Summary

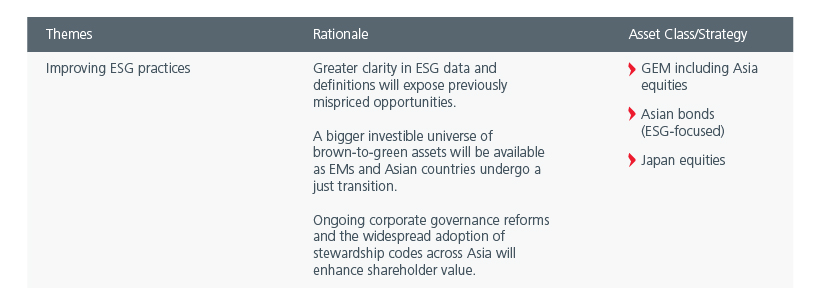

The ESG investible universe is offering more differentiated opportunities, riding on the push for greater transparency and reliability in ESG data and definitions. Improved green and transition taxonomies will pave the way for more ESG offerings that meet investors’ climate objectives.

The Environmental, Social and Governance (ESG) landscape is moving away from definitions and products which address terms like ESG, Sustainability and/or Climate in a broad-brush manner. Progress is being made towards developing standards that serve as a basic guideline for sustainability-related data and disclosures. A better understanding of the risk and value drivers in the ESG context would lead to more realistic pricing of ESG assets, and in turn influence company valuations.

A constructive push for clearer ESG data and definitions

The ESG practice is trending towards greater distinguishment of exact ESG elements which can act as differentiators when assessing both impact and risk-adjusted returns. This is a welcome development for investors who can now look for investment opportunities in previously mispriced ESG assets. Less ambiguity implies that ESG risk and opportunity signals will be easier to identify both on a sector and market basis.

This encourages investors to develop their own ESG “house view” via proprietary analytical tools. Such tools allow investment teams to consider information which third party ESG ratings providers may not offer a uniform assessment of. It can include forward looking ESG data such as exposure to specific climate transition opportunities and/or significant actions taken by companies to develop climate solutions. Such an approach could result in an investible universe that differs from how climate transition is currently defined by the broader market.

Thus far, the market and regulatory focus has been on defining companies in terms of green assets or carbon emissions reduction. The disadvantage with this method is that it will sideline companies that are on a journey towards climate transition. With many developing countries still heavily dependent on fossil fuels, there is growing recognition that the transition to clean energy must be gradual as well as just.

Significant investment opportunity as Asia transitions to green

The move to define ESG elements in a clearer manner is consequential for Emerging Markets (EM) and Asia; many ‘brown’ or high-carbon emitting industries form a significant base of their gross domestic product. The International Energy Agency predicts that EMs will require significant public and private investments of around USD 2 trillion1 per year going forward to transition to clean energy through 2030, to achieve net-zero emissions by 2050.

The available opportunity set of pure green investments is more limited in Asia compared to developed markets. In the Asian investment universe, capturing a company’s progress in areas like energy efficiency, natural gas as a transition fuel, and using low-carbon materials is a crucial step in identifying early transition winners. Many companies in EMs and Asia were sold off as investors sought only pure green stocks, resulting in a big investible universe of attractively valued companies with good growth and return potential.

The regulatory landscape is also increasingly supportive for a just transition in Asia with regulators emphasising the need to develop sustainable taxonomies with a transition element. This can result in potential tailwinds for transitioning companies and assets. Investors and asset owners who help companies decarbonise in a practical and sensible manner can minimise negative social and environmental impact.

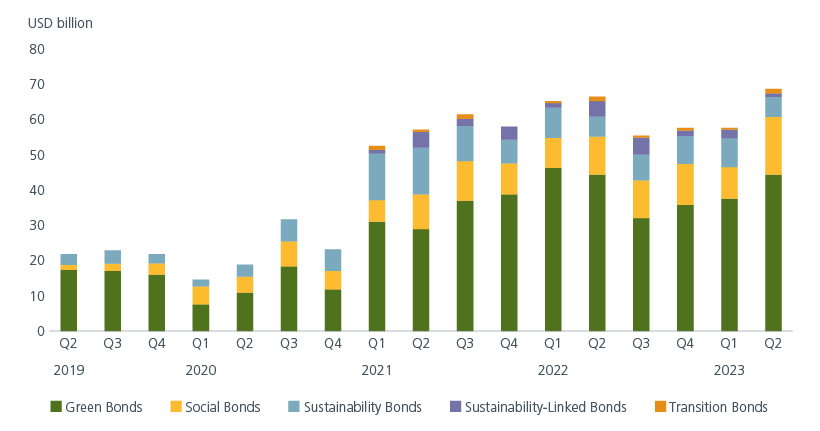

The ASEAN + 32 sustainable bond markets will play a key role in financing these transition assets. As of June 2023, this region maintained its 19.1% share of the global total outstanding sustainable bonds. Green bonds comprised 64%3 of the outstanding bonds and financing was done mostly in local currency. Although the flows to ESG-labelled funds were flat 2023 to date, it compares favourably against non-ESG labelled funds which experienced outflows. There is further potential to provide more long-term financing in local currency as the demand for ESG bonds from ESG-labelled funds remains strong.

ASEAN + 3 sustainable bond issuance is on the rebound

Source: : AsianBondsOnline calculations based on Bloomberg LP data. Data includes both local currency and foreign currency issues.

The move to greater ESG data clarity will also address some of the challenges facing the green bond market such as the lack of a common definition as to what constitutes a green project and the validation of the environmental and social outcomes of the projects. A comprehensive and inclusive approach is one that considers the interplay between the environmental, social, and economic objectives. This requires collaboration between various stakeholders such as issuers, investors, and regulators.

Reforms and regulations act as tailwinds

Regulations on ESG-labelled funds have toughened up considerably in 2023 as investors continue to regard ESG-focused investments as a way to mitigate ESG risks. The burden of proof is on funds to justify their ESG classifications and comply with reporting requirements.

Meanwhile, oversight on ESG reporting and corporate governance practices are gradually improving across Asia. Singapore is proposing a code of conduct for ESG rating and data providers, South Korea is issuing guidelines on ESG ratings and greenwashing, Hong Kong is proposing enhanced ESG disclosures, and India has new rules for ESG investment funds.

Investors’ renewed interest in Japan equities this year is a testament of the positive impact of corporate governance. The Tokyo Stock Exchange’s Action Programme aligns with better corporate governance by promoting transparency, accountability, and adherence to established principles, hence contributing to a healthier market. The representation of independent directors on Japanese company boards is rising. More Japanese companies also now disclose and map ESG strategies to the Sustainable Development Goals compared to five years ago.

In general, Asian jurisdictions have widely adopted stewardship codes which facilitate and support engagement by institutional investors with their investee companies. Active engagement leads to optimal outcomes. Ultimately, regulations will remain as one of the key factors for driving change in ESG practices.

Investment implications

Contributors: Joanne Khew, Fabian Graimann, Goh Rong Ren

Related insights

Sources:

1 https://www.iea.org/reports/scaling-up-private-finance-for-clean-energy-in-emerging-and-developing-economies/executive-summary

2 ASEAN+3 is defined to include member states of the Association of Southeast Asian Nations (ASEAN) plus the People’s Republic of China; Hong Kong, China; Japan; and the Republic of Korea.

3 Asian Bond Monitor – Recent Developments in ASEAN + 3 Sustainable Bond Markets

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).