Summary

Visualising ESG issues holistically can reveal attractive opportunities in sectors that appear “ESG unfriendly” on conventional measures. This empowers investors and asset owners to direct capital where impact and long-term risk-adjusted returns meet in a practical and sensible manner, while minimising negative social and environmental impact.

The number of third-party ESG rating providers has increased significantly with the rising focus on sustainability. Third-party ESG ratings provide valuable inputs into investment frameworks, influencing portfolio outcomes. However, the variance between ESG ratings from different providers is much higher when compared to credit ratings, and this is true across sectors. Research shows that the correlations of ESG ratings across the major providers range from as low as 0.14 to 0.65. On the other hand, the correlation of credit ratings from different rating agencies is much higher, around 0.8 (Source: CFA Institute (2021)).

The lower correlations between the ESG ratings across providers partly result from different methodologies which assign different materiality weights to multiple ESG factors and the varying ways that raw data from different E, S and G dimensions are put together to form a score. It is challenging to achieve consistent ESG ratings given the multi-faceted nature of ESG analysis and the different methodologies that exist. Without a standardised guidance for ESG data, there are many ways to report the same issue which ESG rating providers need to interpret and compare. How different providers define peer groups and address data gaps also affect the ratings. Credit ratings are risk assessments, focused on assessing an issuer’s probability of default. In assessing default probability, the metrics and leverage ratios used as well as the data needed to calculate these ratios are more standardised. Hence, credit rating outcomes tend to be more aligned.

Visualising ESG issues holistically

We view ESG ratings more as “indicators” or informative analysis on the exposure of a company or sector to ESG risk and opportunity, rather than the final word on how companies score on ESG factors. As such, we treat third party ESG ratings as another data source which we can leverage to perform our own ESG analysis.

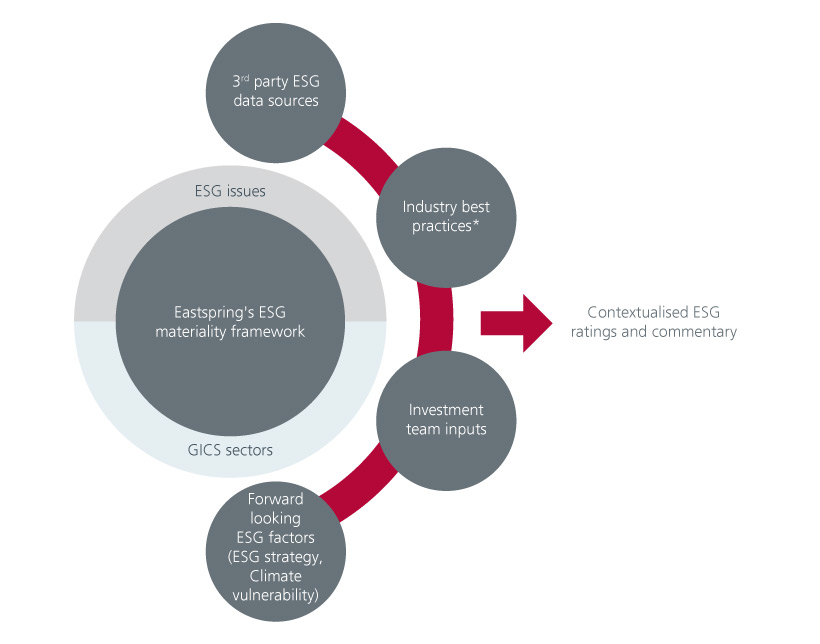

Our proprietary ESG scoring and integration tool leverages ESG data from external ESG rating sources but combines the data components using a proprietary framework. The framework makes use of our internal ESG materiality matrix which references the industry’s best in class frameworks such as the Sustainability Accounting Standards Board and the International Capital Market Association which further incorporates references to the Task Force on Climate related Financial Disclosures’ recommendations but includes additional context which increases relevancy to our investment universe. This adds a quantitative element and complements the bond team’s ESG framework which considers both an issuer’s ESG risk exposure and its preparedness to address those risks. We see portfolio construction as a layering process where we first consider the client’s needs, the client’s, and our Responsible Investment policies, after which we layer the bond team’s credit analysis with further ESG assessment.

