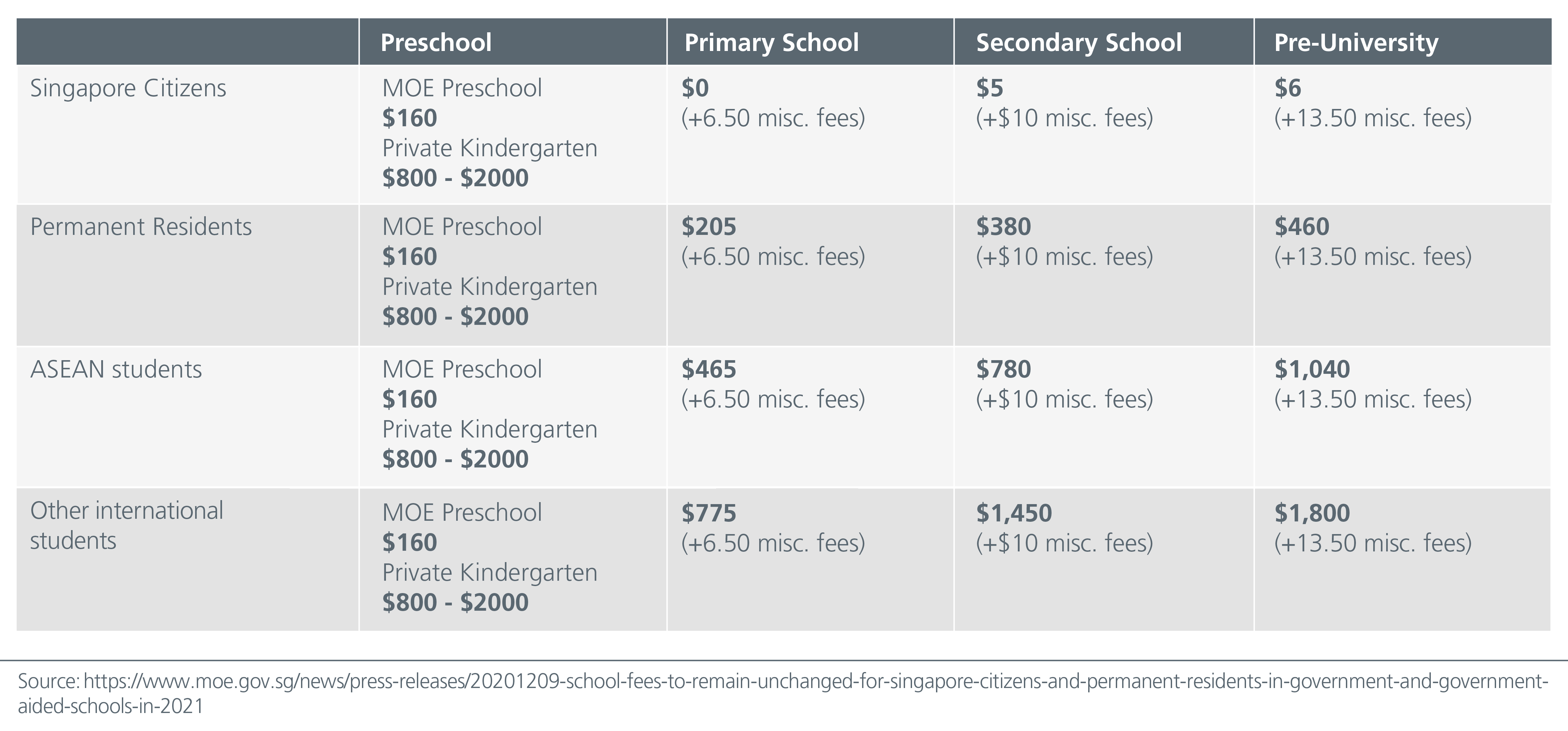

What are the costs of school fees in Singapore?

Let’s look at preschool and kindergarten costs:

Ministry of Education (MOE) kindergartens currently charge $160 a month (half-day) for Singapore Citizens, and $320 a month for Permanent Residents. For full-day services, monthly fees are capped at $395 per month.

