Executive Summary

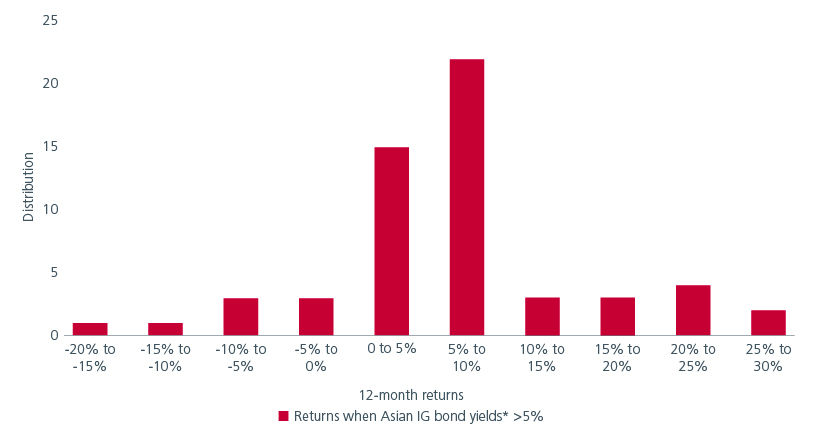

- Asian bond yields are at multi-year highs, presenting investors with an attractive and steady source of income. Historically, when Asian Investment Grade bond yields are greater than 5%, the bonds delivered positive 12-month total returns more than 80% of the time.

- The macro backdrop of moderate growth and muted inflation in Asia is positive for Asian bonds. With rate cuts largely priced out in Asia, Asian bonds can potentially enjoy a larger boost when central banks eventually lower rates.

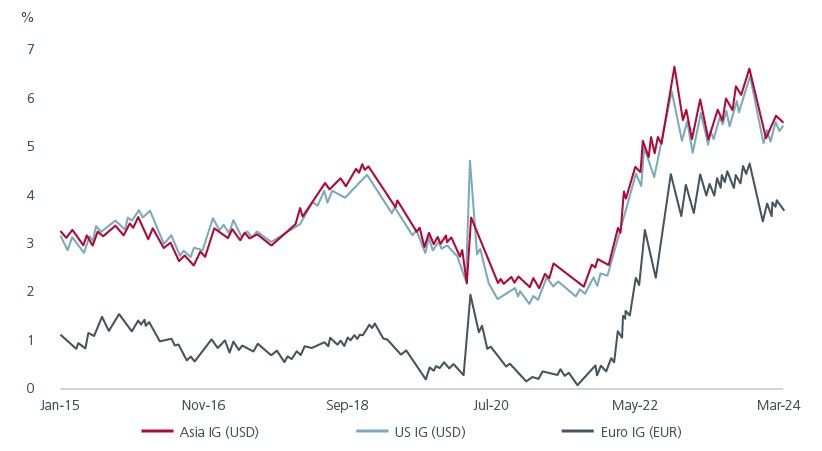

- Compared to US and European Investment Grade bonds, Asian Investment Grade bonds have competitive yields and potentially offer investors a more attractive trade-off between income and risk, given their higher yield per unit of duration.

The bond market has undergone a significant shift in its prevailing narrative since the start of the year. Initially centered around a “Fed pivot”, where markets had anticipated a series of rate cuts in 2024, the focus has now transitioned to a stance of “higher rates for longer.” From 150 basis points (bps) of Fed rates cuts expected at the start of 2024 for the year, the market is now expecting only 47 bp1 of cuts for the rest of 2024. This shift, driven by consecutive months of higher-than-expected inflation readings and signs of a still-resilient US economy saw bond yields rise across various maturities.

While our base case is still that the US economy and inflation would slow sufficiently for the Fed to cut rates eventually, the timing and extent of cuts have become more uncertain. Nevertheless, even with the delay in rate cuts, we believe that there is still a strong case to be made for bonds, especially Asian bonds.

The case for Asian bonds

Asian bond yields are at multi-year highs, presenting investors with an attractive and steady source of income, and an opportunity to guard against future potential declines in short term money market rates which may come earlier than expected if the Fed pivots sooner.

Fig. 1. Asian Investment grade bonds offer yields that are at multi-year highs*

Source: Bloomberg, ICE BofA Asian Dollar Investment Grade Corporate Index (Asia IG), ICE BofA Euro Corporate Index (Euro IG); ICE BofA US Corporate Index (US IG) as of 28 March 2024 (weekly data). IG refers to Investment Grade. Please note that there are limitations to the use of such indices as proxies for the past performance in the respective asset classes/sector. The historical performance or forecast presented in this slide is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for the future or likely performance of the Fund. *Yield to worst.

The benefits of elevated bond yields are under-appreciated. For one, investors do not need to take on significantly more credit risk to enjoy meaningful yields. If inflation reaccelerates, rates will need to rise significantly which results in capital losses for bonds: This is not our base case right now. In another scenario, if the US economy experiences a hard landing, bonds would outperform equities, and Treasuries and investment grade bonds are likely to be more resilient than high yield bonds. Thus, investment grade bonds can provide investors with much needed portfolio diversification.

