Executive Summary

- One of the longest anticipated recessions in history has yet to play out. The first rate hike by the US Fed was nearly 2 years ago, with little to no impact on US GDP growth.

- The monetary policy transmission is elongated, not broken. The elasticity of consumer and corporate spending to interest rates has gone down because of long-term fixed rate debt.

- The current “High growth, Low inflation” environment can remain for a while. But it is important to monitor data for signs of weakness to make swift changes in asset allocation.

It has been two years since the first US Federal Reserve (Fed) rate hike. Financial conditions have meaningfully tightened, and the cost of capital has increased 10-fold. Yet, the US economy is defying all the laws of monetary policy transmission. This has been one of the most anticipated recessions, and yet there are no signs of it in the data.

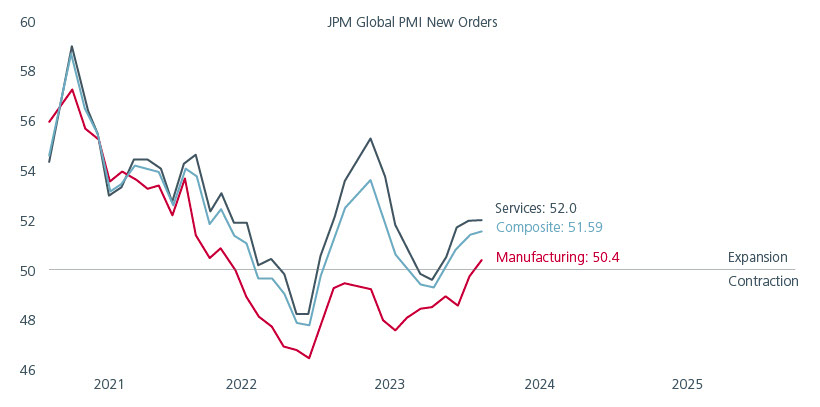

Just when the services sector data began to show signs of weakness, the manufacturing sector seems to have bottomed out and is reaccelerating. Meanwhile, households and corporates in the US seem relatively unfazed by the 525bps increase in interest rates.

Has the link between interest rates and growth broken? Do rate hikes have no impact on the real economy? Will the US defy all odds of recession and continue its flight?

The Fed’s report card

As multi asset investors, we want to know whether the equity-bond correlation will turn negative again, and which asset class will be most impacted. The bottom line – are we in a “No landing” scenario and are we at the start of a reacceleration on a full tank?

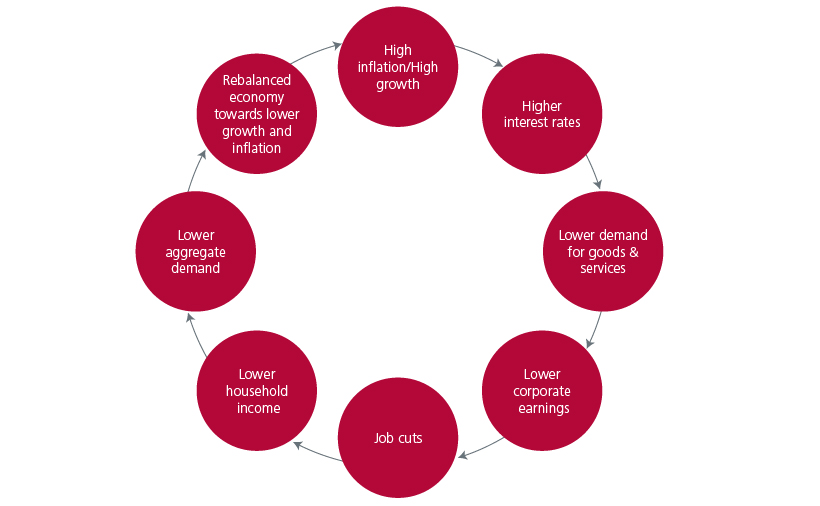

Economic theory dictates that monetary policy drives growth lower as the cost of money increases, steering economic agents (consumers, corporates, and small businesses) to borrow less and spend less. This in turn drives prices lower and unemployment higher. Corporates seeing a drop in demand will cut their workforce, which in turn reduces household income growth. This continues until the central bank believes growth and inflation have slowed enough to begin cutting interest rates.