(However, some Singapore Citizens can apply for a $150 monthly subsidy under KCare – check here to see if you’re eligible).

With private kindergartens and preschools however, costs are highly variable. There’s no real way to give you a reasonable “range” – some of the most high-end schools have fees that reach $6,370.25 for

10 weeks (full-day).

As a loose rule of thumb, however, we estimate private kindergartens to cost between $800 to $2,000 per month.

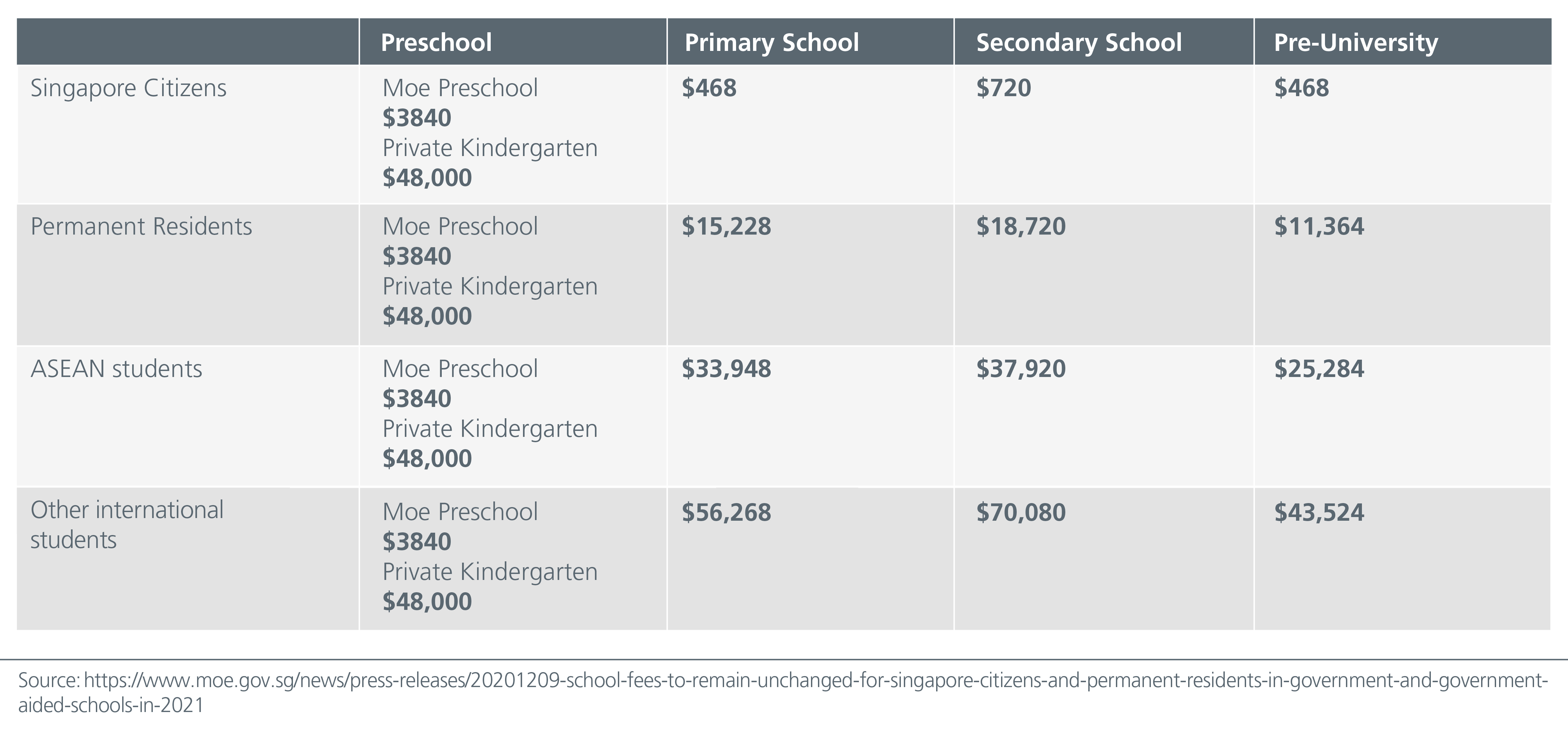

Estimated total costs of preschool education

MOE Kindergartens: $160/month x 24 months = $3840

Private Kindergartens: $800 - $2000/month x 24 months = $48,000

Next, let’s look at Primary, Secondary, and pre-university education.

