Following a strong rebound in the first quarter of 2023, China’s post-opening economic recovery has petered out. Second quarter gross domestic product expanded 0.8% against the previous three months, sharply below the 2.2% expansion in the January to March period. While the normalisation of the service sector drove growth in the first quarter, we said before that corporate confidence would be needed to sustain the recovery. This has not transpired. Confidence remains weak despite recent moves by the central bank to lower borrowing costs for households and companies.

Jingjing Weng, Research Lead at Eastspring Shanghai, cautions investors from being either overly pessimistic or optimistic over the outlook for the Chinese economy. While she does not expect a V-shaped recovery, she is not anticipating the economy to enter a recession either. Given last year’s low base, the economy is likely to achieve the government’s 5% GDP growth target, hence stimulus policies are likely to be measured and more targeted. The recent extension to the tax exemption policy for New Energy Vehicles until 2027, which aims to promote the electric vehicle (EV) industry, is one example. The extension of the loan repayment period for developers which seeks to stabilise the property market, is another. Policy stimulus could turn more aggressive if policymakers think that systemic risks are rising.

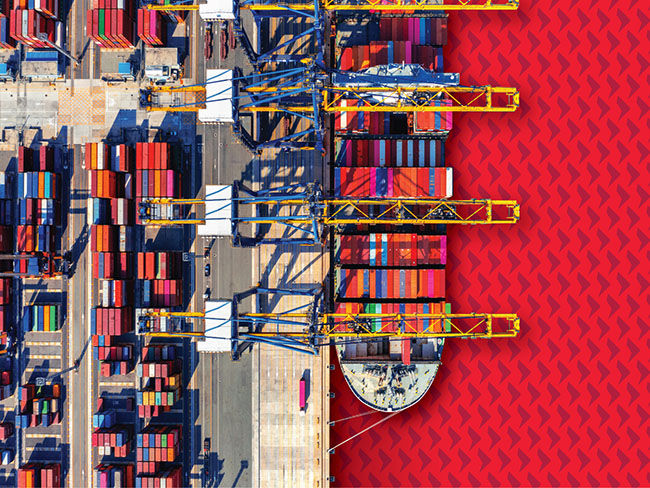

With the A-share market down 35% from its peak in 2021, further downside may be limited. Valuations for the CSI300 Index are attractive at a price to earnings ratio of 9.7x (2023 estimates, as of end June). As companies continue to draw down their inventory, industrial capacity utilisation should bottom out and drive an improvement in corporate profits. A moderate economic recovery does not mean that there are no opportunities for investors. Stock picking will be even more important in this environment. Investors will need to be more patient and focus on strategic sectors that help the Chinese government achieve its desired “security” in supply chains, energy, technology and information.

Over the medium to long term, Eastspring’s China A-share equity team continues to be positive on the high-end manufacturing industry that have technological barriers and the potential to achieve domestic substitution. The team also likes new economy industries such as new energy, consumer, medical services, technology and cyber security that benefit from China’s ongoing structural adjustments.