Fig 1: Monetary policy transmission chain

Source: Eastspring Investments, March 2024

In the last 50 years, the Fed has gone through nine aggressive hiking cycles, five of which led to a hard landing and two of which to a soft landing. Only one out of the nine episodes saw US growth relatively steady despite rate hikes between 2015-2018. Subsequently the COVID-19 pandemic hit and tipped the US economy into a recession. Hence based on history, we think the Fed is unlikely to be able to engineer a “No landing” scenario.

Is the transmission mechanism broken?

The rise in policy rates in this cycle has been quick and aggressive. However, two years after the first rate hike in March 2022, real GDP growth in the US remains positive. A strong services sector, along with tight labour markets, has forced companies to retain workers and raise wages. This has pushed inflation higher and eroded real household income but has not dented consumer spending.

Part of this could be due to a structural change in consumer behaviour towards lower savings post pandemic, and partly driven by the breakdown in the transmission from higher rates to higher consumer debt costs due to the long-term fixed rate housing mortgages. US mortgage debt service ratio declined substantially from 7.2% in 2007 to 3.5% in 2021. With more than 75% of mortgages on 10y+ fixed rates, that ratio has remained relatively low despite the increase in interest rates.

Most economists estimate a two to eight quarter lag before monetary policy impacts the real economy. More recently, macroeconomic researchers have found that monetary policy impacts unemployment rate with a 27-month lag at its peak.1 We are approaching the tail end of that timeline but not out of the woods yet. The latest Fund Manager Survey by Bank of America suggests that 23% of global investors expect there to be “No landing” and only 11% expect a “Hard landing”.2 We think this is possible if a) the economic capacity has increased substantially to drive higher growth without inflation, or b) productivity gains have absorbed increased demand without driving higher inflation.

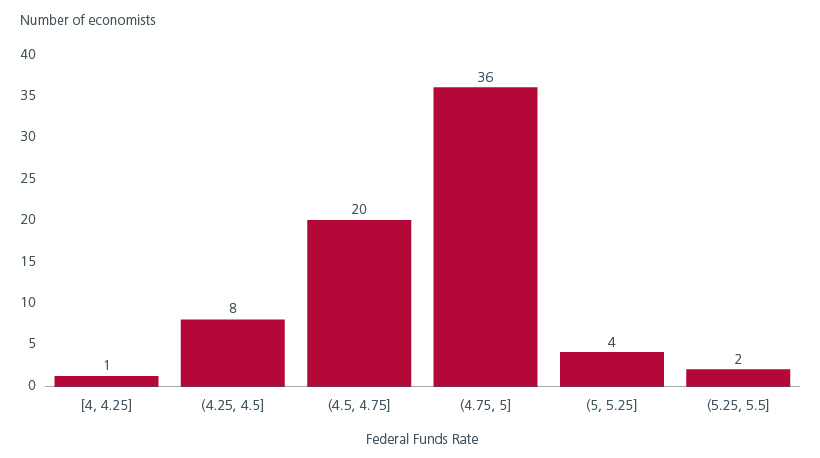

The verdict is still out there. The only thing economists agree on today is that we have reached peak Fed funds rate. Economist expectations for rate cuts this year range between zero to ten times – a materially different economic scenario. This presents opportunities and the potential for high volatility in asset markets in 2024.

Fig 2: Economist expectations of Fed funds rates as of end 2024

Source: Bloomberg, March 2024

Staying informed via data

Eastspring’s multi asset team believes the chain is intact and that this time monetary policy transmission is elongated, not broken. However, if the Fed continues to keep rates high when the debts are due for refinancing, the economy will adjust; we are beginning to see the impact of higher rates on UK and European homeowners where fixed rate mortgages are less prevalent. Until then, we may see continued spending by the US consumers, a reacceleration of the manufacturing sector (as displayed by Bank of America’s Global Wave Index3 and the latest Purchasing Manager’s Index readings – see Fig. 3), and growing confidence that the Fed has managed to engineer a “No landing” scenario.