These are the typical monthly school fees you can expect in Singapore, as of 2021:

Estimated total costs (including misc. fees)

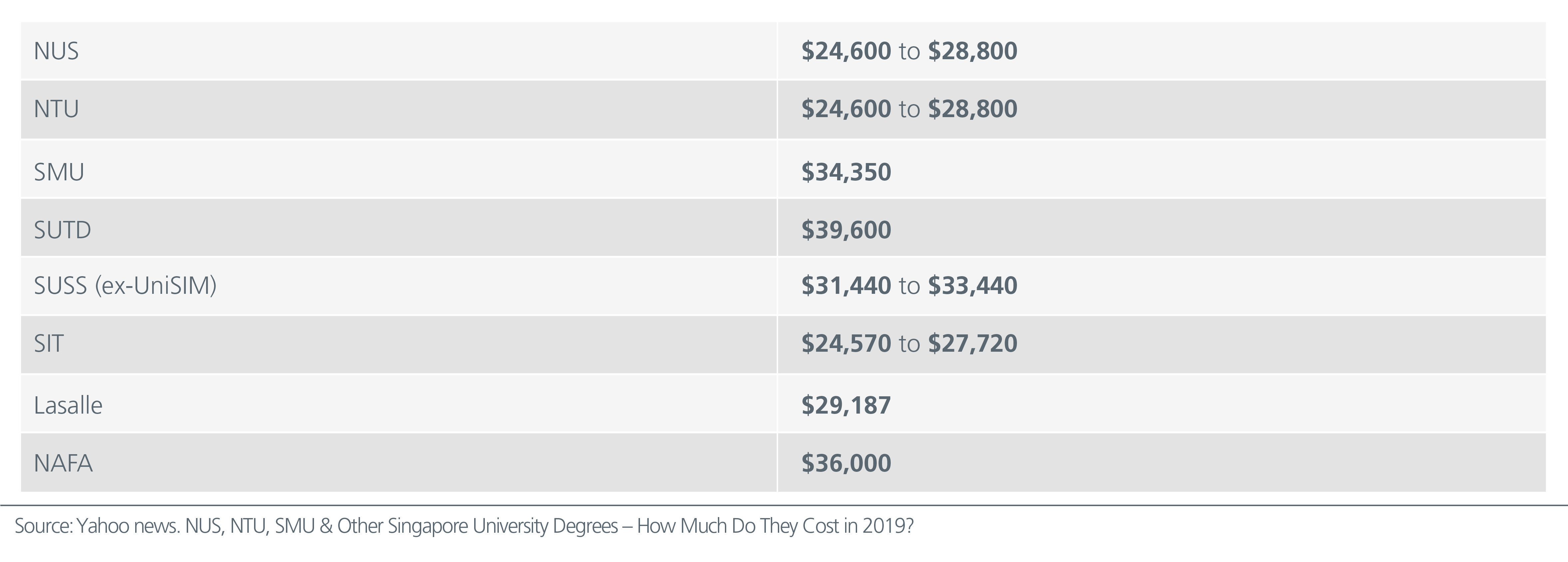

Finally, let’s look at the cost of university education in Singapore:

The cost of a university education will vary significantly, based on the chosen course. For example, Business courses at NUS currently cost $32,250 per year, while Music courses are about $123,750.

As of 2021, average annual course fees for various universities are as follows:

Assuming a three to four-year course, a university education will range between $43,152 to $93,076 for most Singaporeans.

That said, MOE does provide a Tuition Grant Scheme, which will usually reduce the cost by about 50 per cent (for citizens).

