MGIIs are non-interest bearing government securities based on Islamic principles1, of which proceeds raised are used to fund development related expenditure.

Here are a few reasons why MGIIs potentially present an attractive investment opportunity for investors

1. STEADY SUPPLY

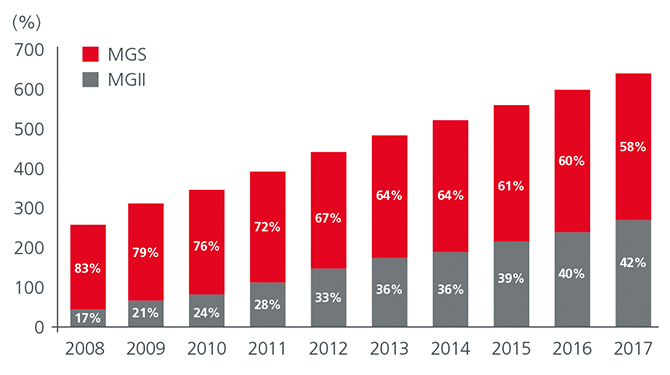

MGII, over the years, has become an increasingly important component of the Malaysian government’s total bond funding. By 2017, the MGII market stood at RM268 billion and accounted for 42% of the government’s total bond funding, up from 17% in 2008 (see Fig.1). This trend appears intact with Bank Negara Malaysia expected to hold 18 MGII auctions in 2018, three more than for Malaysian Government Securities (MGS).

Fig.1: Percentage share in government funding2

2. ROBUST DOMESTIC DEMAND

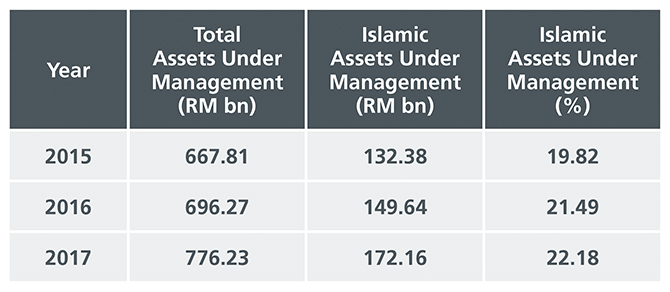

The rapid growth of the MGII market can be partly attributed to the steady rise in Islamic assets under management in Malaysia. Fig.2 shows that Islamic assets under management rose 30% from 2015 to 2017, significantly stronger than the 16% rise in total assets under management over the same period. By the end of 2017, Islamic assets under management accounted for 22% of total assets under management.

Fig.2: Strong growth in Islamic Assets under Management3

Growth was boosted by several incentives, including tax and stamp duty exemptions related to Sukuk issuances, given to Issuers, investors and qualifying Islamic Fund management companies. In particular, Fund management companies managing approved Islamic funds of local and foreign investors are also granted income tax exemptions on income received from fund management services until 2020

3. RISING FOREIGN DEMAND

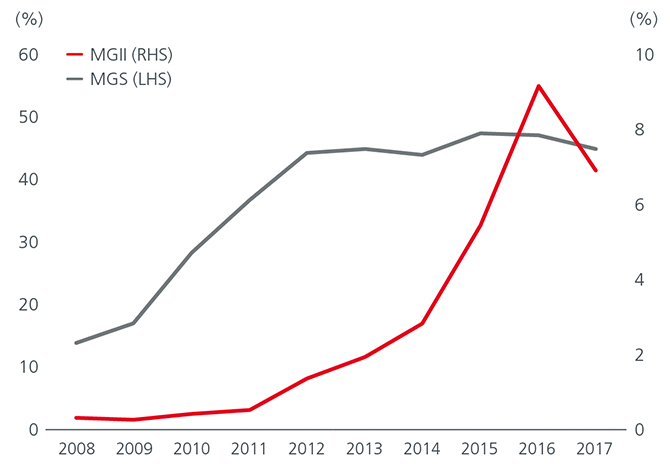

Besides healthy domestic demand, foreign investor interest has also risen, aided by MGII’s entry into selected global bond indices. The Barclays Global Aggregate and JPMorgan’s Government Bond Index-Emerging Markets Indices included MGIIs in March 2015 and October 2016 respectively. Fig.3 shows foreign holdings as a percentage of total outstanding MGII rising from 0.3% in 2008 to a high of 9.2% in 2016. However, this is still far below the share of foreign shareholdings in MGS.

Fig.3: Foreign shareholdings as a percentage of total outstanding bonds4

The strong demand for MGII from domestic and foreign investors is reflected in the healthy bid-to-cover ratios at MGII auctions. New issues of MGII have on average enjoyed a bid-to-cover ratio of 2.21 times in 2017, slightly above MGS’ average ratio of 2.11 times.

