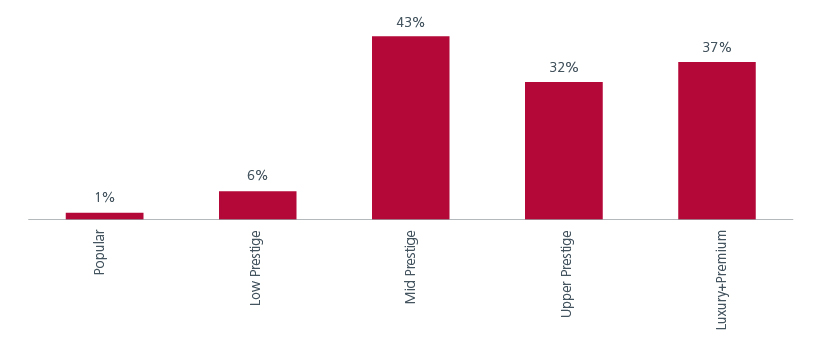

As a result of India’s growing affluence, the new Indian consumer is different from the consumers of the past. They tend to seek more quality, variety, and convenience in their purchases, and are also open to more experiential offerings. They are also more aware of social and environmental issues that align with their values. As a result, brands are offering higher-end products and services to consumers, a trend known as premiumisation. Premiumisation can be seen across multiple categories including fashion, vehicles as well as food and beverages. Fig. 1 and 2. Research suggests that there is strong demand for premium offerings within fashion, packaged foods, cosmetics, eating out and lifestyle accessories from the smaller towns. This has led retailers to expand rapidly in the tier 2 and 3 cities3.

Fig. 1. Apparrels net sales (% yoy)

Fig. 2. FY23 liquor sales (% yoy)

Source: : LHS: Companies, Avendus Spark Research, Note: Vmart and Premium is Trent. RHS: United Spirits; Economy: McDowells No 1 Premium: Antiquity, Signature, Black Dog, VAT 69, The Singleton.

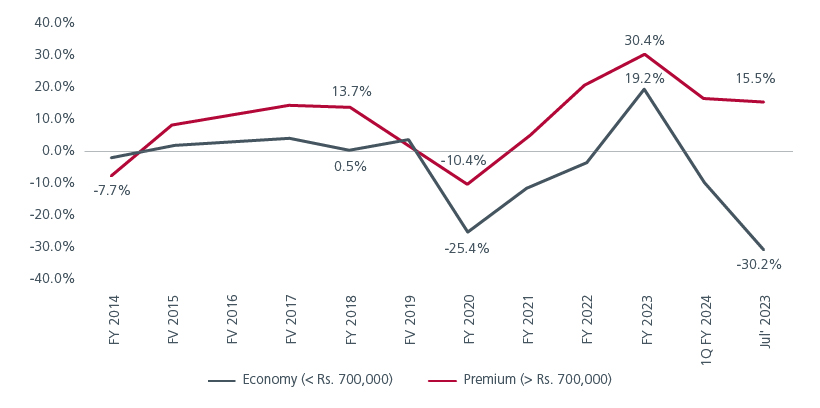

Deloitte's 2023 Global Automotive Consumer Study too reported a clear shift in buying pattern among Indian consumers. Fig. 3. Consumers are now prioritising experience over cost, with 55% of those surveyed willing to accept a longer delivery time in order to enjoy a better experience and get their preferred choice of vehicle.

Fig. 3. Car sales (% yoy)

Source: Kotak institutional research. October 2023.

Connected and diverse

As of January 2023, there are 692 million internet users in India. This number is expected to reach more than a billion by 2030, greater than the populations of Europe and North America combined. However, not all of India’s internet users are buying online despite the rapid growth of e-commerce sales.

There are an estimated 289 million of online buyers in India in 2021 and this number is forecasted to rise to 400-450 million by 2027. The rising availability of affordable smartphones, greater access to information and online payment systems, as well as online promotions and personalised advertisements are helping to fuel online purchases. Greater variety from an expanding online seller base and a more efficient logistics network are also enhancing the online buying experience. According to a report by Accenture, e-commerce spending in India is expected to grow by nearly sixfold from USD38 billion in 2021 to USD200 billion by 2030.