All Singapore Citizens receive the grant automatically; Permanent Residents and foreigners can apply for the grant, but there may be additional conditions (such as having to work in a Singapore-based firm for a given duration,

after graduation). Grants are also reduced for Permanent Residents and foreigners.

You can get the grant information for your given course and institute from the MOE website.

Course fees tend to rise over time due to various factors. You can use this inflation calculator as a guide to estimate costs according to your child’s intended

year of enrolment.

How to plan your child’s educational opportunities, despite the costs

1. Identify and correct existing shortfalls

Take stock of your existing savings and investments, and identify any shortfalls when it comes to your child’s education.

Thanks to heavy subsidies from Primary to Pre-university, the main educational cost for most Singapore Citizens will be university education. This typically takes place at ages 18 to 21.

As such, you should try to project how much your savings and investments will grow by that time. For example:

Say your child is currently 11 years old. You expect him to enrol in a university at age 21. You estimate a cost of $50,000, for a course of her interest.

You currently have a savings plan with $10,000, and you contribute $2,400 annually. It grows at three per cent per annum:

It grows at three per cent per annum:

This would come to around $41,441 after 10 years, or a shortfall of about $8,559. As such, you may want to increase your annual contributions, or find an investment solution that offers a higher interest rate.

If you need help getting a sufficient amount, you can consider starting a savings plan early or look at alternative investment solutions.

Besides ensuring your plans will achieve the required amount, also make certain the monies are readily available at the right time!

There’s not much point if the money ends up stuck in a fixed deposit, or an investment with a maturity date that’s too late. Do take note of when and how you can withdraw the money, when it’s time for your child’s

studies to begin.

2. Have a contingency plan for emergencies

Try to save 15 to 20 per cent more than the required educational fees to cater for:

- Change of educational goals, such as switching to a more expensive course of study, or choosing a double major

- Disruptions in study, such as due to medical emergencies, which may

- delay the graduation timelines

If all goes well and you don’t need the contingency plan, the excess amount can be re-invested elsewhere, or used for expenses such as on-campus accommodation and transport.

