Executive Summary

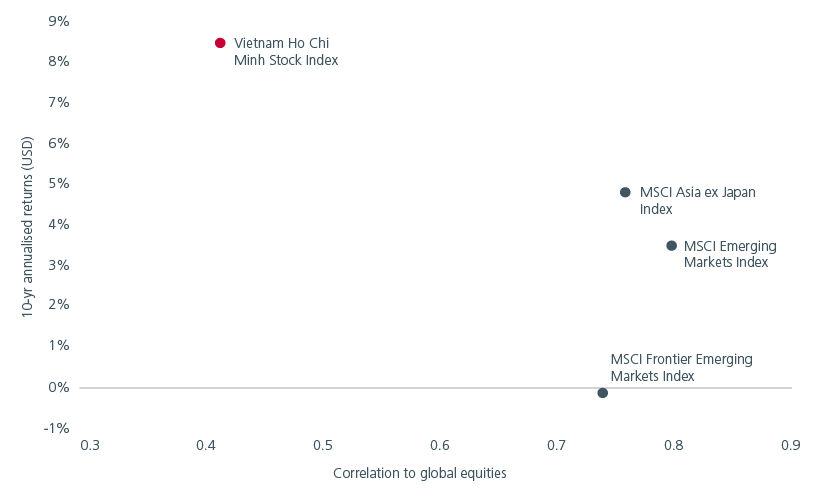

- Vietnam equities delivered annualised returns of 8.5% p.a. (in USD terms) over the last five years. Additionally, their low correlations with the developed markets help them to provide investors with enhanced portfolio diversification.

- The Vietnam equity market allows investors to participate in a dynamic economy with opportunities that tap into the country’s manufacturing competitiveness, digital transformation and growing middle class.

- Vietnam’s bid for emerging market status can potentially result in greater investor interest and inflows. However, addressing the challenges related to settlement procedures and foreign ownership caps remains crucial.

Over the last five years1, the Vietnam Ho Chi Minh Stock Index (VNINDEX) delivered annualised returns of 8.5% p.a. (in USD terms), outperforming both the MSCI Frontier Emerging Markets and MSCI Emerging Markets Indexes. More importantly, Vietnam equities exhibit lower correlations than MSCI Emerging Markets to developed markets, potentially providing investors with enhanced portfolio diversification, although with greater volatility. See Fig. 1.

Fig. 1. Correlations vs annualised returns

Source: Bloomberg. Annualised returns in USD terms as of 10 May 2024. 10-year correlations using weekly data in local currency terms, as of 13 May 2024.

Exciting opportunities

Vietnam’s robust economic growth is expected to help underpin the equity market going forward. The IMF forecasts Vietnam’s economic growth to expand 5.8% in 2024 and 6.5% in 2025, up from 5% in 20232.

Supply chain shifts

Global supply chain shifts have boosted Vietnam’s growth, with the country often referred to as the “China plus one” destination. Vietnam benefits from its cost-effective manufacturing capabilities and skilled labour force. Its proximity to China also facilitates streamlined logistics and efficient coordination between suppliers and manufacturers. At the same time, Vietnam’s status as a net energy exporter and its increasing efforts to diversify its energy sources to include renewable energy enhance its energy security and sustainability.

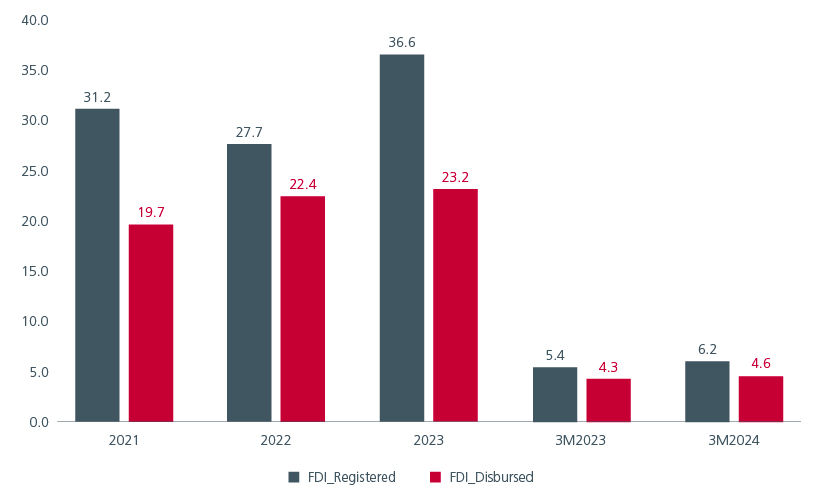

Vietnam attracted USD36.6 billion in foreign direct investment (FDI) in 2023, of which USD23 billion was disbursed, representing the highest level of FDI in Vietnam in the recent five years. The processing manufacturing sector received 64% of the total FDI capital. For 2024, total newly-registered FDI reached USD6.2 billion, representing a 13.4% year-on-year increase. Fig. 2. As the government continues to actively promote FDI through favourable policies including tax incentives, exemptions and streamlined administrative procedures, these investments should boost jobs, infrastructure development and overall economic growth.

Fig. 2. FDI into Vietnam (USD billion)

Source: General Statistics Office of Vietnam, as of 31 March 2024.