Nonetheless, it is essential as investors to remain data dependent and nimble, holding our views lightly. At the moment, key data such as new job openings, household savings rate trend, wage growth, etc., continues to point towards a Goldilocks scenario where growth is re-accelerating (driven by the manufacturing sector) while inflation is coming off. This is driving markets to price in some rate cuts (albeit differing views), and higher earnings expectations.

Fig 3: Global manufacturing PMI is rebounding

Source: LSEG Datastream as at 21 Mar 2024

Asset allocation under different scenarios

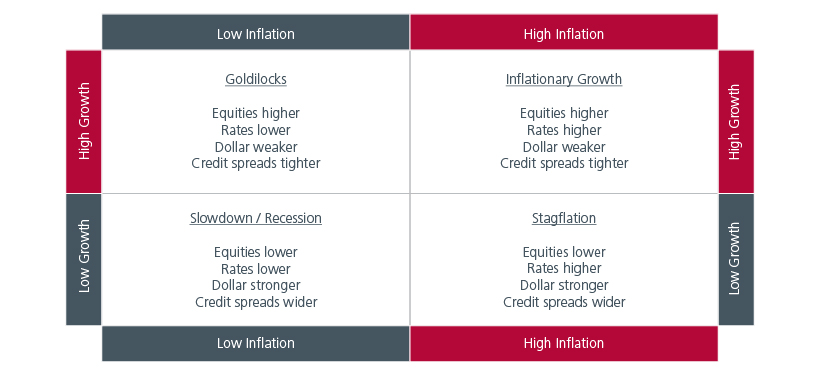

Most of 2022 was characterised by “high growth, high inflation” driving both global equity and bond markets lower. Asset allocators were faced with a challenging backdrop of nowhere to hide. 2023 was gentler as the gradual deceleration in inflation gave investors solace that there was an end in sight to the rate hiking cycle. 2024 can be a repeat of 2023 if we end up in a high growth, low inflation scenario; all risk assets will continue to rally as growth remains strong.

However, if we go back to either of the other three quadrants where either growth or inflation corrects, limiting equity exposure in multi asset funds would be a wise choice. See Fig 4. The scenario that plays out will drive the trajectory of asset allocation in the coming months.

Fig 4: Macro scenarios’ impact on asset classes

Source: Eastspring Investments, March 2024

For now, there are continued expectations of strong economic growth. In the March Fed policy meeting, FOMC members expect the US economy to grow 2.1% in 2024, well above its prior 1.4% estimate in December. This represents strong growth without significantly higher inflation.

In our multi asset portfolios, we are tactically bullish risk assets given the strong growth data but have a large allocation to Treasuries in portfolios that are more conservative and income oriented. The need for investing in risky assets to generate income is low in this economic cycle with risk-free rates above 5%. Even for portfolios that are overweight in risk assets, there is sufficient downside protection in the form of option strategies that will help cushion the drawdown if we were to move to any of the other quadrants. Market pricing in the options market is relatively benign, presenting low-cost opportunities for hedging downside risk in portfolios.

Essentially, we believe the monetary policy transmission is elongated, not broken. If we notice any signs of weakness in the economic data, we will move our portfolios away from risk assets swiftly into safe havens like USD and Treasuries.

Sources:

1 “Presidential Address: Does Monetary Policy Matter? The Narrative Approach after 35 Years”, Christina D. Romer and David H. Romer, American Economic Review 2023, 113(6): 1395-1423

2 “Global Fund Manager Survey: Bulls go Global”, Bank of America, March 19, 2024

3 “Global Wave: Ride the Wave”, Bank of America, March 18, 2024

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).