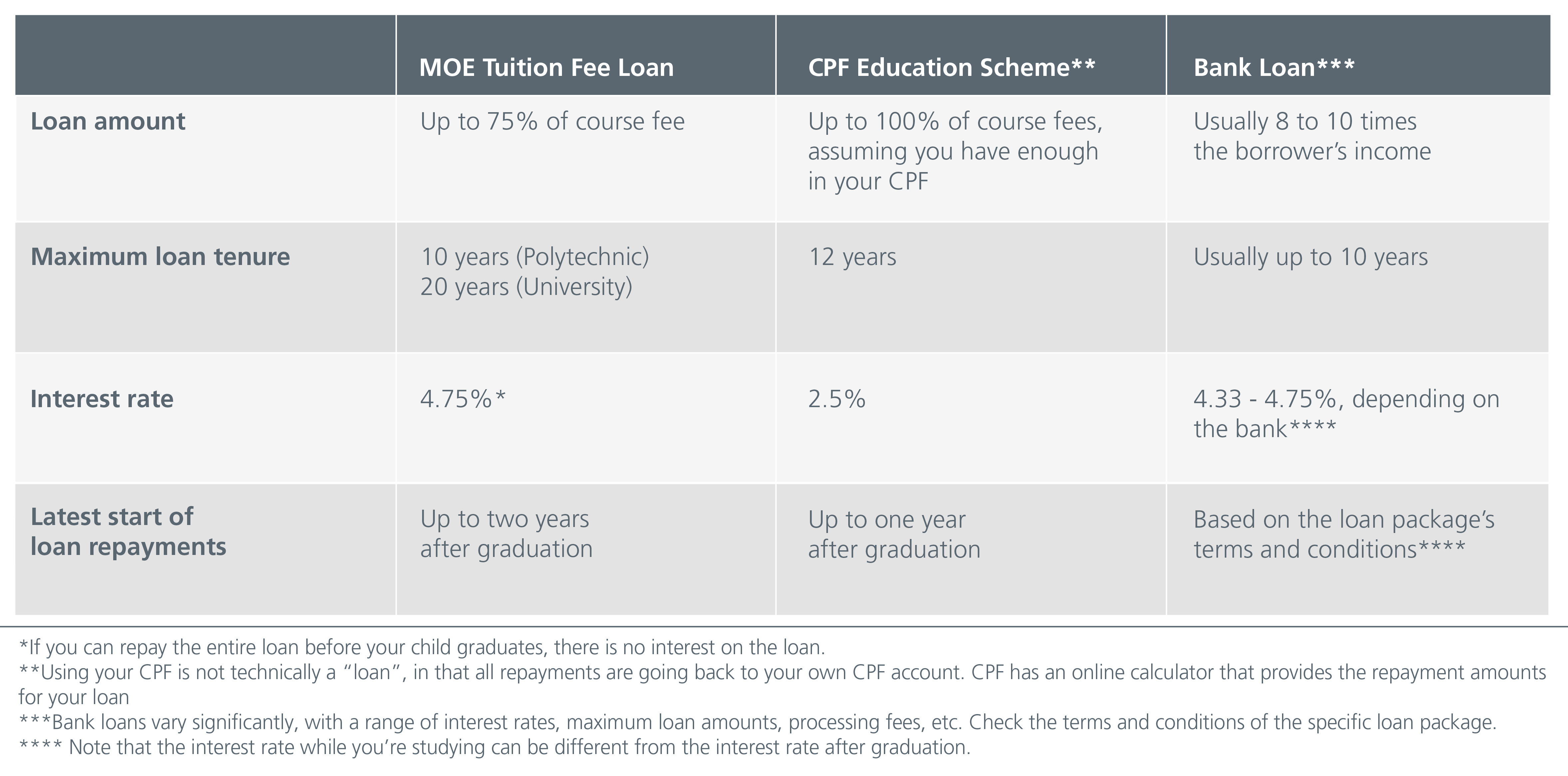

3. Understand the different financing options

*If you can repay the entire loan before your child graduates, there is no interest on the loan

**Using your CPF is not technically a “loan”, in that all repayments are going back to your own CPF account. CPF has an online calculator that provides the repayment amounts for your loan

***Bank loans vary significantly, with a range of interest rates, maximum loan amounts, processing fees, etc. Check the terms and conditions of the specific loan package.

**** Note that the interest rate while you’re studying can be different from the interest rate after graduation.

4. Keep to the 50-30-20 ratio for a sustainable plan

However you choose to pay your child’s education / education loan, remember to maintain cash flow and emergency savings. You can follow the 50-30-20 rule as a guideline:

This means 50 per cent of your monthly income should go to necessities, such as the home loan, education loan, food, etc.

The next 20 per cent should be saved (or if you have hit a target savings of six months of your expenses, invest it instead). The remaining30 per cent can be spent on various wants.

It’s important to ensure you have six months of expenses saved, so that your child’s education is not interrupted in the event of reduced income, changing jobs, etc.

5. Review the plan every year

Financial planning is not a one-off process. Review the plan at the end of each year, and let your child pitch in. Remember that they may have a change of heart; such as deciding to start work before getting a degree, or wanting

to take up a different course of education.

You will have to adapt your budget and savings plans, as they grow older and their intentions change. Likewise, changing life circumstances – such as your own income level – may necessitate tweaks to the overall plan.

Finally, remember that you don’t have to do it alone

We’d all love to provide for our child’s entire education; but realistically, some of the more expensive courses may be out of the budget. In these instances, have a conversation early with the child to explore options –

perhaps they can start working part time to save up. Alternatively, they can repay the loans after graduating. Have a conversation early with your child, if there’s a chance they have to pitch in.

This could mean working part-time through university, or agreeing to pay off part of the monthly loan after graduation. This is, after all, better than not being able to afford the course at all (or having to drop out part way, because

the fees are unsustainable).

It is never too early to start planning for your child’s education. Start preparing now and find the right investments to suit your family’s needs.