More recently, the auction for the 7-year Malaysian Islamic Sovereign Debt on 14 May garnered the strongest year to date bid-to-cover ratio of 3.397 times. With this being the first auction to take place after the general election, the strong demand reflects investors’ confidence in the new government despite uncertainty over how some of the election pledges could impact Malaysia’s fiscal deficit.

4. ATTRACTIVE RISK RETURN TRADE-OFF

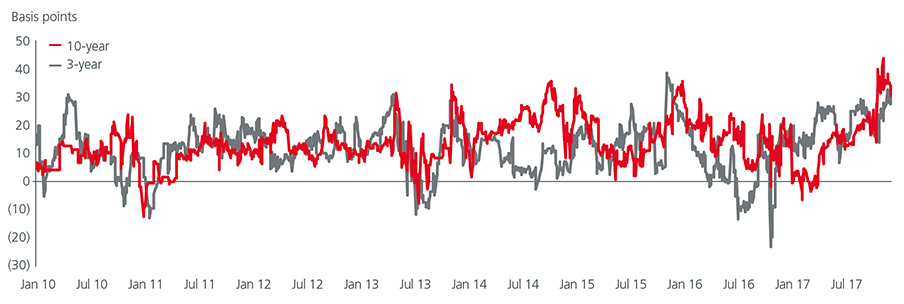

MGII offers a more attractive risk return tradeoff over Malaysian Government Bonds. MGIIs have historically traded at higher yields than corresponding MGS, across multiple benchmark tenors. This is despite both being direct obligations of the Malaysian government (see Fig.4).

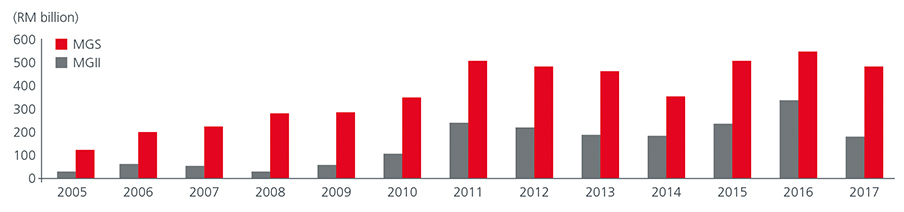

The yield differential partly reflects the liquidity premium for MGII. While MGII trading volume increased from a modest RM30 billion in 2005 to a high of RM334 billion in 2016, it is still below that of MGS’. By 2017, MGII’s trading volume stood at RM179 billion versus RM545 billion for MGS (see Fig.5). There is potential for liquidity to improve and the yield differential to narrow as demand and supply of MGII increases.

Fig.5: Trading volume9

CONCLUSION - MORE UPSIDE

Demand for MGIIs is poised to increase as Malaysia’s Islamic finance industry grows. The Malaysian government has laid a strong foundation for the industry as early as 1983 with the Islamic Banking Act 19836 and Government Funding Act 19837. As such, Malaysia is set to become one of the world’s most developed Islamic finance markets on the back of new initiatives and further market development. Malaysia has the third highest Islamic banking assets in the world.8

The establishment of a new Shariah compliant provident savings fund by the Employees Provident Fund (EPF) in 2017 will help boost the Sukuk market with the new fund poised to become the world’s largest standalone Islamic pension fund

MGII is also attracting interest from investors looking to incorporate Environmental, Social and Governance (ESG) factors into their investments - the Shariah principles of seeking social justice, economic prosperity and sustainable economic activity are largely in line with the core values of Sustainable & Responsible Investment (“SRI”).

With foreign ownership of MGII at 6.9% of total outstanding MGII as at end 2017 versus 45.1% for MGS, there is clearly room for upside. Growing demand for Islamic bonds including MGII can potentially improve MGII liquidity and tighten the yield differential over MGS.

Sources:

1 After 2013, MGIIs are issued based on the Murabaha principle. Murabaha is a form of sale where the cost of the goods to be sold as well as the profit on the sale is known to both parties. The purchase

and selling price and the profit margin must be clearly stated at the time of the sale agreement. Payment of the Murabaha price may be in spot, in instalments or in lump sum after a certain period of time. http://www.financialislam.com/murabahah.html.

2 Bank Negara Malaysia, as at December 2017.

3 Securities Commission Malaysia, as at December 2017.

4 Bank Negara Malaysia, as at December 2017.

5 Bond Pricing Agency Malaysia, as at December 2017

6 The Islamic Banking Act 1983 allows the government to raise funds in accordance with Syariah principles, as at 10 March 1983.

7 The Government Funding Act 1983 helps govern the licensing and operation of the Islamic Bank. http://iimm.bnm.gov.my/.

8 Islamic Financial Services Industry Stability Report 2017. 9www.fast.bnm.com.my, as at December 2017.

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing. Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.