Fig. 1. Eastspring ESG Visualiser

Source: Eastspring Investments. *Industry best practice materiality frameworks referenced include ICMA (which includes TCFD aligned material issues) and SASB, including materiality approaches from ISS, MSCI and Bloomberg ESG. Abbreviations: GICS: Global Industry Classification Standard, ICMA: The International Capital Market Association, TCFD: Task Force on Climate-Related Financial Disclosures, SASB: Sustainability Accounting Standards Board, ISS: Institutional Shareholder Services.

Having a proprietary ESG scoring, and integration tool can allow investment teams to consider information which third party ESG rating providers may not offer a uniform assessment of. This can include forward looking ESG data such as exposure to climate transition opportunities or risks with impacts that scale over time e.g. physical climate risks. As mentioned above, a proprietary tool can provide greater context to current and potential holdings in the teams’ investment universe. This is important as the definition of material ESG issues may not be uniform across all markets especially at different stages of development. Importantly, proprietary tools also tend to be iterative, which means it can be continually enhanced by the investment teams’ ongoing inputs.

Case study: A nuanced view on Real world decarbonisation

We find that the financial institutions sector tends to function as a catalytic sector in ESG. As a regulated sector, financial institutions are often part of the public policy toolkit by which policymakers use to catalyse and regulate other sectors, to address ESG issues such as climate challenges and environmental and social risk management. Being intermediaries, the implications of financial institutions’ sustainability policies cascade down to their clients.

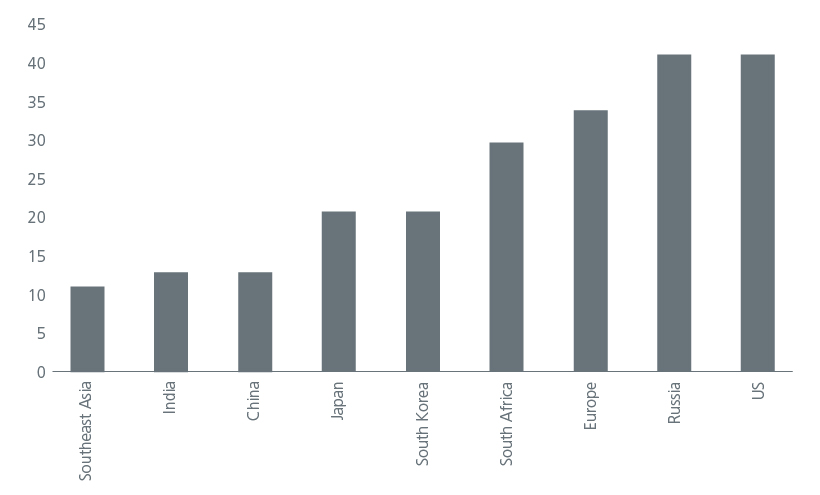

A holistic approach towards ESG analysis potentially allows investors to consider opportunities in sectors that may appear “ESG unfriendly” on conventional measures or based on third-party ESG ratings. The automatic exclusion of companies that are involved in or derive more than a certain percentage turnover from coal, for example, is contentious, especially in Asia, given that our coal plants are relatively young and coal phase-out presents a practical financial challenge. Also, coal forms a key part of the energy baseload in Asia and Emerging markets and strict exclusion would introduce other, perhaps social challenges.

Fig. 2. Average age of coal plants (years)

Source: IEA 2023.

It is important to look at companies’ holistic climate transition efforts and how they are tilting their business models to address the impact of climate change in a credible manner. One of Eastspring’s key Responsible Investment principles is that we prefer engagement to divestments and divestments are a last resort. We believe that investors and asset owners need to help companies decarbonise in a practical and sensible manner, that also minimises negative social and environmental impact. The importance of a just transition is also in line with the Monetary Authority of Singapore’s (MAS) efforts to help financial institutions in Singapore strike a balance between reducing financed emissions while financing credible decarbonisation.

Looking ahead: Moving towards greater convergence and better data

Various efforts are in place to help improve the quality, reliability, and comparability of ESG ratings. In Japan, the Financial Services Agency (FSA) finalised a new code of conduct for ESG ratings and data providers in December 2022. The MAS has also recently launched a public consultation on an industry code of conduct for providers of ESG ratings and data products. The call for similar regulation is gathering pace in Australia as the scale of ESG investment increases.

We are optimistic that the quality and consistency of ESG data and ratings will improve, and the different approaches will eventually converge. As such, the correlations of the ESG ratings across different third-party providers should rise over time. Against a constantly evolving ESG landscape with multiple, often conflicting inputs, having better quality and more standardised ESG data is helpful for active investors like us in our proprietary and, in combination, holistic ESG assessment.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).