Growing FDI inflows are expected to drive industrial park (IP) demand, which should support rents. We like developers that can create a complete IP ecosystem by linking IPs with residential homes, utilities and social infrastructure as well as those that have large leasable areas to meet the needs of global manufacturers.

Digital transformation

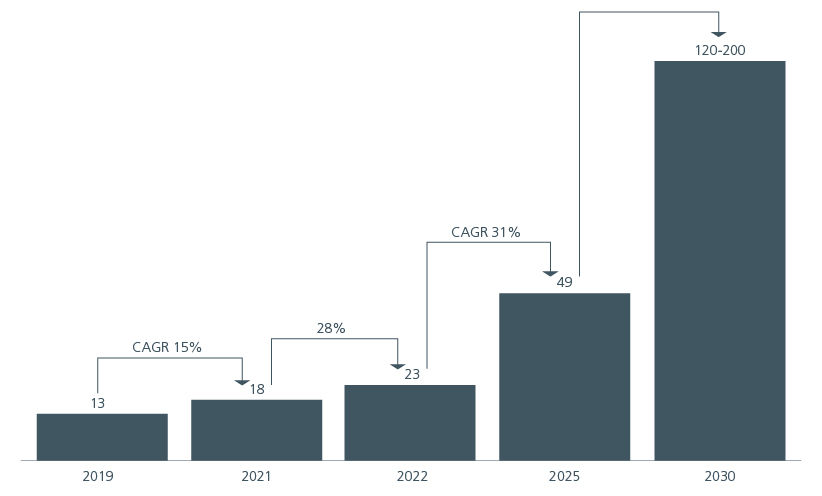

We also see opportunities in technology companies that can leverage on the government’s ambition to accelerate digital transformation within the country as laid out in the Digital Transformation Agenda. Domestic spending on digital infrastructure is expected to be significant amid rising digitalisation across industries, following years of underinvestment. The gross merchandise value of Vietnam’s digital economy in 2022 was USD23 billion, and is forecasted reach USD49 billion in 2025, largely driven by the e-commerce sector.

Fig. 3. Gross merchandise value of Vietnam’s digital economy (USD billion)

Source: Vietnam’s digital economy value and compositions. Bain Report 2022.

Rising middle income

The country’s robust economic growth has also created a rapidly expanding middle income population. Investing in Vietnam’s equity market potentially provides exposure to sectors such as retail, real estate, and consumer goods that stand to benefit from rising disposable incomes. Vietnam’s banks are increasingly focusing on the still-underdeveloped retail banking segment to diversify their income streams and improve profit margins. Digitalisation is also helping to reduce operational costs and supporting earnings growth. Compared to their ASEAN peers, Vietnamese banks generate higher return on equity (ROE).

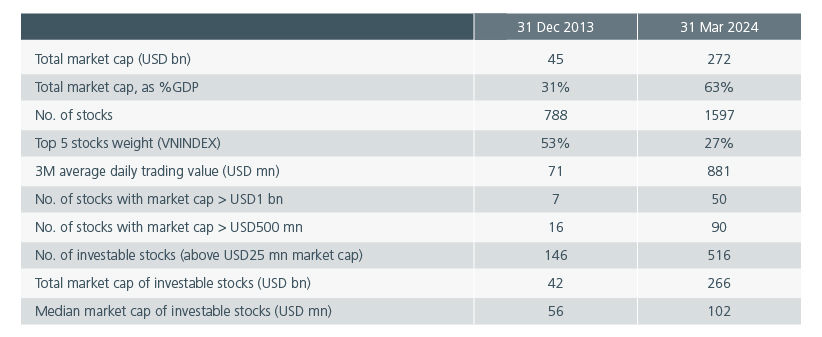

Emerging market bid

Vietnam is committed to strengthen its capital market to drive economic growth and stability. The equity market has grown rapidly over the last decade in breadth and depth (Fig. 4.) With the equity market’s current capitalisation averaging 60% of GDP, the government aims to raise market capitalisation further to 100% and 120% of GDP by 2025 and 2030, respectively. The government’s crackdown on corruption also demonstrates its commitment to maintain a more transparent and investor-friendly environment.

Fig. 4. Vietnam’s equity market has grown rapidly

Source: Bloomberg data as of 31 March 2024, computed by EIVN. Note: VNINDEX = Vietnam Ho Chi Minh Stock Index.

Vietnam has been working towards achieving an emerging market status by July 2025 which can potentially result in greater investor interest and inflows. However, addressing the challenges related to settlement procedures and foreign ownership caps remains crucial. On this front, Vietnam is piloting a trading system to resolve the need to have available funds before an order can be made, as well as to shorten the settlement cycle, although the system has yet to be officially launched.

Promising potential

The Vietnam equity market allows investors to participate in a dynamic economy with promising potential. The market’s return on equity had averaged 14.6% over the last five years, surpassing its ASEAN peers, and is forecasted to remain relatively steady at 14% in 20253. Whether it is tapping into Vietnam’s manufacturing advantages, leveraging on the country’s digital transformation, or capitalising on its growing middle class, Vietnam presents an exciting opportunity for long-term investors.

Access expert analysis to help you stay ahead of markets.

Sources:

1 As of 10 May 2024. Bloomberg.

2 IMF. April 2024.

3 Bloomberg. As of 16 May 2024.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).