Start a Regular Investment with Eastspring

Eastspring Regular Investment Choice (RICh) is a regular investment plan that employs the strategy of Ringgit cost averaging and allows you to invest in your choice of eligible Eastspring Investments funds with a fixed sum of money on a regular

basis. It is a systematic investment technique which is applied to maximise the potential returns of unit investing.

The approach works in 3 simple steps:

Invest as low as RM100 on

a regular basis into selected

Eastspring Investments funds

Don’t worry about

timing the market or where interest

rates are headed

Let your investments

reap the potential returns

with RICh!

Invest regularly with RICh

Direct debit with participating banks

A direct debit instruction can now be done with the bank of your choice to transfer a fixed amount from your savings account into your investment account. By setting up a direct debit instruction, you will ensure that you invest consistently. You can now invest conveniently at no bank charges through MyClear Direct Debit at the following participating banks:

You can also setup a direct debit instruction via myEastspring (for existing customers).

Trivia to test your knowledge

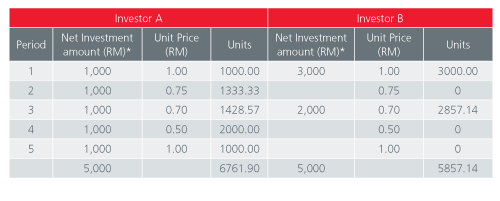

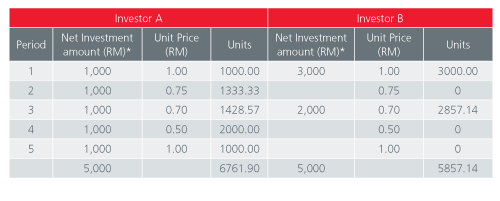

Let’s take a look on the case below.

Which Investor Would Potentially Reap More Returns ?

Investor A

Invested a total of RM 5000 in 5 years, by contributing regularly every month

You are right!

The example indicates the average cost per unit for Investor A works out to be RM 0.7394 while RM 0.8536 for investor B who invests in an ad-hoc basis. Therefore, Investor A will potentially earn more.

Note:Use two-finger and stretch out to zoom the table below.

Investor B

Invested a total of RM 5000 in 5 years, by a lumpsum amount for 1 year and the 3rd year.

Oops! The answer is investor A.

Investor A earns more as, the average cost per unit for Investor A works out to be RM 0.7394 while RM 0.8536 for investor B who invests in an ad-hoc basis. Therefore, Investor A will potentially earn more.

Note:Use two-finger and stretch out to zoom the table below.

Tips on becoming a successful investor

You don’t need huge sums of money to start. Here are a few tips on how to be a successful investor.

Tip 1: Pay yourself first

Put aside funds before paying off expenses. By doing this, not only will you have a good rainy day fund, but over time you will come to a stage of financial stability.

Tip 2: Start Early

The sooner you start saving and investing, the greater the total rewards you may possibly earn over the years. Starting early also means you can invest small amount at a slower pace to meet your long term financial goals.

Tip 3: Don’t time the market

The market is a very complicated system affected by investors’ sentiment, the economy and many other factors. Investors who base their decisions on timing the market often endures stress as they fail to consider the other intricacies of the market.

Tip 4: A little goes long way

(Sikit-sikit lama-lama jadi bukit) - As this old Malaysian adage goes, even a small sum put away periodically will slowly start to grow. Similarly, investing even small sums wisely may help you have a sizeable nest egg in the long term.

RICh Kids – Small Steps towards a Bigger Future

Give your child a head-start by investing in them. RICh Kids is a simple way to invest for your children who are under the age of 18. It allows you to open a joint investment account with your child from as low as RM100 a month at 0% sales charge*.

Why RICh Kids?

So they can invest just like you.

Invest as low as RM100 on a regular basis at 0% sales charge*

Keep track of your child’s investment account via MyEastspring

Investing together can start important conversations about money, break taboos and even help you fill those knowledge gaps.

Starting early is the best way to make good money habits feel as natural as tying shoelaces with RICh!

See how your money could grow under different circumstances. Select your preferred investment type or desired investment return which you’re looking to achieve and enter a lump sum or a monthly investment amount into the calculator below and find out how much it might be worth in the future.

- Desired Investment Return (RM)

- Monthly Investment Amount (RM)

Desired Investment Return (RM) – This is the investment return which you will potentially achieve

This calculator is purely for illustration purposes only and does not constitute advice or guarantee amounts.

With an initial investment of RM , a monthly investment of RM , at an annual growth rate of % and investment period of year(s), you may potentially achieve a desired investment return of RM .

Leave your details below and our customer service representative will get in touch with you

Through our unit trust consultants (UTC)

- Get personalised consultation and assisted application for our funds

Videos

This advertisement is prepared for information only and may not be published, circulated, reproduced or distributed in whole or part, whether directly or indirectly, to any other person without the prior written consent of Eastspring Investments Berhad ("Manager").

Investors are advised to read and understand the contents of the respective fund’s prospectus and product highlights sheet (collectively, “offer documents”) before investing. The offer documents are available at offices of Eastspring Investments Berhad or its authorised distributors and investors have the right to request for a copy of the offer documents.

This advertisement has not been reviewed by the Securities Commission Malaysia ("SC"). The respective fund’s prospectus has been registered with the SC who takes no responsibility for its contents. The registration of the fund prospectus with the SC does not amount to nor indicate that the SC has recommended or endorsed the product. Past performance of the Manager/fund is not an indication of the Manager’s/fund’s future performance.

Investors are advised to consider the risks as elaborated in the respective fund’s prospectus, as well as the fees, charges and expenses involved before investing. Investors may also wish to seek advice from a professional adviser before making a commitment to invest in units of any of our funds.

Eastspring Investments ("Eastspring") is an ultimately wholly owned subsidiary of Prudential plc. Prudential plc, is incorporated and registered in England and Wales. Registered office: 1 Angel Court, London EC2R 7AG. Registered number 1397169. Prudential plc is a holding company, some of whose subsidiaries are authorized and regulated, as applicable, by the Hong Kong Insurance Authority and other regulatory authorities. Prudential plc is not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc. A company incorporated in the United Kingdom.