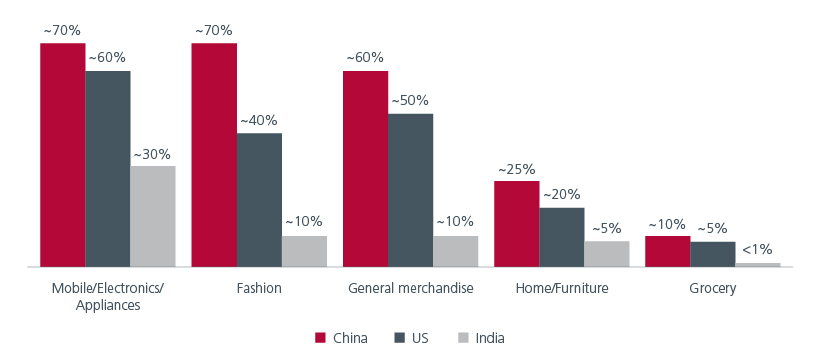

The market penetration of e-retail is expected to double from 5% in 2022 to 9%-10% over the next 5 years. Compared to China and the US, there is significant headroom for e-retail penetration in India to rise across multiple product categories. Fig. 4.

Fig. 4. E-retail penetration by category (2021)

Source: Penetration represents e-retail as a percent of total retail. Forrester. Market participant interviews. Bain analysis.

The profile of India’s online buyers has also evolved over the last decade. During the early adoption phase, India’s online shoppers were previously middle-aged, and from the higher income groups and tier one cities. They now include Gen Z shoppers, as well as those from tier two cities and beyond. The shopper base has also expanded to include the lower-middle income group and has matured, with a rising percentage of daily active users.

Urbanising and transforming

Urbanisation is a major driver of consumer spending in India, as it transforms the size, composition, and dynamics of the consumer market, creating opportunities and challenges for businesses and therefore investors. According to the World Bank, India's urban population as a percentage of the total population increased from 28% in 2001 to 35% in 2020 and is projected to reach 40% by 2030⁴.

Urbanisation has several impacts on consumer spending in India, including increasing income and purchasing power. Urban areas tend to offer higher wages, more employment opportunities, and better access to education and health care than rural areas. This tends to lead to higher income levels and purchasing power for urban consumers, who can afford to spend more on discretionary items, such as consumer durables, entertainment, travel, and personal care.

Urbanisation also changes consumer preferences and behaviour by exposing consumers to new products, services, brands, and lifestyles. Urban consumers tend to be more aspirational, quality-conscious, convenience-seeking, and digitally savvy than rural consumers. They also have more diverse and sophisticated tastes and demands, such as for health and wellness, sustainability, personalisation, and social responsibility. These factors drive demand for new and innovative offerings across various product categories and sectors.

Urbanisation also creates new market segments and channels for consumer spending in India. For example, the emergence of peri-urban spaces, which are transitional areas between rural and urban habitats and have developed around cities due to rapid urbanisation and urban expansion, offers a unique opportunity for businesses to tap into a large and underserved consumer base that has both rural and urban characteristics.

Tapping into India’s consumer growth potential

Consumption is an important driver of India GDP with Personal Final Consumption Expenditure accounting for 59.7% of India’s nominal GDP in June 20234. Besides a large population, other structural factors such as premiumisation, digitalisation and urbanisation are driving India’s consumption growth. With the Indian consumer market positioned to become the world’s third largest by 2027, investors can tap into this significant growth by investing in businesses that can understand and meet the changing needs of the Indian consumer.

We would like to thank ICICI Prudential Asset Management Company (IPRU) for contributing their insights to this article. IPRU is a joint venture between our parent Prudential plc and ICICI Bank. This partnership has been in place since 1998 and brings together two leading asset managers with expertise in Asia and India respectively.

Sources:

1 BMI Research.

2 BMI Research.

3 Report by consulting firm Redseer, in collaboration with Plural by Pine Labs. al payments firm. June 2023.

4 CEIC data. June 2023.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).