The macroeconomic backdrop of moderate growth and muted inflation in Asia is also positive for Asian bonds. Healthy external demand is helping the more trade-dependent Asian economies such as Korea, Taiwan, Malaysia, Singapore, and Taiwan sync up with other economies in the region that had benefitted from strong domestic demand. Asia’s real exports had accelerated in the past three months to reach a new post-2021 high. Improvement in the ratio of global new orders to inventory suggests that external demand should remain robust over the course of the year. A recovery in the capex cycle in the Developed Markets should also help sustain Asia’s exports. In addition, inflation has moderated across most of Asia (excluding China) as domestic demand normalised and the pass-through from higher input costs has largely been completed and reflected in the economy.

Despite inflation being under control, Asian central banks are in no hurry to cut rates given the potential impact such cuts could have on their currencies while the Fed remains on hold. As such, rate cuts have been largely priced out in Asia. This implies that Asia local currency bonds can potentially enjoy a larger boost when Asian central banks eventually ease rates.

A quality bias

We are biased towards Asian Investment Grade bonds given how much spreads have narrowed and the strong performance of Asian high yield bonds year to date. Still elevated geopolitical tensions also lead us to have a quality bias. As mentioned earlier, the high bond yields in the current environment can boost bond returns and buffer against potential losses. We looked at every month where Asian Investment Grade bonds were yielding at least 5% and considered the returns over the next 12 months in Fig. 2. The returns were positive in 86% of the observations.

Fig. 2. Distribution of 12-month total returns

Source: Bloomberg. Monthly returns from September 2005 to May 2024. *JP Morgan JACI Investment Grade Yield to Worst. Total returns calculated using the JP Morgan JACI Investment Grade Total Return Index. In USD terms. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance.

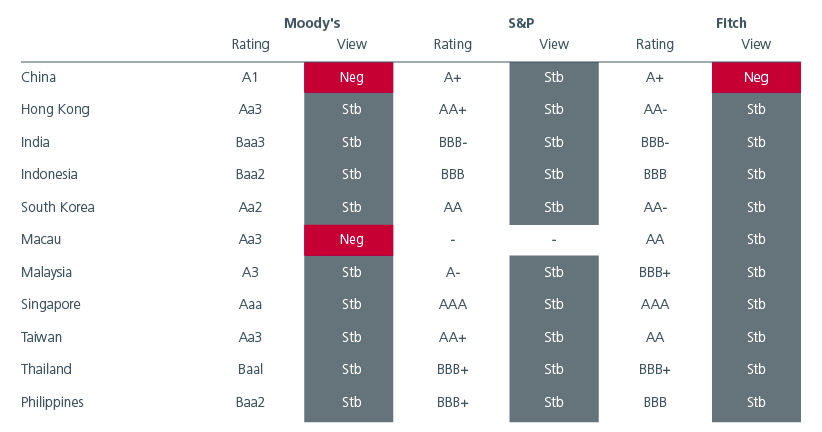

Meanwhile, there are diverse opportunities for investors within the Asian Investment Grade bond universe. About 85% of the JP Morgan Asia Credit (JACI) Index, which includes debt issued by Corporate, Sovereign, and Quasi Sovereign entities from the region, is rated Investment Grade. Most of the region’s sovereign bonds have an Investment Grade rating and are expected to retain that credit rating over the medium term. Fig. 3. This should in turn help underpin the ratings for the country’s quasi-sovereigns and state-linked corporates. The region is also home to some of the world’s largest and best-run companies. Corporate fundamentals are expected to remain broadly stable. Despite edging higher, leverage is still at manageable levels. Importantly, Asia corporates have been able to withstand the higher interest cost environment of the last couple of years.

Fig. 3. Foreign currency long-term rating of Asian Investment Grade sovereign bonds2

Source: Moody’s, S&P and Fitch Ratings extracted from Bloomberg in April 2024; Outlook View : Stb = Stable; Neg = Negative; Pos = Positive. Any credit ratings are solely statements of opinion of the credit rating agency, are not statements of fact and do not constitute investment recommendations or advice.

In the near term, the net supply of USD denominated investment grade bonds in Asia is expected to be negative in 2024, which is supportive of bond prices. Longer term, demand for bonds is supported by an aging population and structural current account surpluses in many Asian economies. Growing and stable demand from Asian long-term investors potentially translates to steadier returns for Asian bonds.

Compared to US and European Investment Grade bonds, Asian Investment Grade bonds have competitive yields and may offer investors a more attractive trade-off between income and risk, given their higher yield per unit of duration (Duration is a measure of a bond’s sensitivity to interest rate changes). Fig. 4.

Fig. 4. Comparison of Investment Grade bonds

Source: Bloomberg, ICE BofA Asian Dollar Investment Grade Corporate Index (Asia IG), ICE BofA Euro Corporate Index (Euro IG); ICE BofA US Corporate Index (US IG) as of 28 March 2024 (weekly data). IG refers to Investment Grade. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance of the portfolio.

Seize the opportunity

Given tight credit spreads and an uncertain Fed easing timetable, carry would be an important driver of bond returns over the medium term. We favour Asian Investment Grade Bonds and believe that at current yields, investors can lock in good quality yield and benefit from diversification benefits at the same time. Historically, when yields of Asian Investment Grade bonds are above 5%, 12-month returns have been positive more than 80% of the time. The diverse investment universe of Asian Investment Grade bonds presents active managers with the opportunity to add alpha. Meanwhile, positive supply/demand dynamics are supportive of Asian bonds over the medium and long term.

Access expert analysis to help you stay ahead of markets.

Sources:

1 As of 6 June 2024

2 Moody’s, S&P and Fitch Ratings extracted from Bloomberg in April 2024; Outlook View : Stb = Stable; Neg = Negative; Pos = Positive.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).