Summary

Divergent data and concerns over China’s growth are being tempered by more concerted government action. In the meantime, while the US’ Magnificent 7 has hogged headlines, a handful of stocks in Asia has actually done even better.

What’s top of investors’ minds

1.What will be the impact of Trump's policies on US rates?

Looking at history, it is worthwhile to note that US rates are influenced by a combination of 1) local development (growth/inflation), 2) the influence of external events on local dynamics and 3) funding patterns.

The first and most significant phase of the US rates selloff has happened. While yields may still creep higher as tariffs are announced, any further increases from current levels will likely be more tepid as tariff policies are gradually being priced in prior to their official announcement/confirmation.

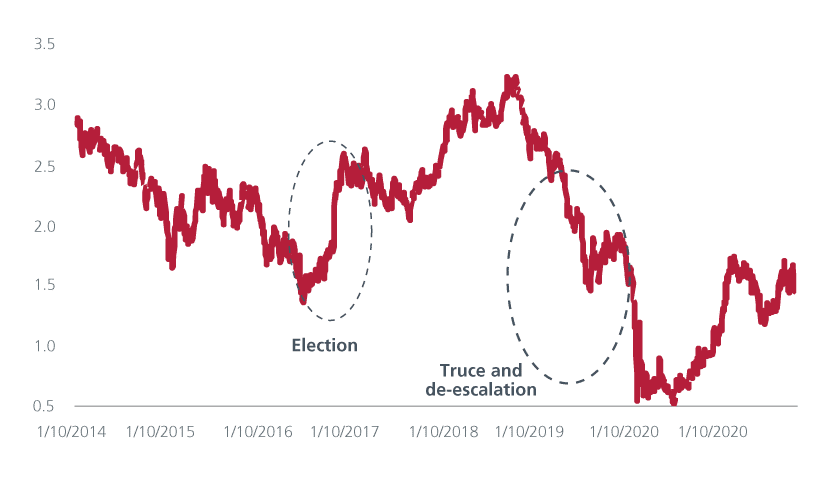

History suggests that a rates selloff due to tariffs tends to temporary as tariffs are seen as a “negotiating tool” to help balance trade. Rates and FX volatility were higher during the period of tariff escalation for most of FY2018 - the magnitude of the move this time is more subdued as the impact is spilt/absorbed across asset classes. Additionally, countries are better prepared to retaliate. This could dampen the tariffs' intended impact or reduce the level of US aggression. Ultimately, a truce/de-escalation phase would be highly positive for markets.

We view this current episode as offering a potential trading opportunity, first for investors to short US rates and subsequently to go ‘long’ when signs of de-escalation emerge (the speed of transition in Trump 2.0 may be faster than Trump 1.0).

Aside from the tariff impact, we note that the US economy was already slowing going into the election. With inflation rates averaging around 2% or higher and US rates at 4% - and the highest real rate in almost 2 decades - investors have a healthy buffer. The recent nomination of Scott Bessent for Treasury Secretary also illustrates that while the US wants to escalate to de-escalate trade policies, they are also concerned about high US interest rates and deficits. Bessent, in a recent interview, indicated that he would like to raise US economic growth to 3%, reduce the fiscal deficit to 3% of GDP and increase US oil production by 3mn barrels/day. These goldilocks targets, if achieved, could put downward pressure on both rates and inflation.

US 10-year treasury yield (2016-2020)

2. What next for the Chinese economy?

Divergent data and concerns over the growth path are being tempered by, arguably, more concerted government action.

It has been a tricky time attempting to gauge a likely path for the Chinese economy in 2025. Data over recent weeks has painted a positive picture for manufacturing PMI through the Caixin survey, yet official data was more subdued showing the dividing line potentially between private companies and more state-focused enterprises. As we head into December, concerns over housing and tariffs have weighed on confidence with various forecasts for Chinese GDP being revised below 5% for both 2024 and 2025. Perhaps critically, trade data has continued to show a wide gap - exports grew 6.7% year on year but imports fell 3.9% over the same period.

Against this slightly tepid backdrop, the question most commentators have asked is whether the central government will step forward with much more meaningful monetary stimulus. This fiscal impact could help to encourage the domestic consumer and stabilise growth; a chart in our 2025 market outlook paints the current picture for consumer confidence in China quite clearly.

Addressing the housing crisis may have been one focus connected to initial stimulus, but this does not appear to have moved to the broader economy where consumer confidence is muted, and savings rates remain high. Unlocking the potential within the consumer appears key for growth and confidence in 2025.

China consumer confidence

3. Broadening the rally?

Investors could arguably have done pretty well by buying a very small selection of US stocks to drive their performance, or so the headlines read.

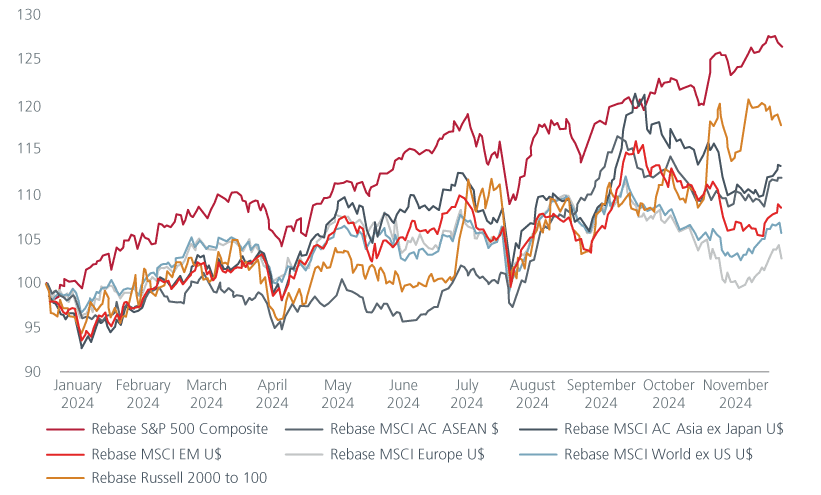

Recent data from Morgan Stanley showed that approximately 20-25% of companies within individual markets such as China, India, Korea and Taiwan, did better than the magnificent 7 in 2024. If you then consider market capitalisation, this increases the impact, for example in markets like Taiwan and Singapore.

Significant valuation discounts still exist between the large cap US stocks and markets beyond the US – selective stock picking would have offered good gains in 2024. What is the chance that more of this persists in 2025? The rally may broaden to the small and mid -cap area of the Japanese market. Selected ASEAN markets still have considerable potential, particularly those that benefit from favourable long-term themes and arguably lesser impact from tariffs.

Equity market performance (2024)

Data source: LSEG Datastream, Eastspring Investments (Singapore) Limited. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance of the Fund. The latest data provided is as of 11 December 2024.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).